75% of Economic Impact Payments Have Been Paid So Far

The $1.7 trillion CARES Act included an estimated $293 billion for direct payments to individuals, officially deemed “Economic Impact Payments.” These payments offer a one-time refundable tax credit of $1,200 for each adult and $500 for each child under 17, with payments phased out over income thresholds of $75,000 for single filers and $150,000 for married couples. Payments have been distributed primarily through direct deposit, but are also being sent through physical checks and debit cards.

This blog post is a product of the COVID Money Tracker, a new initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.

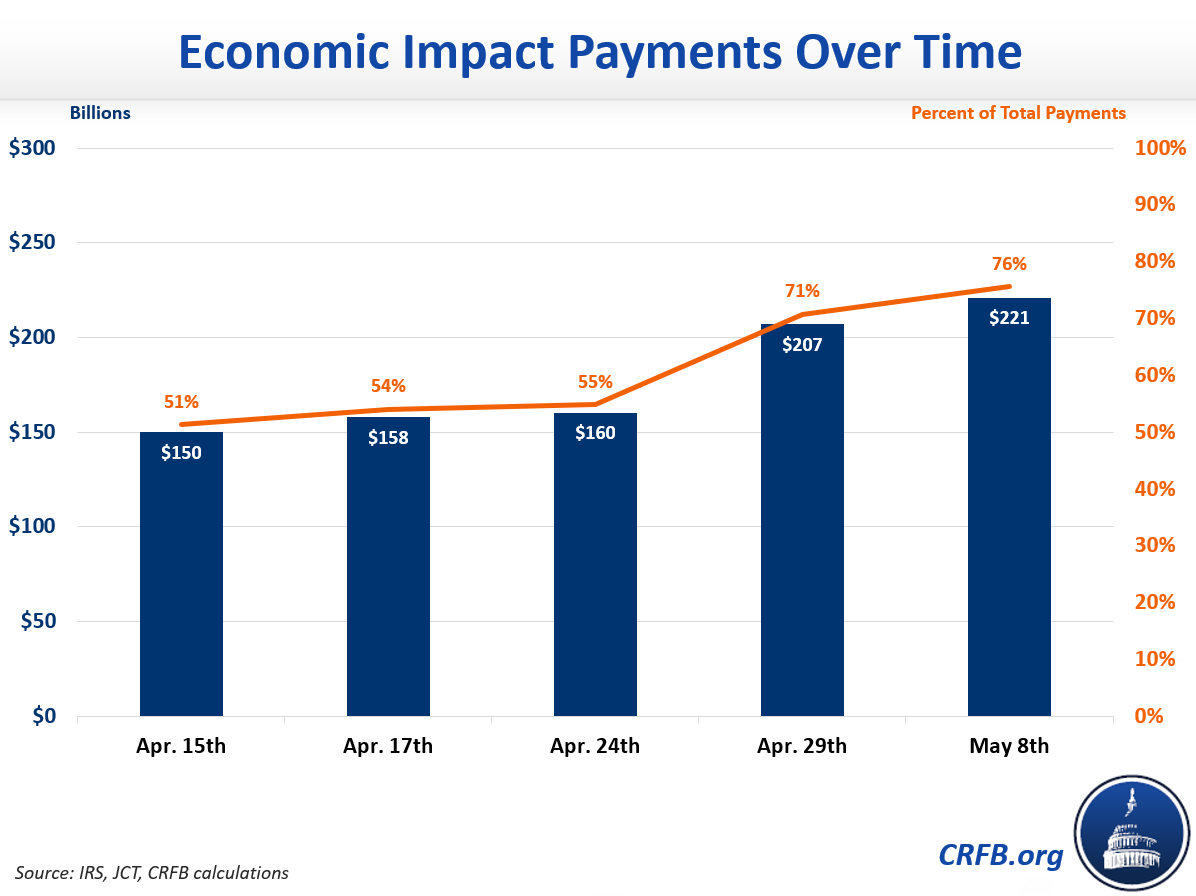

As of May 8th, the Treasury Department had made 128 million Economic Impact Payments totaling $221 billion. Assuming CBO's original estimates were correct, this suggests more than three-quarters of payments have been made. The remaining payments will mostly be distributed through September – though some taxpayers will instead get the payment as a reduction in their 2020 taxes and thus not receive a payment until early 2021. Of the payments that CBO projected would go out this fiscal year, 82 percent have been issued.

