Adding Up Senator Sanders's Campaign Proposals So Far

NOTE: This is an archive version of this analysis and contains out-of-date estimates. The most up-to-date analysis can be found here: https://fiscalfactcheck.crfb.org/adding-up-senator-sanderss-campaign-proposals-so-far/

UPDATED: This analysis was originally published on April 7, 2016. It has since been updated to reflect new policies offered by the Sanders campaign as well as changes in the Congressional Budget Office’s baseline. You can view the original analysis here: https://fiscalfactcheck.crfb.org/adding-up-senator-sanderss-campaign-proposals-so-far-archive/

Democratic presidential candidate Senator Bernie Sanders (I-VT) has proposed to significantly expand the federal government as part of his presidential campaign platform, which includes initiatives for universal single-payer health care, tuition-free college, and paid family leave, among other things.

Based on his campaign’s own estimates, Senator Sanders would increase non-interest government spending by 38 percent over the next decade (or 33 percent including interest), paid for with significantly higher tax revenue.

Senator Sanders deserves a great deal of credit for proposing specific and serious offsets for his spending proposals.

However, based on our estimates, which come largely from independent sources like the Tax Policy Center (TPC),1 these offsets would fall significantly short of the costs, and the plan would add at least $2 trillion and as much as $15 trillion to the already unsustainable national debt.

Based on our estimates, Senator Sanders’s proposals would raise both spending and revenue to far beyond any previous levels in the United States over the last half century. Assuming lower health costs, spending (including net interest) will average 30 percent of Gross Domestic Product (GDP) over the decade, and assuming higher health costs, spending will average 35 percent. By comparison, the United States has spent an average of about 20 percent of GDP over the last half century and never more than 24.4 percent.

Senator Sanders would also increase revenue substantially, to about 25 percent of GDP over the decade, which is significantly higher than the historical average of 17.4 percent and well above the previous record of 20 percent of GDP set in the year 2000.

