CBO Releases New Long-Term Budget Projections

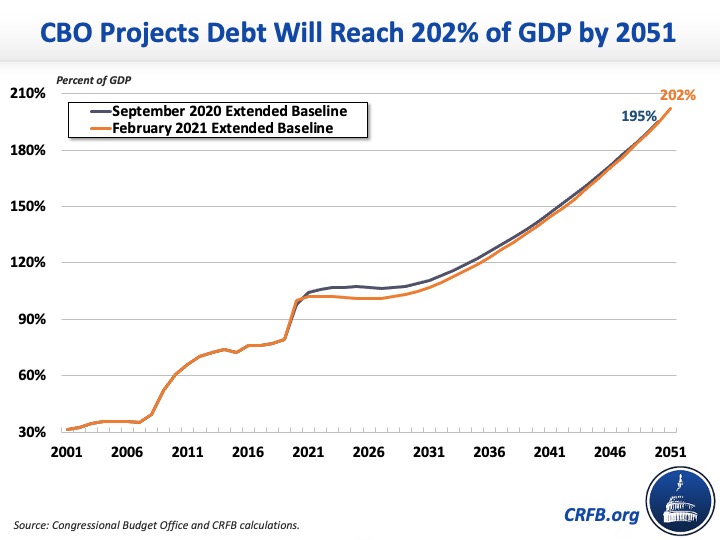

The Congressional Budget Office (CBO) released a new set of long-term budget projections today, showing that the long-term fiscal outlook remains unsustainable even after the COVID-19 pandemic subsides. CBO's report partly extends their ten-year budget projections from last week through Fiscal Year (FY) 2051. Under current law, national debt is expected to grow to more-than-twice the size of the economy within 30 years, and interest is on track to become the largest single line-item in the federal budget.

Under current law, federal debt held by the public will have grown from over 79 percent of Gross Domestic Product (GDP) in 2019 to over 102 percent of GDP in 2021. From there, CBO expects debt to grow steadily to over 107 percent of GDP by 2031, 145 percent of GDP by 2041, and 202 percent of GDP by 2051. In nominal dollars, debt will grow from $16.8 trillion at the end of 2019 to $133 trillion by the end of 2051.

The debt situation could be much worse if lawmakers continue to act irresponsibly. We previously estimated that if lawmakers enact additional fiscal support to fight COVID-19, extend expiring tax cuts, and grow annual appropriations with the economy, without any offsetting savings, debt-to-GDP would be about 50 percentage points higher by 2050 than under current law. Applying that same rule-of-thumb to CBO's latest projections, we predict debt will grow to around 250 percent of GDP by 2051 under our alternative scenario.

Deficits more than tripled from $984 billion (4.6 percent of GDP) in 2019 to a record $3.1 trillion (14.9 percent of GDP) in 2020 and are expected to fall slightly to $2.3 trillion (10.3 percent of GDP) in 2021. From there, CBO expects deficits to decline from their current spike but resume growing in the second half of the decade, reaching $1.9 trillion (5.7 percent of GDP) in 2031. Beyond 2031, deficits will average 7.9 percent of GDP between 2032 and 2041 and 11.5 percent of GDP between 2042 and 2051.

Rising debt and deficits continue to be driven by a disconnect between spending and revenue. Spending grew from 21.0 percent of GDP in 2019 to 31.2 percent in 2020 and is expected to fall to 26.3 percent in 2021, which is still very high historically speaking. From there, spending is projected to fall as a share of GDP over the next three years as the pandemic ends before rising again. CBO expects spending to average 21.9 percent of GDP between 2022 and 2031, 25.6 percent between 2032 and 2041, and 29.7 percent between 2042 and 2051. Meanwhile, revenue will increase steadily as a share of GDP from a pandemic-induced low of 16.0 percent in 2021. CBO expects revenue to average 17.5 percent of GDP between 2022 and 2031, 17.7 percent between 2032 and 2041, and 18.2 percent between 2042 and 2051.

The projected growth in long-term spending is mostly driven by rising health, interest, and retirement costs. CBO estimates spending on Social Security will total 5.2 percent of GDP in 2021, then average 5.6 percent between 2022 and 2031, 6.1 percent between 2032 and 2041, and 6.3 percent between 2042 and 2051. Outlays for the major health care programs – Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the Affordable Care Act (ACA) exchanges – will total 5.8 percent of GDP in 2021, then average 6.3 percent between 2022 and 2031, 7.8 percent between 2032 and 2041, and 9.0 percent between 2042 and 2051.

Interest costs will total 1.4 percent of GDP in 2021, then average 1.6 percent between 2022 and 2031, 4.0 percent between 2032 and 2041, and 7.0 percent between 2042 and 2051. At some point in the 2040s, net interest costs will become the largest single item in the federal budget, surpassing even Social Security and Medicare.

Budget Projections Under CBO's Extended Baseline (Percent of GDP)

| 2019 | 2020 | 2021 | 2022-2031 | 2032-2041 | 2042-2051 | |

|---|---|---|---|---|---|---|

| Spending | 21.0% | 31.2% | 26.3% | 21.9% | 25.6% | 29.7% |

| Social Security | 4.9% | 5.2% | 5.2% | 5.6% | 6.1% | 6.3% |

| Health Care | 5.3% | 6.2% | 5.8% | 6.3% | 7.8% | 9.0% |

| Other Mandatory | 2.7% | 10.4% | 6.3% | 2.3% | 2.1% | 2.0% |

| Discretionary | 6.3% | 7.8% | 7.6% | 6.1% | 5.5% | 5.5% |

| Net Interest | 1.8% | 1.6% | 1.4% | 1.6% | 4.0% | 7.0% |

| Revenue | 16.3% | 16.3% | 16.0% | 17.5% | 17.7% | 18.2% |

| Deficit | 4.6% | 14.9% | 10.3% | 4.4% | 7.9% | 11.5% |

| Debt* | 79% | 100% | 102% | 107% | 145% | 202% |

Source: Congressional Budget Office and CRFB calculations. Debt figures represent debt held by the public at the end of the period.

CBO's newest long-term projections show lower debt over the short- and long-term compared to last year's projections. Specifically, debt is projected to be 2 percentage points lower in 2021 compared to the previous projection, 4 percentage points lower in 2031, and two percentage points lower in 2041. Although CBO's previous long-term outlook ended in 2050, it would have likely predicted a similar level of debt in 2051 as predicted in this newest outlook.

Furthermore, these new long-term projections demonstrate that our debt trajectory is still unsustainable. High and rising debt will ultimately have serious, adverse consequences. As we've written before, rising debt slows income growth, increases interest payments, places upward pressure on interest rates, reduces the fiscal space available to respond to a recession or emergency, places an undue burden on future generations, and increases our risk of a fiscal crisis.

Once the current crisis ends and the economy is well on its way to recovery, policymakers must turn their attention to long-term debt and deficit reduction to get the country on solid fiscal ground. This includes action to secure Social Security and other trust funds headed toward insolvency, limit the growth of health care and other costs, and raise additional tax revenue.