2015’s Fiscal Follies and Reasons for Hope

It’s the end of the year and like so many organizations, CRFB wanted to share with you our top 10 list: a look back at Congress’s 10 top fiscal achievements of 2015.

The problem is, we couldn’t. Even pooling the creative minds of our entire staff, we could not produce 10 solid Congressional actions that reduced the national debt or deficit, or were a clear step toward a responsible federal budget.

Compiling a list of the year’s 10 greatest fiscal follies was a lot easier, so we are delighted to share that with you now.

Thankfully there were a few bright spots, and we are happy to point them out in the hope that they are precursors to a very happy and fiscally responsible New Year.

So here, drawn from our 334 blogs, 29 papers, and countless charts, are The Bottom 10: Fiscal Follies of 2015, and the Top 5 Reasons for Hope in Fiscal Policy.

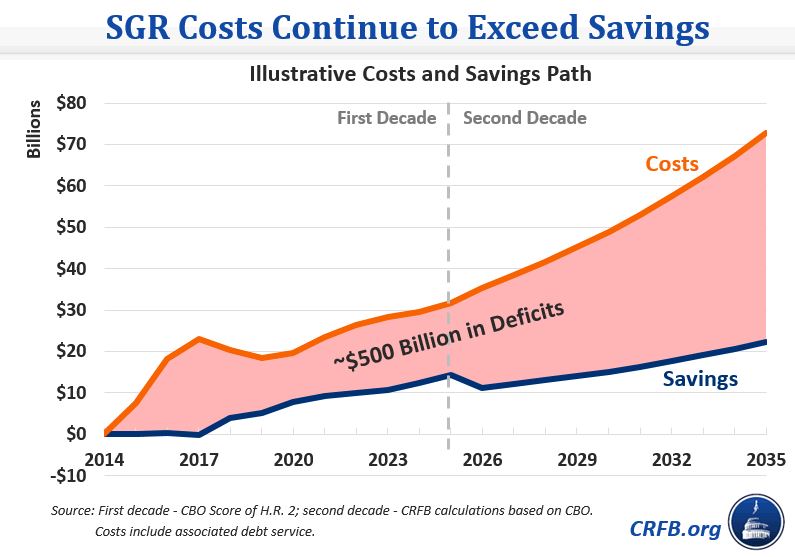

10. "Doc Fix" Breaks the Bank

Lawmakers finally ended the charade of scheduling deep cuts to Medicare physicians. Everyone knew they would be avoided at the last minute; they always were. But those previous patches had been paid for 98% of the time. Instead, this year they tacked most of the bill onto the debt at a cost of more than $500 billion over the next 20 years.

