CBO Releases July 2021 Budget and Economic Outlook

The Congressional Budget Office (CBO) just released its updated Budget and Economic Outlook, accounting for enactment of the American Rescue Plan and months of new economic data. CBO’s latest baseline is an update to its February 2021 Budget and Economic Outlook and it shows the fiscal picture has slightly improved since then in large part to an improved economic outlook.

Under current law, the budget deficit will hit $3.0 trillion (13.4 percent of Gross Domestic Product (GDP)) in Fiscal Year (FY) 2021 and total $12.1 trillion (4.2 percent of GDP) over the subsequent decade. Deficits are projected to decline after FY 2021 to $1.2 trillion (4.7 percent of GDP) in 2022 and to $753 billion (2.9 percent of GDP) in 2024 before rising to $1.9 trillion (5.5 percent of GDP) by 2031.

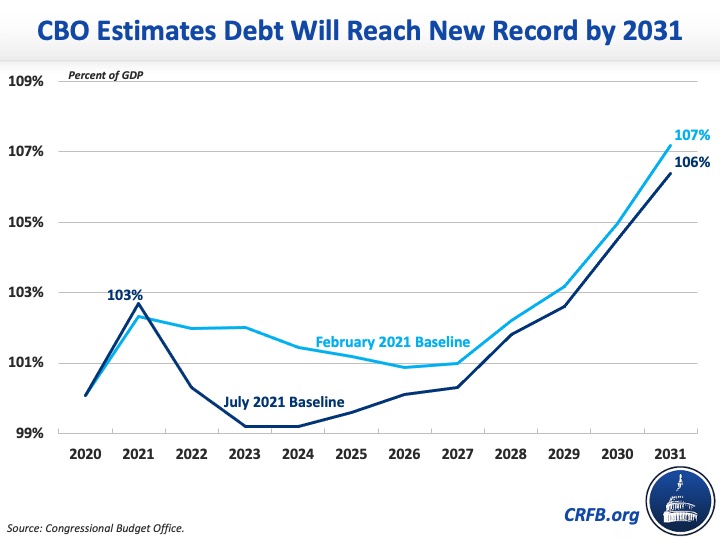

Meanwhile, the national debt will reach a new record by the end of the budget window. CBO estimates federal debt held by the public will rise from 100 percent of GDP at the end of FY 2020 to 103 percent of GDP in 2021. From there, debt will remain relatively stable as a share of GDP (between 99 and 102 percent of GDP) through the end of FY 2028 before ultimately rising to 106.4 percent of GDP by the end of FY 2031 – surpassing the prior record of 106.1 percent of GDP set in 1946.

In nominal dollars, debt will grow by $13.6 trillion, from $22.2 trillion today to $35.8 trillion by the end of FY 2031.

In addition to its budget projections, CBO released a new ten-year economic forecast showing that the economy (as measured by real GDP on a fourth quarter to fourth quarter basis) will grow by 7.4 percent in calendar year (CY) 2021 and by 3.1 percent in 2022, enough to exceed its sustainable capacity under CBO's forecast. Between CY 2023 and 2025, CBO projects real GDP growth of 1.1-1.2 percent per year as the economy returns to its potential. Over the second half of the decade, real GDP will grow by roughly 1.6 percent per year.

CBO expects higher-than-normal inflation in CY 2021, with the Personal Consumption Expenditures (PCE) Price Index growing by 2.8 percent and the Consumer Price Index (CPI) growing by 3.4 percent. Beyond this year, CBO expects steady PCE inflation of about 2.1 percent per year.

CBO project the unemployment rate will fall from 6.8 percent at the end of CY 2020 to 4.6 percent in 2021 and 3.6 percent in 2022 before rising slightly to 3.8 percent by the end of 2023 and to 4.5 percent by the end of the decade.

Lastly, CBO estimates ten-year bond rates will rise from 0.9 percent in CY 2020 to 1.6 percent in 2021, to 1.9 percent in 2022, and to 2.0 percent in 2023. From there, the rate on ten-year bonds will average 2.4 percent between CY 2024 and 2025 and 3.2 percent between CY 2026 and 2031.

The Committee for a Responsible Federal Budget will release our full analysis of CBO’s report later today.