Big 6 Tax Framework Could Cost $2.2 Trillion

The so-called "Big 6" today released their framework for comprehensive tax reform. While significant detail still needs to be filled in, enough exists for a very rough and very preliminary estimate of the details presented. Based on those details – and many assumptions – we estimate the plan calls for roughly $5.8 trillion of tax cuts and $3.6 trillion of base broadening, resulting in about $2.2 trillion of net tax cuts.

These numbers come with a high degree of uncertainty and exclude a number of potential offsets where no details exist. But it is clear that much more work needs to be done to ensure tax reform is fiscally responsible. Given today's record-high levels of national debt, the country cannot afford a deficit-financed tax cut. Tax reform that adds to the debt is likely to slow, rather than improve, long-term economic growth.

The plan outlined today includes the following proposals:

- Consolidating and reducing individual income tax rates to 12, 25, and 35 percent

- Eliminating the Alternative Minimum Tax (AMT) for both corporations and individuals

- Nearly doubling the standard deduction to $12,000 for individual and $24,000 for families

- Establishing a $500 non-child dependent credit and larger child credit

- Repealing the personal and dependent exemptions, and deductions for the blind and elderly in light of the larger standard deduction and credits.

- Repealing most itemized deductions, leaving those for mortgage interest and charitable giving

- Repealing the estate tax

- Reducing the corporate tax rate to 20 percent

- Establishing a maximum "pass-through" rate of 25 percent with unspecified protections against gaming

- Enacting full expensing for at least five years

- Moving to a territorial system for overseas earnings and imposing a one-time tax on past earnings held by U.S. businesses

- Indexing tax brackets to a more accurate measure of inflation, likely the Chained CPI

- Limiting the amount of business interest than can be deducted by C-corporations

- Repealing the deduction for domestic manufacturing (Section 199)

The framework also calls for further reforms to individual and business tax preferences but offers no details. Including more details would allow the plan to save more, potentially hundreds of billions. The plan suggests there could be a higher rate for the highest earners.

Many of these policies are similar to those in previous House Republican and Trump Administration plans, though many differences exist as well.

Making many assumptions about the plan – including that the brackets apply to the same income as the Trump campaign's plan, that its 25 percent pass-through rate contains guardrails so it only applies to active business income, and that the limit on interest makes up about half the revenue lost from expensing – we estimate the plan has about $5.8 trillion over a decade of gross tax cuts and would cost $2.2 trillion on net through 2027. Given that it calls for only five years of expensing rather than permanent – a major budget gimmick – it also potentially sets the stage for an extenders package of over $1 trillion when expensing expires.

| Policy | 2018-2027 Deficit Impact |

|---|---|

| Cost ($) | |

| Change individual rate structure to 12%, 25%, and 35% and repeal AMT | $1.7 trillion |

| Almost double the standard deduction to $12,000/$24,000 | $0.7 trillion |

| Create $500 credit for non-child dependents and significantly expand child credit (we assumed by $500) | $0.4 trillion |

| Repeal estate tax | $0.2 trillion |

| Reduce corporate tax rate to 20% and repeal AMT | $1.9 trillion |

| Cap top rate of 25% on [active] business income° | $0.5 trillion |

| Enact full expensing for "at least five years" | $0.4 trillion |

| Move to territorial system with one-time tax on overseas profits | $0** |

| Subtotal, Tax Cuts | $5.8 trillion |

| Repeal most itemized deductions except those for mortgage interest and charitable giving | -$1.6 trillion |

| Index tax brackets to a more accurate measure of inflation (we assumed Chained CPI) | -$0.1 trillion |

| Repeal personal/dependent exemptions | -$1.6 trillion |

| Enact partial limit on interest deduction* | -$0.2 trillion |

| Repeal Section 199 (domestic production deduction) | -$0.1 trillion |

| Repeal or reform other business tax expenditures | unspecified |

| Repeal or reform other individual tax breaks | unspecified |

| Consider additional tax bracket with higher tax rate on high-earners | unspecified |

| Subtotal, Tax Increases | -$3.6 trillion |

| Net Cost | $2.2 trillion |

| Debt Impact of a $2.2 Trillion Tax Cut with Interest | $2.7 trillion |

Source: CRFB calculations based on estimates of similar policies by the Tax Policy Center and the Tax Foundation. Our estimate is very rough, as the plan lacks some details that could change the score significantly. We did not model this plan, but we compiled estimates of the component pieces from various similar estimates, notably the 2016 version of President Trump's campaign plan, the House GOP "Better Way," and the White House's April tax "framework." For instance, we assumed the rate structure of 12/25/35 contained the same income breakpoints as the 2016 Trump campaign plan, but the actual cost highly depends on where those breakpoints lie. For the child tax credit, the plan declines to specify how large of a "significant" increase is included, but we included the 50 percent increase that was included in the Better Way plan and the increase in the income limits considered by Ways and Means in 2014. Our number could be a significant understatement. Numbers may not add due to rounding.

