CBO: Federal Investment is Good for Long-Term Growth - If It's Paid For

Public investment has the potential to significantly increase economic growth, but only if its paid for – that's the key finding of a recent report, The Macroeconomic and Budgetary Effects of Federal Investment, from the Congressional Budget Office (CBO). The report also finds that while paid-for public investment could reduce the deficit after dynamic effects are included, deficit-financed investment not only wouldn't pay for itself but would actually add more to the debt than the initial cost when dynamic effects are included.

Today's low interest rates offer an opportunity to front-load new investments to spur economic growth. But if new investments aren't eventually paid for, the harmful effects of debt will ultimately outweigh the economic gains from investment. Policymakers should therefore couple any new investments with a plan to offset the costs over the medium run and reduce the long-term growth of the national debt.

How Will Public Investment Impact the Economy?

Of course, every investment will have a different impact on the economy. In general, government spending on physical capital (infrastructure), education and training, and research and development will all tend to boost economic output, but by different amounts and at different paces. CBO estimates that, on average, federal investment generates about 5 cents of economic growth each year for every dollar of productive investment, with the productivity of the investment phasing in about half over 4 years, all the way over 20 years, and depreciating in value not long after that.1

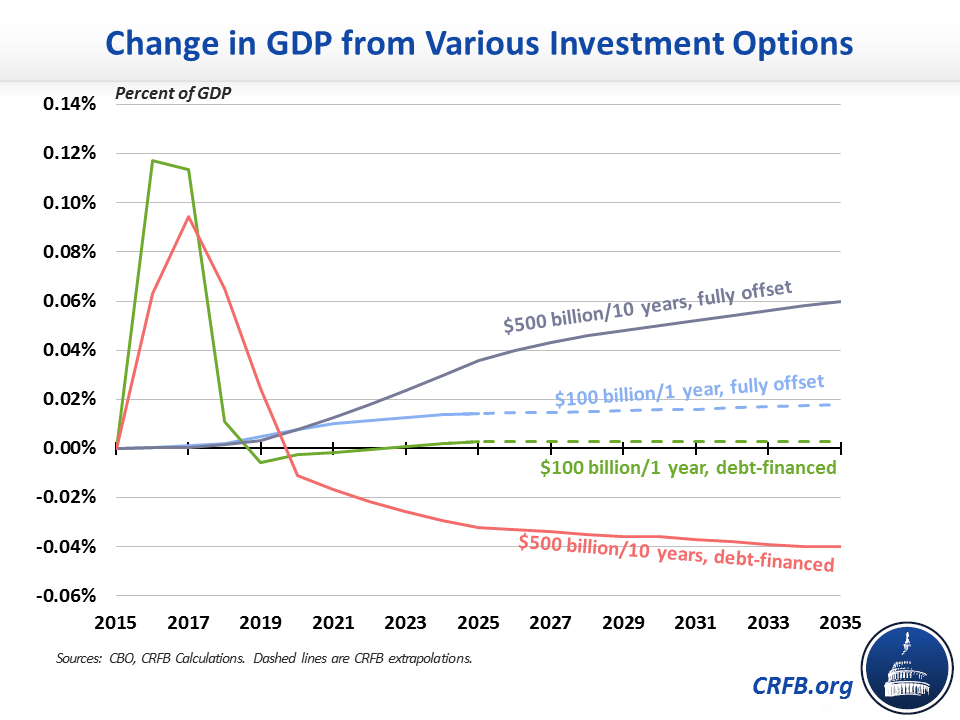

In its analysis, CBO estimates the economic impact of increasing investment by $100 billion, mostly spent in five years (all appropriated in the first year), and by $500 billion, mostly spent over 15 years (with $50 billion appropriated per year for ten years). In each case, CBO projects the economic impact under two scenarios: assuming the investments were entirely debt-financed and assuming they were entirely paid for in the year they were spent.

While CBO found debt-financed investments would do far more than paid-for investments to stimulate the near-term economy, they would do far less to increase long-term economic growth. Specifically, CBO estimated that $100 billion of front-loaded investments would increase Gross Domestic Product (GDP) in 2025 by four times as much if it were paid for than if it were deficit-financed – 0.015 percent of GDP ($4 billion) versus 0.004 percent of GDP ($1 billion).

