Comparing the Permanent Costs of Build Back Better and the TCJA

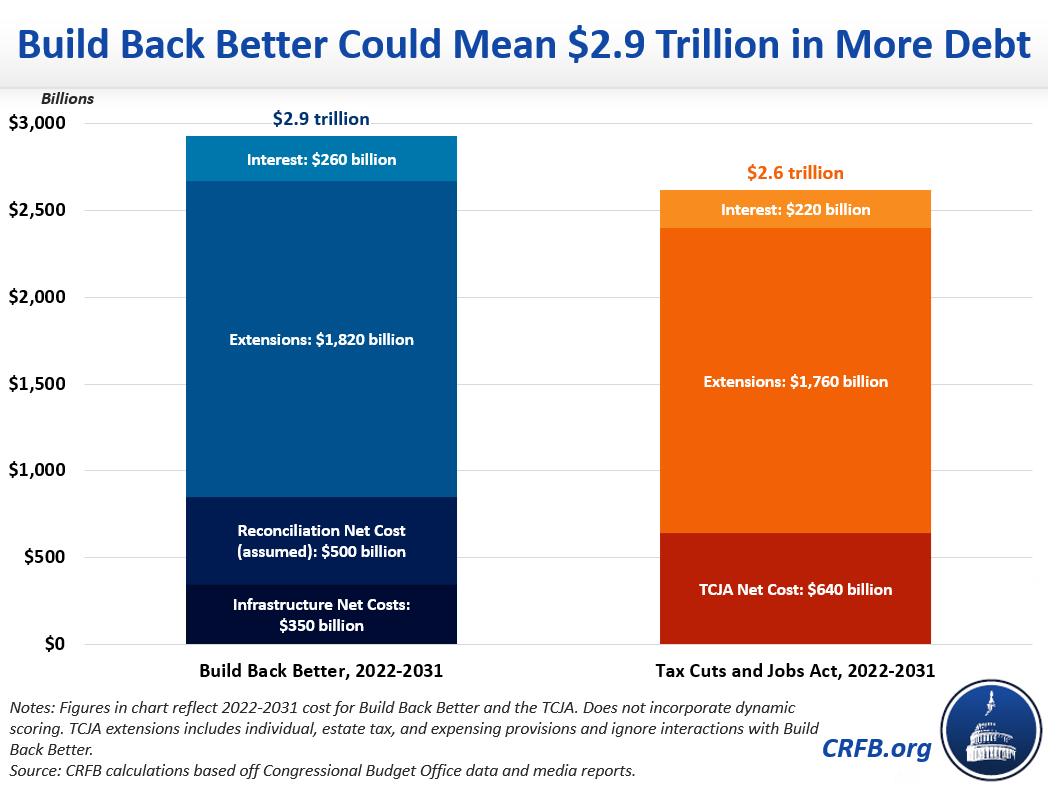

The bipartisan Infrastructure Investment and Jobs Act and the forthcoming budget reconciliation bill – together making up the core of the "Build Back Better" agenda – are likely to add significantly to the debt, especially if the latter's policies are extended. In a companion analysis, we estimate they could cost a combined $2.9 trillion with extensions, depending on some unknown details. The cost, which would accrue between 2022 and 2031, is similar to the total cost of the Tax Cuts and Jobs Act (TCJA) of 2017 over that same period.

Though the TCJA has already been in effect for several years, we estimate it will cost about $640 billion (excluding interest) from 2022 to 2031, with the costs all accruing by 2026. However, the individual income and estate tax provisions in the TCJA mostly expire after 2025, and full expensing of business equipment begins to phase down starting in 2023. If these provisions were extended, it would cost an additional $1.76 trillion. Added together and incorporating interest, the TCJA would cost $2.6 trillion from 2022 to 2031 if extended. This is on top of the $1.1 trillion of costs already incurred from 2018 to 2021.

To avoid these costs, policymakers could reform, reverse, or replace elements of the TCJA; allow them to expire as scheduled; or offset any extensions with alternative revenue or spending cuts. By the same token, policymakers should avoid early sunsets in the upcoming reconciliation bill, honestly accounting for permanent spending and financing it with permanent revenue or spending reforms.

Read more options and analyses on our Reconciliation Resources page.