Tax Extenders Resources

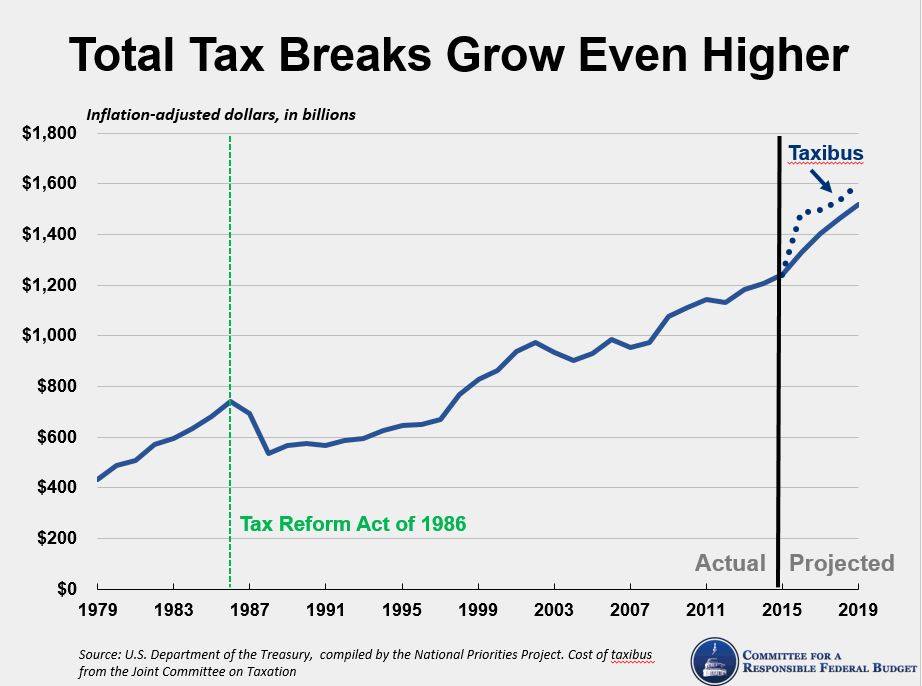

Dozens of supposedly temporary tax breaks are routinely renewed by Congress. Collectively, they are known as "tax extenders." Lawmakers once again extended many of these tax breaks, in the process making some permanent and expanding a few others. The cost was not offset, meaning it added significantly to the national debt.

Dozens of supposedly temporary tax breaks are routinely renewed by Congress. Collectively, they are known as "tax extenders." Lawmakers once again extended many of these tax breaks, in the process making some permanent and expanding a few others. The cost was not offset, meaning it added significantly to the national debt.

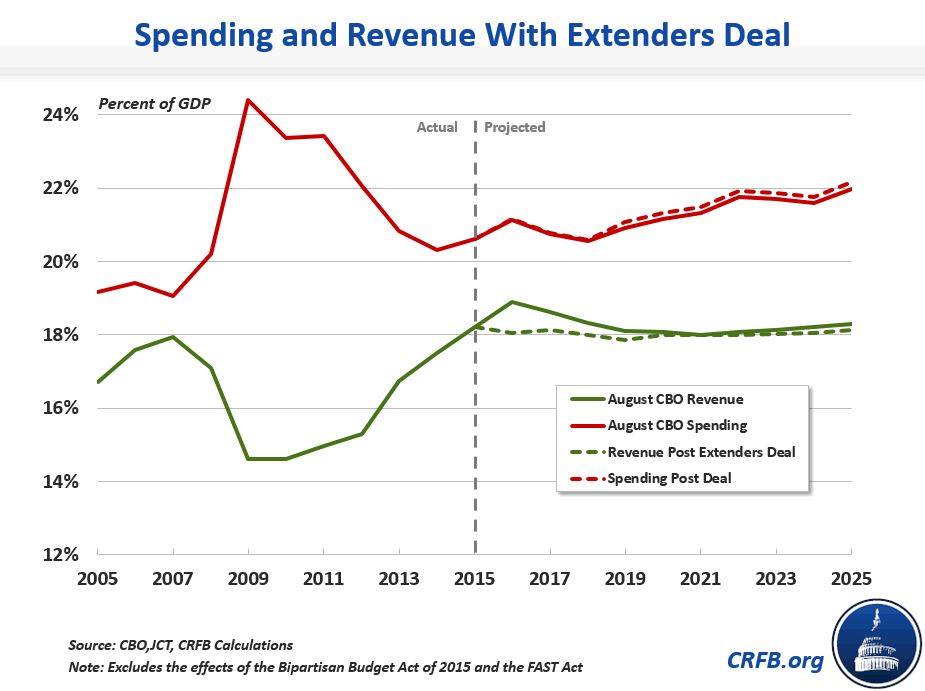

The tax extenders package will cost close to $700 billion over a decade in lost revenue. Most of these tax breaks will benefit businesses. Yet, the package is more than tax cuts. Over one-third of the package involves increased spending as well.

It is also worth noting that the funds could be used to pay for a number of policies that are priorities for many.

Deficit-Financed Tax Bill Blows a Hole in the Budget

The Fiscal Irresponsibility of the Tax Deal in 6 Charts

Negotiated Tax Deal Would Cost $680 Billion

Are Tax Extenders Worth the Cost?

Who Gets What in the Tax Extenders Deal?

Short-Term Tax Extenders Package is Still Irresponsible

The PREP Plan: Paying for the Tax Extenders to Set Up Tax Reform

Congress Should Pay for Any Extension of Tax Breaks

Seven Reasons to Pay for Tax Extenders

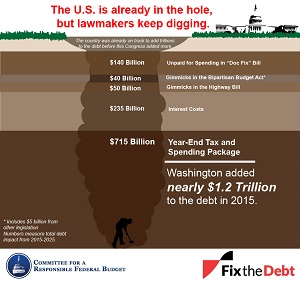

Including interest, the tax extenders deal added $830 billion to the national debt over the next decade. About $2 trillion will be added to the debt by 2035.

Including interest, the tax extenders deal added $830 billion to the national debt over the next decade. About $2 trillion will be added to the debt by 2035.

When added to the debt increases already enacted this year, the total added to the debt is over $1 trillion over the next ten years alone.

Emerging Tax Deal Could Add $2.3 Trillion in Debt by 2035

To Keep Expiring Tax Cuts, Congress Considers Another Borrowing Bonanza

Tax Extenders Deal May End Up Adding $4 Trillion to the Debt

Tax Deal Goes Beyond Simple Extensions

The $830 billion added to the debt by the tax extenders deal translates to over $6,600 per U.S. household. That's not small change by any measure.

The $830 billion added to the debt by the tax extenders deal translates to over $6,600 per U.S. household. That's not small change by any measure.

Cost per Household Infographic

The Tax Break-Down: Tax Extenders