CBO's findings were much more stark when estimating $500 billion of sustained investment. They estimated paid-for investment would increase GDP by 0.04 percent in 2025 and 0.06 percent in 2035, but debt-financed investment would shrink the economy by 0.03 percent in 2025 and 0.04 percent in 2035. In other words, CBO estimates that increases in the debt would do more to harm the economy than increases in public investment would do to help it – at least on average.

To be sure, not everyone agrees with CBO's findings – some argue the economic return to investment could be much higher. But CBO shows that if the economic return were twice what they assume, paying for infrastructure will still grow the economy more than debt-financing it. In this scenario, CBO finds that while $500 billion of debt-financed investment could increase GDP by up to 0.06 percent in 2025, $500 billion of fully paid-for investment would increase it by 0.08 percent.

How Will Public Investment Impact the Budget?

Some advocates for debt-financing federal investment argue that with interest rates so low, investments will pay for themselves. In the past, we've debunked similar arguments that tax cuts pay for themselves – and CBO's latest report confirms that investment does not either.

By increasing economic activity, fully paid-for investment can modestly reduce budget deficits according to CBO. But because debt-financed investment both slows growth and increases interest rates,2 CBO finds the economic feedback would actually add to rather than subtract from its costs, which can be seen by looking at CBO's four theoretical scenarios. For purposes of the effect on budget deficits, we refer to the $500 billion investment as a $400 billion investment because only about $400 billion is spent in the first ten years following enactment.

For example, while CBO estimates that $400 billion of paid-for investment will reduce the debt in 2025 by $4 billion and reduce the debt-to-GDP ratio by 0.05 percentage points, they find that $400 billion of debt-financed investment will add nearly $500 billion to the debt, including interest, and increase the debt-to-GDP ratio by 1.9 percentage points. Over the long run, those costs would grow further.

| Debt Impact of Economic Feedback ($) |

Total Debt Impact ($) |

Total Debt Impact (% of GDP) |

|

|---|---|---|---|

| $100 billion, Paid-For | ↓$2 billion | ↓$2 billion | ↓0.02% |

| $100 billion, Debt-Financed | ↑$13 billion | ↑$141 billion | ↑0.53% |

| $400 billion*, Paid-For | ↓$4 billion | ↓$4 billion | ↓0.05% |

| $400 billion*, Debt-Financed | ↑$26 billion | ↑$497 billion | ↑1.90% |

*This reflects CBO’s option to spend $500 billion, of which $398 billion is spent in the first decade.

In other words, there is no free lunch when it comes to federal investment.

What is the Best Way to Promote Growth?

The CBO analysis makes clear that paying for new investments will grow the economy, while debt-financing them will ultimately shrink the size of the economy.

Unlike debt-financed investment, however, paying for all investments in the year they are made does nothing to give the economy a near-term boost nor does it allow policymakers to take advantage of today's record-low interest rates. A third possible option – to invest heavily in infrastructure now and pay for it over time – may offer a win relative to either of the choices CBO has offered.