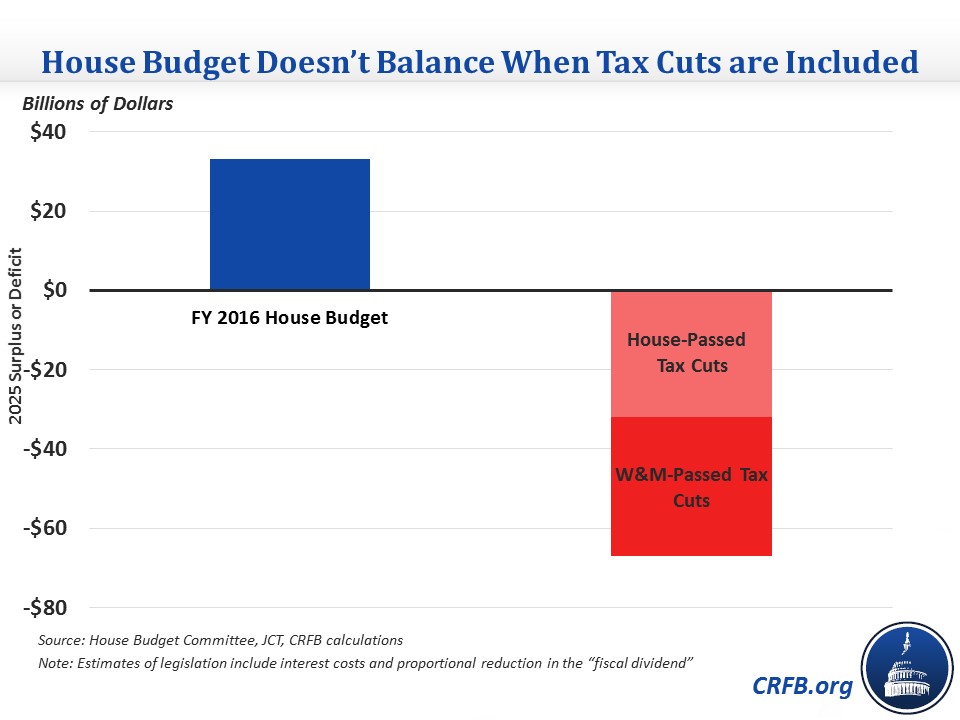

9. Tipping the Scales on a "Balanced" Budget

For the first time in five years, Congress approved a budget blueprint – one that balanced, no less. But they quickly proposed and eventually passed legislation that blew a hole in that resolution.

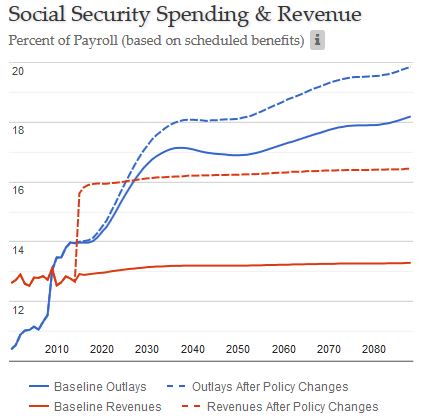

8. Not Securing Social Security

What to do when the Social Security trust fund is set to run out of money by 2034, at which point only 79 percent of benefits can be paid? Expand it, of course. At least that's what some lawmakers propose, including Democratic presidential candidate Sen. Bernie Sanders (I-VT). We put his Social Security legislation through our Reformer tool and found that, even with his proposed revenue increases, the trust fund would still not be solvent over the next 75 years.

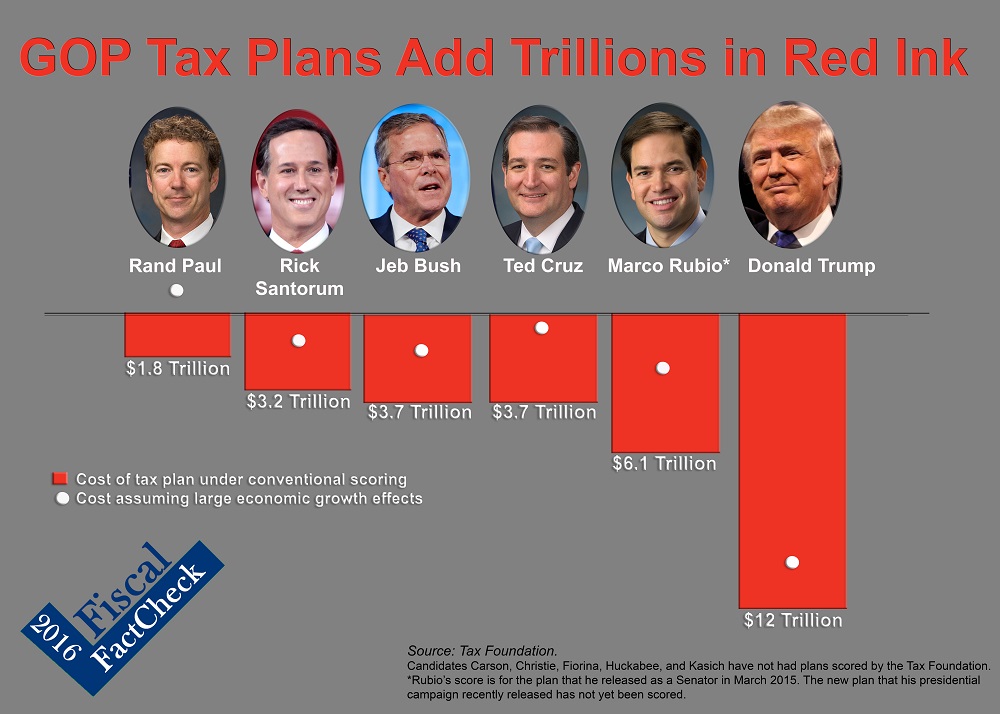

7. Cut and Run (Up the Debt)

Despite a huge and fast-growing debt, the six comprehensive tax reform plans released so far by GOP presidential candidates would add trillions more in red ink – between $2 trillion and $12 trillion over the next 10 years, according to the Tax Foundation, which has scored six of the plans.

