Budget Issues Abound in the Senate Defense Authorization

Update: The Reed amendment was rejected in floor consideration by a 46-51 vote.

The Senate is currently considering the National Defense Authorization Act (NDAA), and there are a number of issues at stake. Most notably, this bill has the potential to bring the issue of sequester relief to a head, with Senate Democrats and the White House threatening to block passage of the bill due the use of war spending (Overseas Contingency Operations, or OCO) to allow defense spending to rise above sequester levels. There are also military compensation reforms in the bill, although there is less controversy there since the White House generally supports them.

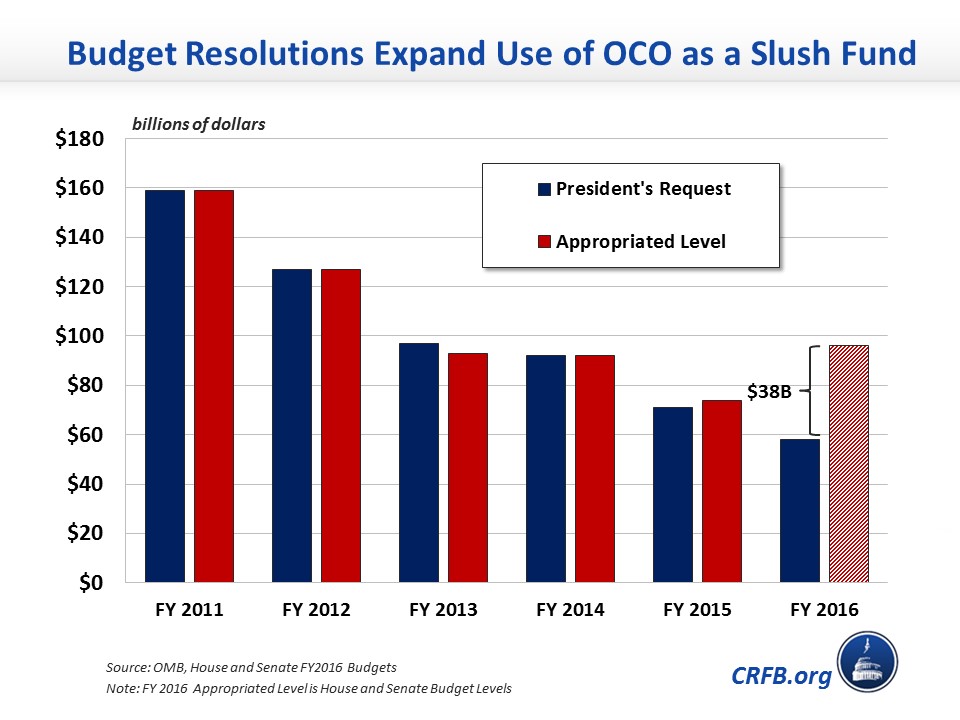

The NDAA, largely reflecting the Congressional budget resolution, would authorize defense appropriations totaling $605 billion for FY 2016, including $516 billion for regular defense spending, in line with the sequester-level caps, and $89 billion in OCO funding, which is not subject to spending caps. CBO estimates that $50 billion of this OCO funding would be used for war-related activities, with the remaining $39 billion to be explicitly used to backfill regular defense spending (actually slightly larger than the budget resolution's $38 billion slush fund). We’ve written many times about the problem with using this slush fund to get around the spending caps and how it is much more preferable to lift the spending caps and offset them with other savings as they did in 2013. Although this has been a growing trend on the margins, this year's budget and appropriations utilize this gimmick to an unprecedented degree, increasing war spending well above the President's request as opposed to past years when appropriations typically matched the request.

Senate Armed Services Committee Ranking Member Jack Reed (D-RI), who voted against the bill in committee, is offering an amendment that would shut off the slush fund until an agreement was made to lift the caps. This would certainly be an improvement and would make it much more clear to lawmakers that they would have to come to a sequester relief deal rather than fund defense through gimmicks. A bigger step would be to codify, for legislative purposes, strict criteria for what can qualify as OCO spending, thus ensuring that lawmakers cannot abuse this gimmick this year or in future years.

While the NDAA takes a clear step back on fiscal responsibility with regards to OCO, it does take positive steps on reforming military compensation that the Pentagon has generally supported to make it easier to budget within the current spending caps.

For one, the NDAA reduces the basic pay raise by 1 percentage point (lowering it from 2.3 percent to 1.3 percent) and reduces the Basic Allowance for Housing from 99 percent of costs to 95 percent. But the biggest changes come in military retirement and TRICARE.

The bill adopts key features of the Military Compensation and Retirement Modernization Commission's recommendations for military retirement. It changes the current defined-benefit system that only benefits those who have a 20-year military career to a hybrid system. Service members would have 1 percent of their pay automatically contributed to the Thrift Savings Plan (TSP), a defined contribution plan for federal employees, and after two years of service, they would have additional contributions of up to 4 percent of pay matched. The defined-benefit pension would be reduced from 2.5 percent to 2 percent of base pay, and retirees would have the option of receiving a lump-sum payment when they leave the service in exchange for reduced annuities later.

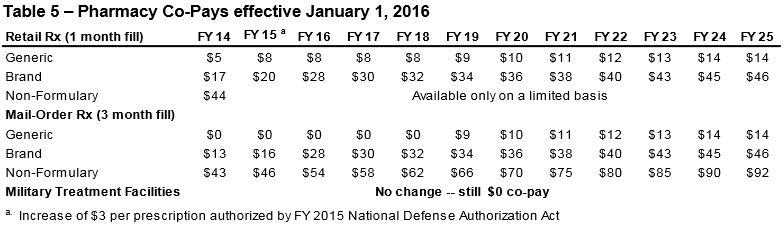

On TRICARE, the bill does not adopt the MCRMC's recommendations -- which would replace TRICARE with an allowance to buy health insurance for active-duty service members -- but it does adopt the Pentagon's requested policy for pharmacy co-pays after the authorization bill last year approved a much more limited increase. The schedule of increases is shown below.

The mandatory spending and revenue changes would reduce deficits by $4 billion over ten years. CBO does say that the bill would increase deficits in the second decade as a result of the lump-sum payment, but that provision -- and thus the bill itself -- would ultimately save money over the longer term as the reduced annuities would overtake the lump-sum payments. These changes are a good step forward but do not go as far as the MCRMC and the Pentagon have recommended in some cases.

The compensation reforms are a good step forward, but ultimately they have a much smaller effect than the OCO slush fund the bill contains. Hopefully, the full Senate will move to limit the gimmick.