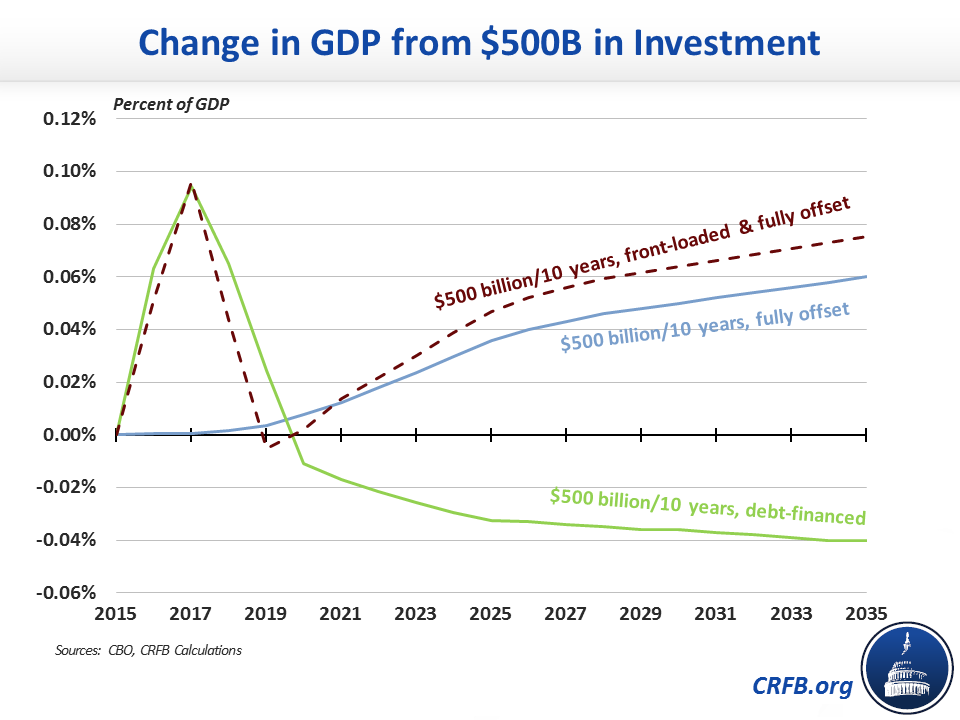

To test this theory, we adjusted CBO's growth numbers to assume policymakers funded $180 billion of infrastructure in two years and $40 billion each for the subsequent eight years; in other words, we assumed the same $500 billion as CBO but with much more of the spending occurring in the early years.3 Meanwhile, we assumed the offsets phased in gradually over 5 years so that new investments would add to the debt in the early years, but these deficits would be completely paid off after a decade.

We found that this policy would do just as much to stimulate the economy in the near-term as $500 billion of debt-financed investment, but it also would increase long-term GDP growth by more than either of CBO's two scenarios. Specifically, we estimate this policy would increase GDP by 0.076 percent in 2035 – compared to a 0.06 percent increase if the investment is fully paid-for in the year it is made and a 0.04 percent reduction if it is debt-financed.

Some near-term debt-financed spending may be wise given today's low interest rates, but only if accompanied by a plan to pay back the cost of that spending as interest rates rise and before debt accumulates. We hope that this year's presidential candidates will heed this advice and incorporate this finding into their recommendations for increased infrastructure.

As CBO's analysis shows, fiscal responsibility and economic growth go hand-in-hand when it comes to sustaining the economy over the long term. While increasing investment could cure some of the ails the nation's infrastructure, research, and education face today, these benefits will only materialize if policymakers acknowledge that there is no free lunch. The best growth strategy would combine important investments and tax reforms with a thoughtful mixture of spending cuts, revenue, and entitlement reforms.

1 Rather than look at a specific set of investments, CBO assumes a generic mixture of investments almost half of which is in physical capital like infrastructure, nearly a third of which is in education, and the remaining nearly quarter of which is in R&D. CBO estimates this mixture will generate about 5 cents of economic growth each year for every dollar of productive investment, with the productivity of the investment phasing in about half way over four years, all the way over 20 years, and depreciating in value not long after that. Importantly, CBO's estimates for public investment are both lower and slower than private investment, largely because they believe public investment is less aimed toward achieving GDP growth, regulations increase the cost of public investment, state and local governments will invest less when the federal government investments more, and a larger share of public investment is in slow-returning R&D as compared to private investment. Importantly, CBO also estimates the effects of investment with different returns to show a range. Unless otherwise noted, this analysis uses CBO's central estimate.

2 Interest rates would rise in this scenario for two reasons. First, increased federal investment would likely improve economic productivity, which would tend to increase interest rates. At the same time, the additional borrowing to finance infrastructure would also likely increase interest rates. Importantly, when national debt levels are high – as they currently are – even small changes in interest rates can significantly increase federal interest costs and therefore the budget deficit.

3 Our calculations for this scenario are rough extrapolations created by separating out CBO's offsetting effects. These calculations may not fully account for interacting effects, which could change the results.