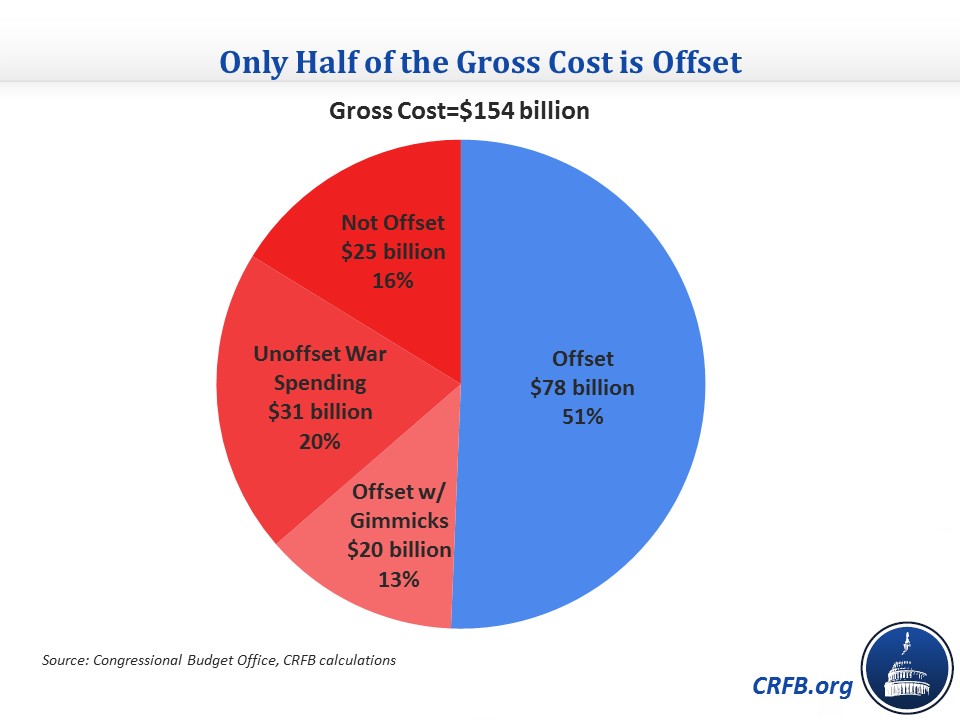

6. Bipartisan, but Half-Hearted

Bipartisan support for relief from the sequester cuts translated into just half the cost of the bill being paid for. Instead lawmakers used gimmicks and double counting. There are much better options and on the bright side, the new spending might be paid back ... after 20 years.

