Clinton Proposes New Taxes to Offset New Proposals

In recent weeks, Democratic Presidential candidate Hillary Clinton has proposed a series of new tax breaks for small businesses and for parents in order to simplify the tax code and reduce child care costs. By our estimates, these new policies will cost about $250 billion over a decade.

Consistent with how other campaign proposals have been financed, the campaign has said they would pay for these tax changes by increasing taxes on higher earners. These new tax increases have been added to the Clinton campaign’s website.

In short, Clinton would pay for these new tax breaks by further increasing the estate tax for very large estates, taxing capital gains at death, and limiting the use of “like-kind” exchanges. By our estimate, these three changes would roughly offset the cost of their new spending. Details of each policy are provided below.

Additional Policies Proposed By Secretary Clinton

| Policy | Change |

|---|---|

| Simplify Small Business Taxes and Expand the Child Tax Credit | -$250 billion |

| Increase Estate Tax Rates for Large Estates | $75 billion |

| Tax Some Capital Gains at Death | $150 billion |

| Limit Deferral on Like-Kind Exchanges | $35 billion |

| Net Deficit Reduction | $10 billion |

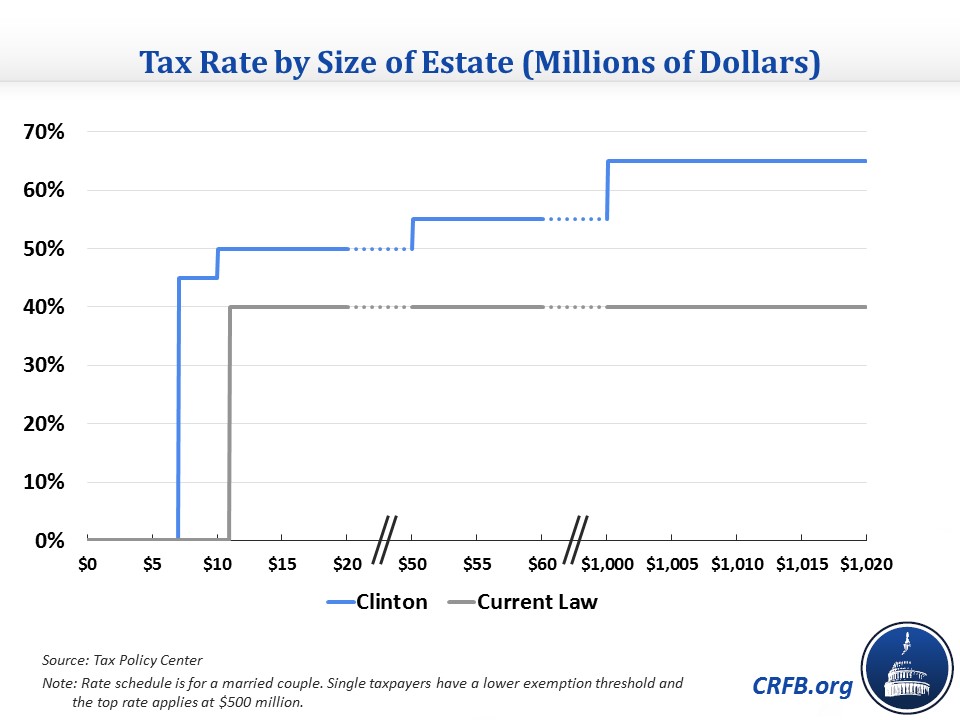

Progressive Estate Tax Increase. Previously, Clinton proposed restoring the estate tax to 2009 levels by increasing the rate from 40 to 45 percent, reducing the exemption from $5.45 million to $3.5 million, and reducing loopholes used to avoid the estate tax. Relative to current law, these changes alone will raise about $160 billion over a decade. In addition to these changes, Secretary Clinton now supports an even larger estate tax increase, to levels proposed by Senator Bernie Sanders (I-VT) during the primary campaign.

In addition to a 45 percent rate for estates larger than $3.5 million (and twice as high for couples), Clinton’s plan would now include a rate of 50 percent on the value of estates over $10 million, 55 percent over $50 million, and 65 percent over $500 million ($1 billion for couples). Based on estimates from the Tax Policy Center, we expect these increased rates to raise about another $75 billion.

Taxation of Some Capital Gains at Death. Under current law, individuals generally pay taxes on capital gains in the year assets are sold. But if assets are instead inherited upon death, the basis value of most assets is “stepped” up and thus the tax on those gains to that point is essentially forgiven. For example, if someone bought a share of stock for $1 and sold it for $100, they would pay capital gains taxes on $99 of gains. But if they passed that stock to an heir when it was valued at $90 before the heir sold it at $100, taxes would only be paid on $10 of gains. The other $89 of gains would never be taxed.

To help pay for her new tax breaks, Clinton would largely eliminate the “step-up basis” of capital gains at death, treating inheritance like a sale of a stock and thus taxing capital gains at that point.

Although the Clinton campaign has not outlined specific parameters, it has expressed support for a variety of exemptions to prevent the tax from applying to taxpayers making less than $250,000 and to limit its impact on various non-financial assets such as farms, businesses, and real estate.

Clinton’s proposal is similar – though not identical – to one proposed by President Obama and another proposed by Senator Sanders during the primary campaign. While lack of detail makes an exact estimate impossible, we estimate it will raise in the range of $150 billion over a decade.

New Limits on Like-Kind Exchanges. Under current law, businesses and individuals are typically taxed on capital gains when selling property (such as real estate or artwork). However, no tax is imposed if property is instead traded for similar property (e.g, if sale proceeds from one piece of real estate are used to buy another). In that case, capital gains taxes are deferred until the property is sold without being exchanged. Sometimes, gains are deferred through multiple sets of exchanges until the owner eventually dies and all gains become tax-free.

The Clinton campaign would limit the use of like-kind exchanges, similar to President Obama’s recent proposal, which would limit the gains deferred to $1 million per year. He would also end the use of like-kind exchanges all together for collectibles and art.

President Obama’s proposed limit has been estimated to save over $35 billion over a decade, and we expect similar savings from Clinton’s policy.

Note that in addition to these new tax proposals, the campaign also offered more specifics on its proposal to tax large financial institutions, suggesting their tax would be larger than the one proposed by President Obama.

We have incorporated these and other changes since June into our latest update of Promises and Price Tags.

Update: Several hours after publication, we added links to the Clinton campaign website where these additions are detailed. Based on those details, we have also corrected the description and graph of the estate tax increase to clarify that the top rate for married couples applies at $1 billion instead of $500 million.