The CARES Act was signed into law on March 27. Two and a half weeks later, on April 15, the IRS paid out about half the benefits using direct deposit, initially to taxpayers who had received direct deposit tax refunds. By April 17, the IRS reported that more than 88 million Americans had received payments totaling nearly $158 billion.

The first round of physical checks was issued the week of April 24, to individuals and families with income between $0 and $10,000 in 2019. Meanwhile, direct deposit payments were still being issued, including payments to those who provided their account information through the IRS’s website. By April 29, another $50 billion in payments had been issued, bringing the total to $207 billion, or approximately 71 percent of the total amount allocated.

Checks were sent to those who earned between $10,000 and $20,000 the week of May 1 and to those who earned between $20,000 and $30,000 the next week. On May 8, the IRS reported that 128 million payments had been issued, totaling more than $221 billion. The IRS will continue issuing physical checks on a weekly basis by income through September.

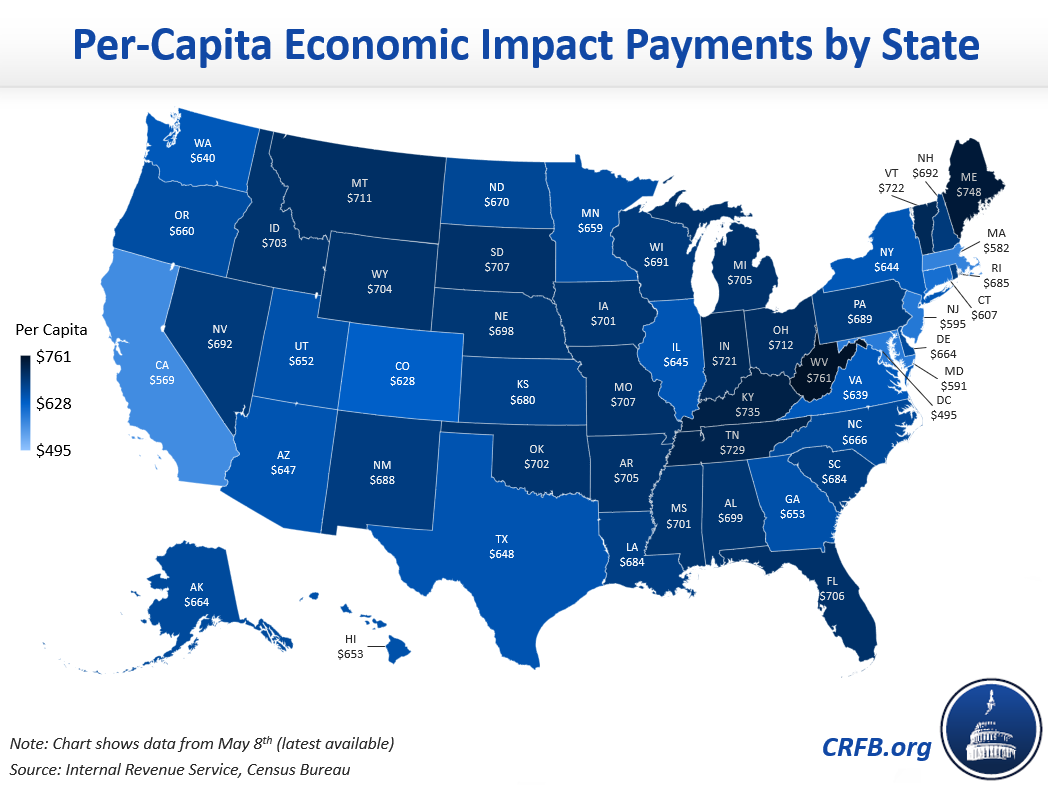

These payments have been issued to taxpayers throughout the country. Overall, California has received the most economic impact payments ($22.5 billion), followed by Texas ($18.8 billion) and Florida ($15.2 billion). These three states have the largest populations, and thus the most recipients.

On a per-capita basis, West Virginia has received the largest average payments ($761), followed by Maine ($748) and Kentucky ($735). Thus far, the District of Columbia ($495) has received the lowest average payments per-capita, followed by California ($569). These differentials are driven by the share of the population eligible for payments – payments do not go toward higher-income households, non-resident aliens, non-child dependents, or those without Social Security numbers – as well as the share of children in each state, the number of taxpayers who use direct deposit, and the income of those taxpayers who do not.

We will continue to track payments over time at COVIDMoneyTracker.org.