The Concord Coalition Provides Fiscal Lessons From Europe

The Concord Coalition has just unveiled a new paper, authored by Edmund Andrews, Joe Minarik, and Diane Lim Rodgers, called "Not Just Their Problem: The Euro Debt Crisis and U.S. Fiscal Policy," shedding some light on our fiscal outlook in an international context. The release of the paper was accompanied by an event hosted by the Concord Coalition and the Committee for Economic Development, including a speech from Senator Kent Conrad (D-ND) and a panel discussion featuring Douglass Elliot of the Brookings Institution, Simon Johnson of MIT, Joe Minarik of the Committee on Economic Development, and Diane Lim Rodgers from the Concord Coalition.

The Eurozone debt crisis is in the news every day, and the Concord paper offers a good overview of how a potential crisis could affect the U.S. while offering relevant lessons for the United States and its future fiscal policy. The United States may have been able to weather past international economic crises, but U.S. exports have been one of the largest drivers in this recovery. Not only does the euro crisis pose a threat to exporters dependent on Europe, but also American companies that export to countries that are large trading partners of the Eurozone are at great risk as well. In its current fragile state, our economy would be unlikely to avoid a collapse of the Eurozone, and policymakers should take European weaknesses into consideration.

One of the other large concerns for the economy right now is of course the possibility of going over the fiscal cliff. Adding to the worrying projections of the cliff's impact on the economy are the experiences of the European austerity measures which have had hindered economic recovery. From the paper:

The United States can learn from the European experience that excessive budget austerity during a tenuous economic recovery can make things worse. In the long term, however, persistently high deficits will undermine confidence, drive up interest rates and choke off growth in the nation’s productive capacity. We must find the delicate balance between: (i) adequately supporting the demand side of the economy in the near term, and (ii) making credible commitments to policies that will reduce budget deficits and increase supply-side growth over the longer term.

The European experience is proof that sudden austerity measures, like those that are set to occur under the fiscal cliff, are poor policy in a weak economy. But that is not the type of deficit reduction plan that is being discussed. If we put in place a plan that replaces the cliff with more gradual deficit reduction, we can avoid the immediate austerity set to take effect and austerity down the road that may be forced on us if we do not address the debt at all. Furthermore, there would likely be at least some positive short-term effect to announcing a plan now that will take effect only gradually.

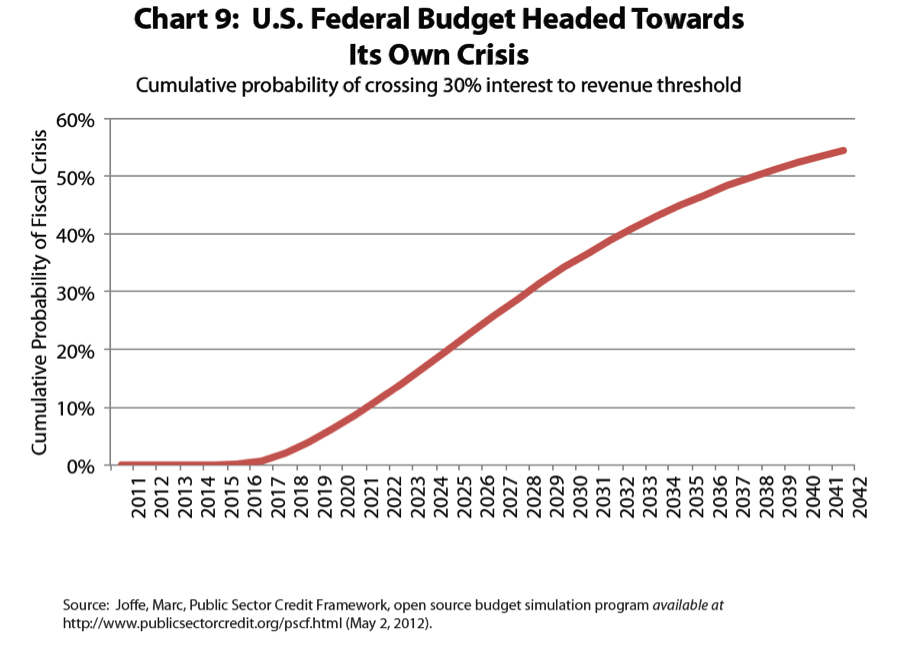

One of the key indicators for debt sustainability is the level of interest to revenue. As shown in the graph above, by 2030, our fiscal outlook will be rapidly deteriorating and with a substantial risk of passing the 30 percent interest to revenue threshold, a level at which a fiscal crisis could become a very real possibility. Making the needed changes will not be easy. Simon Johnson commented that anyone who thinks that we can solve this problem without addressing revenues or entitlements is not being realistic. That adds a tremendous political challenge to the economic one. We will need leaders in Congress to step up and reach a bipartisan deal for long term debt reduction.