Could Eliminating the Payroll Tax Cap Extend Solvency to 2061 and Allow for Expanded Benefits?

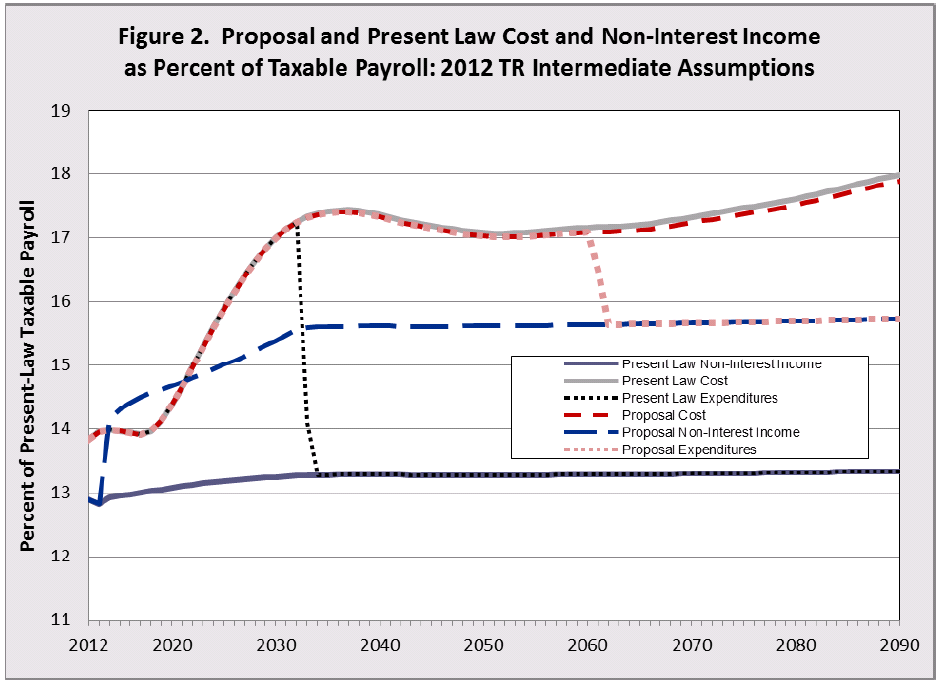

Sen. Bernie Sanders (I-VT) discussed his plans to increase Social Security benefits and extend the program's solvency by saying "And the way you expand it is by lifting the cap on taxable incomes so that you do away with the absurdity of a millionaire paying the same amount into the system as somebody making $118,000. You do that, Social Security is solvent until 2061 and you can expand benefits." He is presumably referring to his plan that the Social Security Administration (SSA) evaluated in 2013, a plan that taxed all income over $250,000 and allowed the current payroll tax cap to eventually catch up so that all income was taxed. This plan did extend solvency to 2061 -- leaving a deficit of 1.5 percent of payroll in 2062, growing to 2 percent by 2090 -- but did not also increase benefits. If it had increased benefits, the insolvency date would be sooner.

SSA currently estimates that eliminating the payroll tax cap immediately would extend solvency to 2066, or 2080 if additional benefits were not credited based on the new taxes, so there would be some room to expand benefits and still extend solvency to 2061. Sen. Sanders's most recent plan would expand benefits by changing the benefit formula and by calculating cost-of-living adjustments using the faster-growing CPI-E, and the plan would extend solvency until 2065 – but it relies on a 6.2 percent investment income tax on high earners in addition to eliminating the cap. We estimate that the insolvency date would be in the early 2050s if the investment tax was not included.