The Decisions Behind Getting to a Sustainable Debt Path

Although this idea isn't brand new, CBO director Doug Elmendorf has a blog post that concisely illustrates the trade-offs that must be made in order to get our fiscal policy back in line. In other words, we're going to have to make some choices about the size of government and the allocation of resources within that constraint.

Given the aging of the population and the rising cost of health care, attaining a sustainable budget for the federal government will require the United States to deviate from the policies of the past 40 years in at least one of the following ways:

- Raise federal revenues significantly above their average share of GDP;

- Make major changes to the sorts of benefits we provide for older Americans;

- Substantially reduce the role of the rest of the federal government—that is, defense (the largest single piece), Food Stamps, unemployment compensation, other income-security programs, veterans’ benefits, federal civilian and military retirement benefits, transportation, health research, education and training, and other programs—in our economy and society.

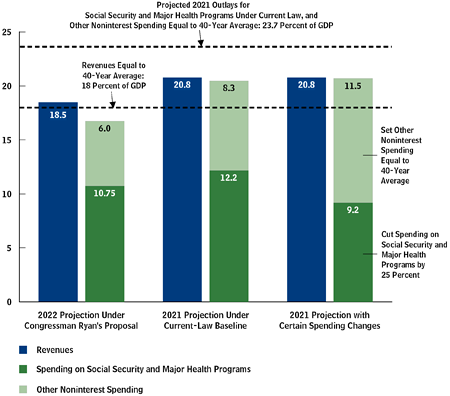

Any serious bipartisan deficit reduction plan would likely do a combination of all three that looks at each area of the budget for savings. Elmendorf presents three different scenarios for how we would get to fiscal sustainability. Scenario 1 involves keeping revenue at its historical average and reducing all non-interest spending. Scenario 2 maintains current law benefits for Social Security and health programs, but allows revenue to rise above its historical average and allows other spending to fall well below its historical average. Scenario 3 maintains "other spending" while cutting the major entitlements and allowing revenue to increase.

An illustrative example of these trade-offs in the graph below that originally appeared in the post. It shows primary (non-interest) spending and current law revenue levels for the House Republican budget (Scenario 1), current law projections (Scenario 2), and an illustrative option where the "other spending" category is maintained at its historical average, but Social Security and health programs are cut to get to primary balance (Scenario 3).

In CBO's long-term outlook, the default path is basically Scenario 2, or current law. Under that scenario, Social Security and health programs are projected to grow as under current law, rising with the growth in the economy, health care costs, and population aging. However, revenues rise way past its historical average--partially due to the expiration of the tax cuts and the AMT patch--and other spending falls well below its historical average. If we keep the government essentially on auto-pilot, the choice is already made. So, if lawmakers want to prevent discretionary and other mandatory spending from falling as it is scheduled to do, or prevent real bracket creep from pushing revenue way up, they will have to deviate from the current law path and prioritize accordingly.

However, current law isn't exactly a great path to follow. Debt still remains elevated throughout the entire 75-year period, and would not stabilize until the 2040s. We need a true deficit reduction plan now that will get our debt onto a sustainable path this decade. Let's hope lawmakers can forge a bipartisan solution.