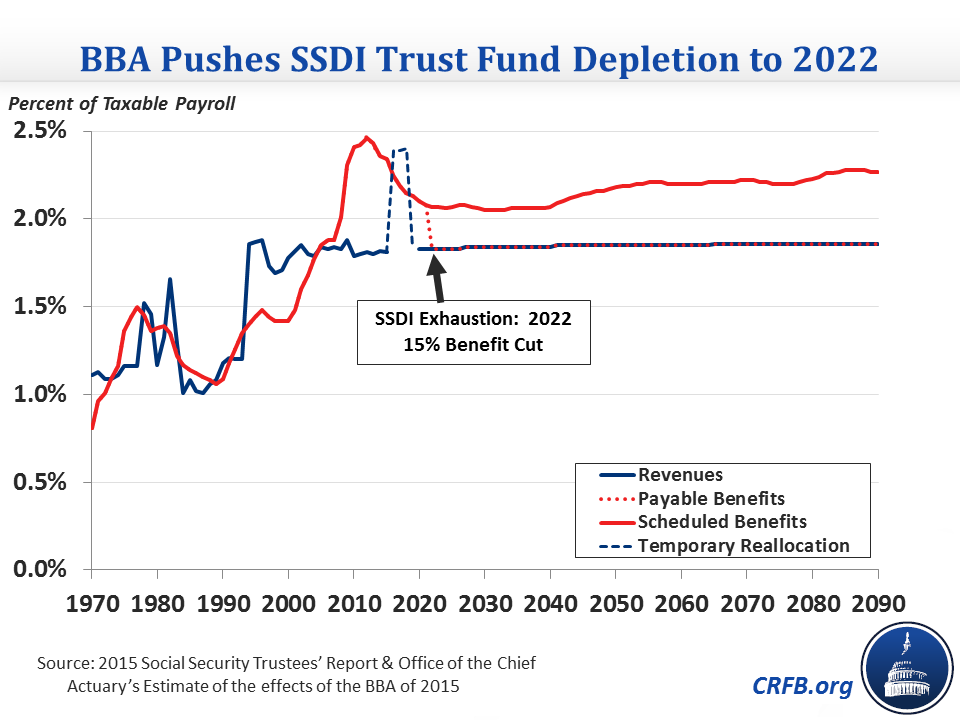

5. A Missed Opportunity for Fixing Social Security

With the Social Security Disability Insurance trust fund scheduled to be exhausted in 2016, we were hoping lawmakers would make real improvements, or start on comprehensive Social Security reform. Instead, we got a few small, though useful, reforms to Social Security and a delay of the expected depletion until 2022.

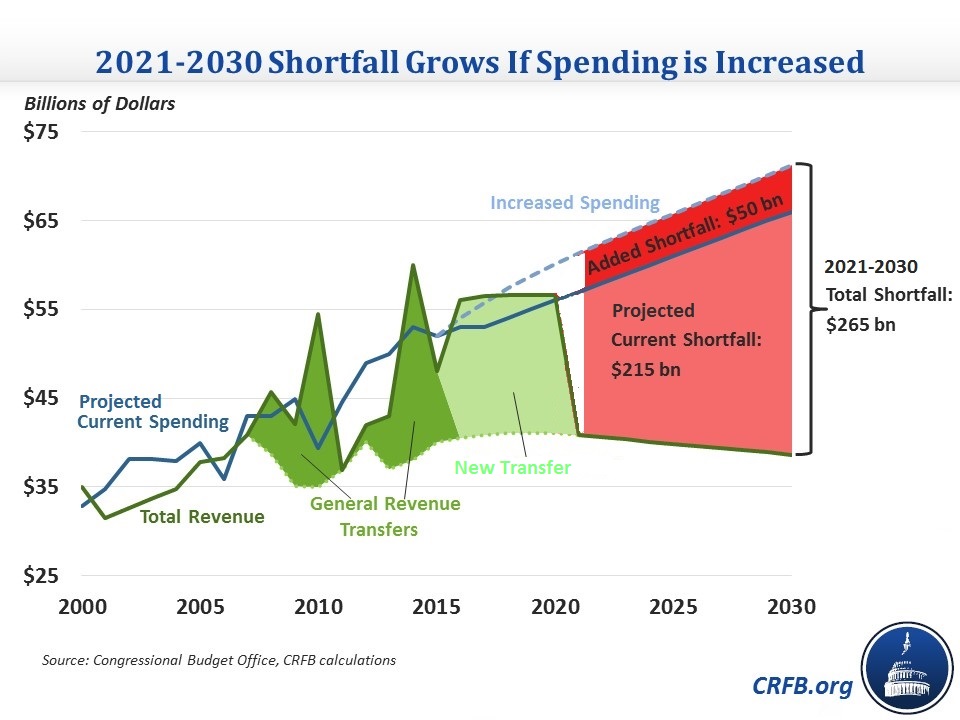

4. Highway Robbery of the Fed

Lawmakers took money from the Federal Reserve's capital surplus account to pay for more highway spending. Not only is that robbing Peter to pay Paul, but it increases the Highway Trust Fund's shortfall, which will only make it more difficult to responsibly close the gap when the temporary funding runs out.

