Do Temporary Tax Cuts Only Have A Small Impact on Growth?

While promoting tax reform, House Speaker Paul Ryan stated Tuesday that temporary tax cuts do not produce a large boost to economic growth:

These reforms—these tax cuts—they need to be permanent. Every expert agrees that temporary reforms will only have a negligible impact on wages and economic growth. Businesses need to have confidence that we will not pull the rug out from under them. They need the certainty from permanent tax cuts to hire more workers, invest in their businesses, and plan for the future.

Temporary tax cuts can have a stimulative short-term effect on the economy if the economy is operating below potential (such as after a recession). However, in today's economy with the unemployment rate below 5 percent and the economy nearing potential, temporary cuts are likely to have little long-term effect on wages or growth.

In the near term, tax cuts can boost the economy. For instance, the Tax Policy Center (TPC) estimated last year that a $350 billion tax cut in 2017 would increase the size of the economy by 1 percent in that year. However, these effects are a short-term Keynesian effect caused by additional investment and consumer spending, and unlikely to have a persistent effect on long-term growth rates. Once the stimulus ends, growth rates will slow.

Further, a temporary tax cut could actually lead to slower growth than the baseline in future years, due to the negative effects of higher debt.

We explained this in more detail in How Fast Can America Grow?:

During a recession, an injection of tax cuts or spending increases (“stimulus”) can help the economy recover to its potential. However, with the unemployment rate well below 5 percent, the economy is likely already operating near its potential. A major stimulus package would therefore bring output above potential levels, where it cannot remain for an extended period. Either inflation or Federal Reserve actions (or both) would likely slow growth in future years to bring the size of the economy back down to its potential levels.

In other words, any faster near-term growth generated through deficit-financed tax cuts or spending would likely be offset by slower growth in subsequent years.

Moreover, the increase in the national debt resulting from this stimulus could further slow economic growth and eventually reduce the size of the economy to below what it would have been without the stimulus. The borrowing that could support consumption in the near term would crowd out investment and thus slow capital growth in the long run.

Thought of another way, many of the policies that could boost near-term growth would do so simply by borrowing that growth – effectively with interest – from future years.

The same tax cut that TPC found would boost the economy by 1 percent in 2017 also reduced future growth rates so that by 2027, the economy was 0.5 percent smaller than it would have been. The drag on growth continues into the future, so the economy could be 4 percent smaller after 20 years.

In a follow up press conference, Speaker Ryan made it clear that he was talking about temporary cuts to the tax rate. Some temporary measures other than the tax rate (e.g., expensing and investment provisions) can have small growth effects that persist beyond the end of the tax cut.