*Very little detail is available on how ambitious this limit would be, and the amount saved could vary significantly, ranging from nearly $0 to $1 trillion. For the central estimate, we assumed the limit on interest makes up about half the revenue lost from expensing.

**Estimate would differ based on details, but these two proposals are likely to largely offset each other.

°We assume the 25 percent rate for active business income based on the Better Way plan, but actual details remain unspecified.

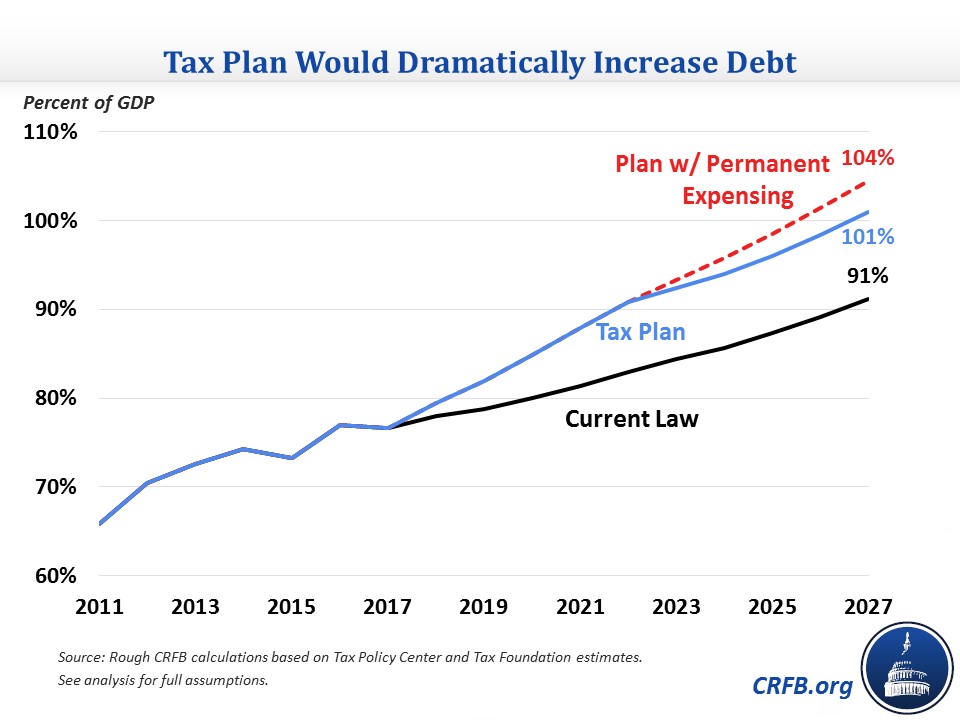

Including interest costs, the plan would cost $2.7 trillion and increase debt to 101 percent of Gross Domestic Product (GDP) by 2027, exceeding the size of the economy. Assuming expensing is ultimately made permanent, the cost could rise to $3.7 trillion, resulting in debt reaching 104 percent of GDP by 2027. These numbers are all well above the 91 percent of GDP debt that is expected under current law by 2027.

There are many details left out of the plan, and others that are simply alluded to. In particular, the plan does not detail what will happen to many individual and corporate tax breaks. Nor does the it say what income levels the new tax brackets apply to; we assumed they remained at the levels proposed by President Trump during the 2016 campaign. This plan has also left open the possibility that lawmakers will add a higher individual tax rate to help maintain progressivity. Further detail on these policies could significantly change the tax plan's revenue effect in either direction by hundreds of billions or perhaps more.

As is, the plan would add a substantial amount to federal debt, and it would be impossible to offset this amount solely through higher economic growth. As we’ve shown before, the economy is unlikely to grow at the 3 percent annual rate assumed by the Administration, and tax reform itself is unlikely to improve growth by more than a few decimal points. If anything, the added debt would slow growth over the longer term and further add to the cost of the tax plan.

There is still plenty of time to build fiscally responsible tax reform. Lawmakers can first start by including reconciliation instructions that ensure that tax reform doesn't add to the debt. They will then need to put enough tax breaks on the table to make that happen or scale back the tax cuts they have proposed. Adding trillions to the debt is not the way to go.