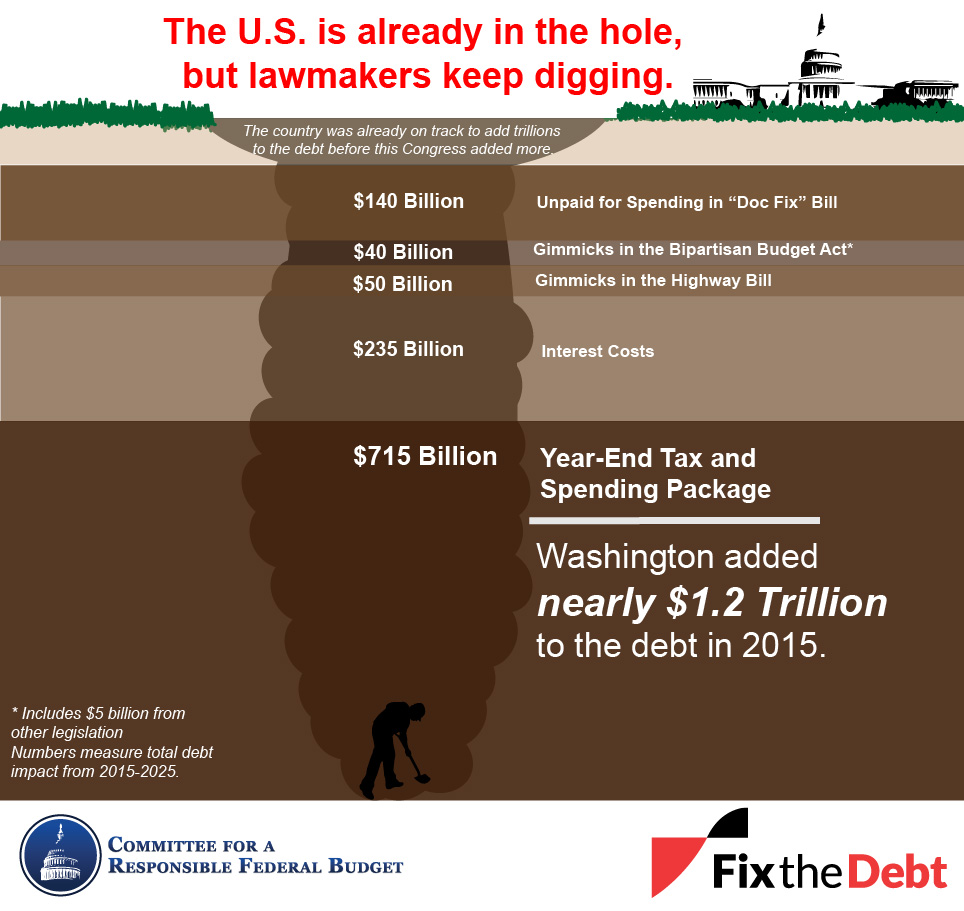

3. Backtracking on Entitlement and Tax Reform

Instead of making progress on entitlement and tax reform to reduce the national debt, lawmakers managed the impressive feat of adding more than $1 trillion to the debt.

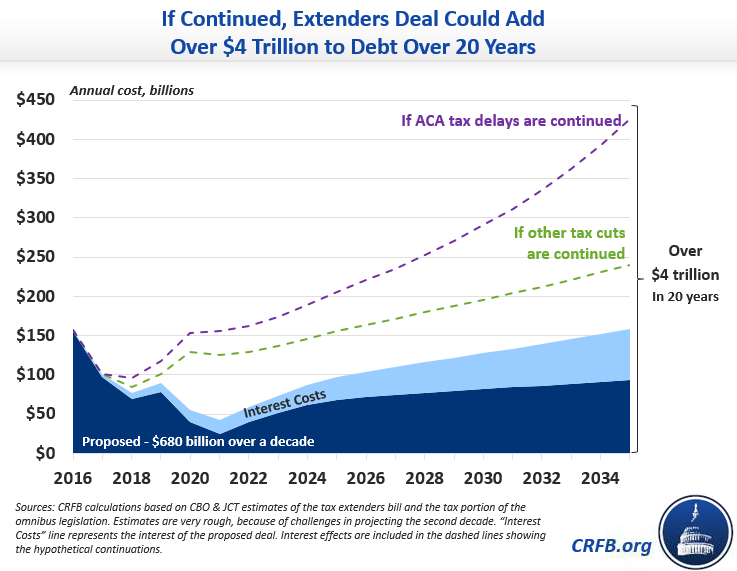

2. Not Caring Much about Cost Control

Undermining the cost-control side of the Affordable Care Act by delaying the "Cadillac" tax on high-cost health care plans may prove the most harmful part of the year-end tax extenders deal, given its role in slowing health care cost growth. And if the delay leads to repeal (and that’s looking likely), it would push the cost of that year-end deal up to more than $4 trillion over the next 20 years.