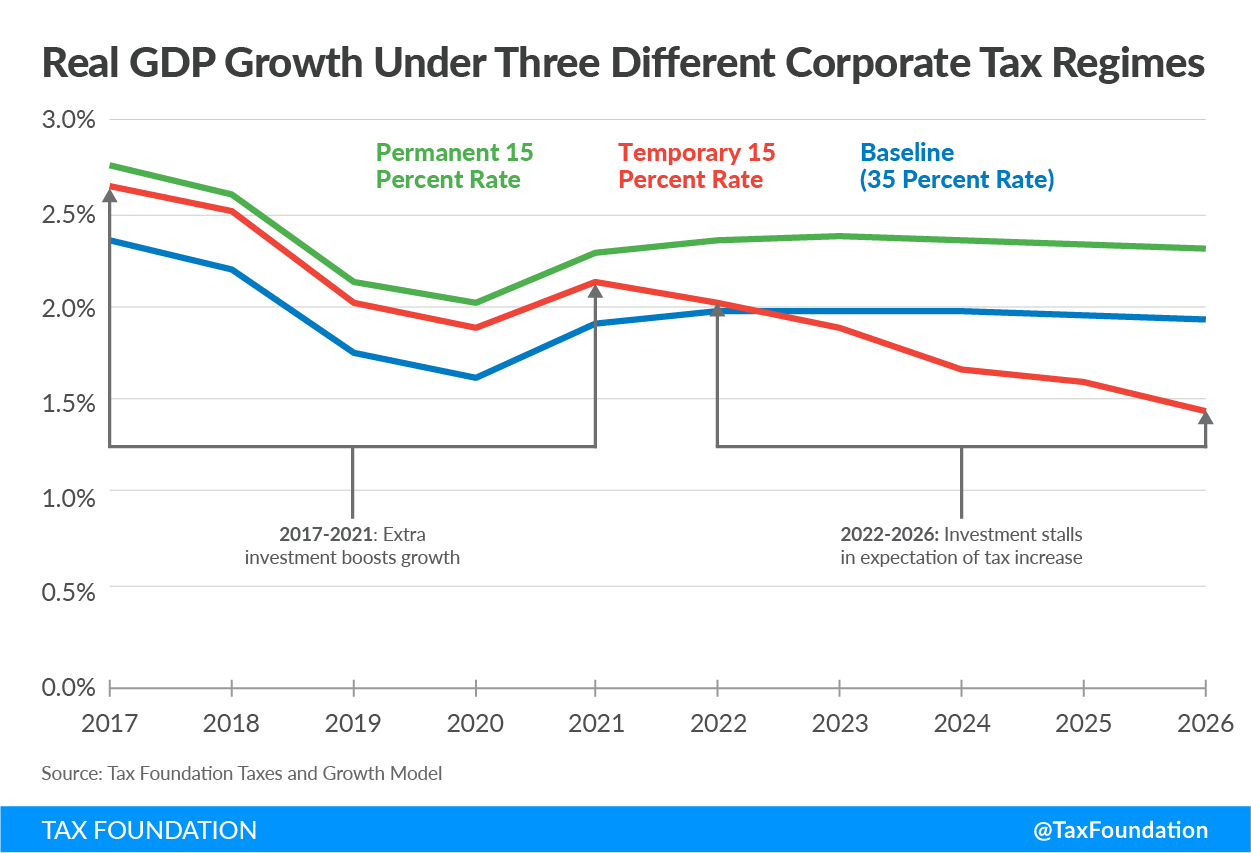

The Tax Foundation also recently modeled the economic effects of a corporate tax rate cut which expires after ten years, finding that it produces much less growth than a permanent change. They found growth rates increase during the first five years, but then growth slows in the second five years even while the tax cut is still in effect. This is because business investment is a forward-looking behavior; a future tax increase has the potential to slow growth years before it takes effect.

Under the Tax Foundation model, the economy is ultimately is only 0.14 percent larger at the end of the decade than it would have been without the cut (and even that small boost disappears over the following two years).

There are several factors that could result in growth being either higher or lower than Tax Foundation's estimate. On one hand, their model does not include any negative economic effects of higher debt, such as the crowding out of private investment. They estimate a $2.1 trillion cost for a temporary rate cut, and CBO projects that $2 trillion higher debt will shrink the economy by about 0.4 percent after 10 years.

On the other hand, the Tax Foundation model assumes absolute certainty that the tax cut will expire after 10 years. If some businesses instead think the tax cut will be continued, they may not slow their investment decisions and therefore the temporary cut could promote some growth. Note that if some companies assume the tax cut will be continued, growth after 10 years will be negatively affected with either policy choice – whether or not the cut is retained. If the tax cut is allowed to expire, companies will reduce investment and slow growth. If it is extended, only some of the growth benefits will be realized (some would have already occurred). The economy will only benefit from some of the positive growth effects, but all of the negative effects of higher debt.

Official scores for tax legislation are provided by the Joint Committee on Taxation, which does assume a small negative effect of higher debt levels. That economic effect is the reason that tax reform can be more pro-growth by devoting some revenue to reduce deficits.

Temporary tax cuts can produce short-term growth impacts, especially when the economy is in recession. However, in today's economy, Ryan is correct to say that temporary tax cuts would have a negligible impact on (long-term) wages or economic growth.

Our Rating: Mostly True