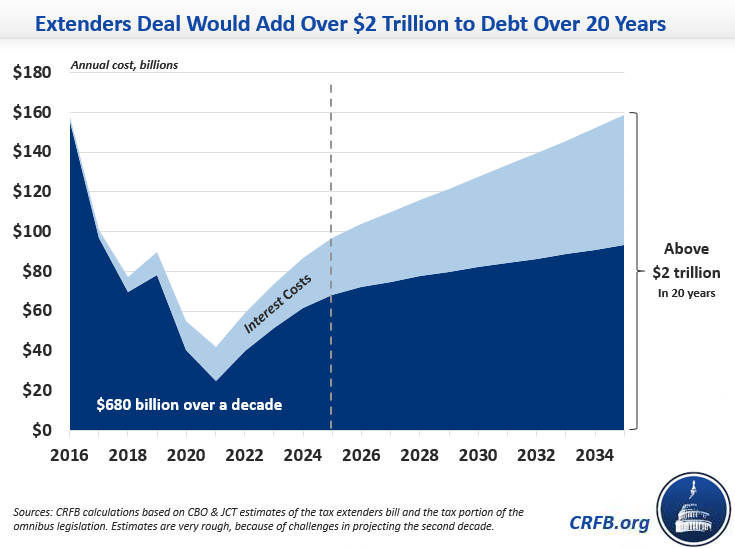

1. A $2 Trillion Deal

The end-of-year tax extenders and omnibus appropriations deal blew a hole in the budget. Instead of paying for priorities like credits and deductions for businesses and individuals, lawmakers added more than $2 trillion to the debt over the next two decades. As CRFB President Maya MacGuineas put it, "if these tax breaks are worth extending, they are also worth paying for."

2015's Top Reasons for Hope: Promising Moments in Fiscal Policy

We promised some reasons for hope and here they are, in no particular order:

1. Congress Passed A Budget Resolution

The last time Congress passed a concurrent budget resolution was five years ago. Despite our misgivings that it would actually lead to a balanced budget, it’s a promising step towards a return to regular budget processes.

2. The Government Stayed Open, With No Default

Yes, we flirted with a shutdown, but lawmakers managed to avert it. And the risk of default on our nation's obligations was pushed back to 2017 with minimal drama, leaving the full faith and credit of the government intact.

3. We Saw Some Responsible Fiscal Plans Proposed

Many lawmakers and thought leaders proposed responsible ways to address deadlines facing Congress this year. And though the ideas weren’t all adopted, their presence suggests that responsible voices will speak out in 2016 on fiscal issues.

These ideas include Rep. Scott Rigell's (R-VA) America First Act, Sen. James Lankford's (R-OK) amendment improving the Social Security Disability Insurance program, Rep. Sander Levin's (D-MI) and Sen. Tammy Baldwin's (D-WI) bill to eliminate the carried interest loophole, Reps. John Carney's (D-DE) and Jim Renacci's (R-OH) bill to improve budget process, and Reps. John Delaney's (D-MD) and Tom Cole's (R-OK) bill creating a commission for Social Security reform.

4. Democratic Presidential Candidates Plan to Pay For Their Initiatives

Some Democratic presidential candidates have included offsets with their new policy initiatives. Secretary Hillary Clinton, for instance, has released plans on transportation, education, and prescription drugs, among others, that identify how they will be paid for. Sen. Bernie Sanders and Gov. Martin O'Malley have done the same with their college proposals. All candidates should do this.

5. Republican Presidential Candidates Plan Entitlement Reform

A number of Republican candidates have proposed meaningful plans on entitlement reform, including Gov. Chris Christie (R-NJ), former Gov. Jeb Bush (R-FL), and Sen. Marco Rubio (R-FL). Additionally, Gov. John Kasich (R-OH) has released a budget framework, while Sen. Ted Cruz (R-TX) plans to release his entitlement reform plan soon. Other candidates should join them.