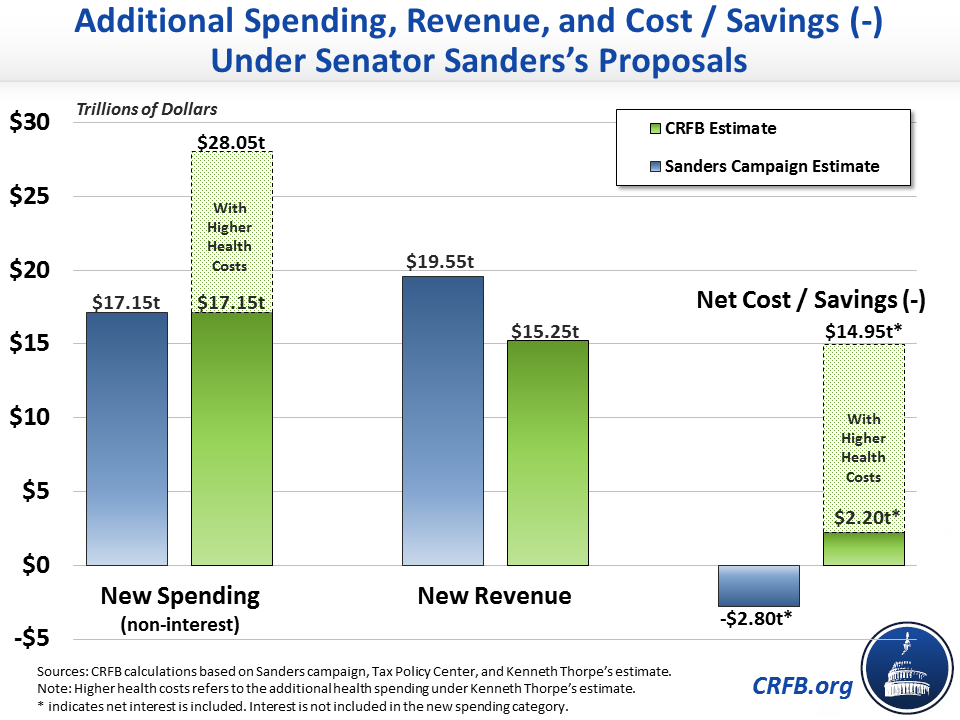

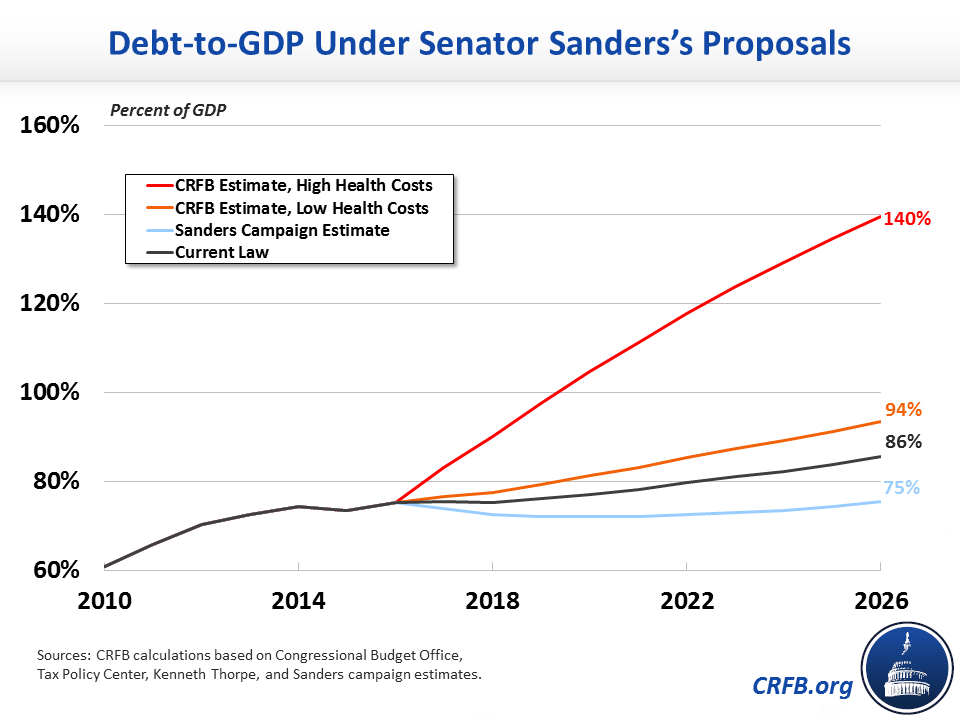

In dollar terms, we find that Senator Sanders’s major initiatives would cost over $17 trillion and up to $28 trillion (depending on health assumptions), while his tax increases – based largely on estimates from TPC – would raise less than $16 trillion.2 Incorporating interest, the result would be $2 to $15 trillion of additional debt, causing debt to rise from 74 percent of GDP in 2015 (and 86 percent by 2026 under current law) to between 94 and 140 percent of GDP by 2026.3 By comparison, the Sanders campaign’s own estimates suggest his major policies would actually reduce debt by $2.8 trillion relative to current law, resulting in a debt-to-GDP ratio of 75 percent of GDP by 2026.

Importantly, none of these estimates incorporate the potential economic consequences of the significantly higher tax rates that Senator Sanders proposes on both labor and capital (nor his more generous entitlement spending), which would likely be above the revenue-maximizing levels for the highest earners and could lead to slower growth and an even higher debt-to-GDP ratio.

Since the 2016 presidential campaign began, the Committee for a Responsible Federal Budget has analyzed several campaign proposals through our Fiscal FactCheck project. This analysis of Senator Sanders’s policies, originally published on April 7, 2016 and updated on May 9, 2016, is based on the proposals currently available his website. (Read our analysis of the policies put forth by Secretary Hillary Clinton, Senator Ted Cruz, and Donald Trump.) We aimed to assess all major policy proposals on Senator Sanders’s website (BernieSanders.com) as of May 9, 2016; however, we have excluded several smaller initiatives which, on net, would likely further increase debt modestly. Senator Sanders may also support additional policy changes not listed on his website. As with our other analyses, we shared our estimates with the campaign ahead of time to solicit comments. We intend to follow up with further updates and analyses of the Presidential candidates as more proposals are released. Estimates provided in this analysis are both rough and rounded.

It is quite encouraging to see Senator Sanders put forth a serious effort to pay for his ambitious agenda and improve the solvency of Social Security As tempting as it is to pander during a campaign, committing to a principle of fiscal discipline sets an important precedent, and demonstrating how much it will cost to pay for initiatives helps voters understand the real tradeoffs. However, it appears unlikely these offsets would be sufficient to fully pay for his new initiatives – let alone put the debt on a fiscally sustainable path.

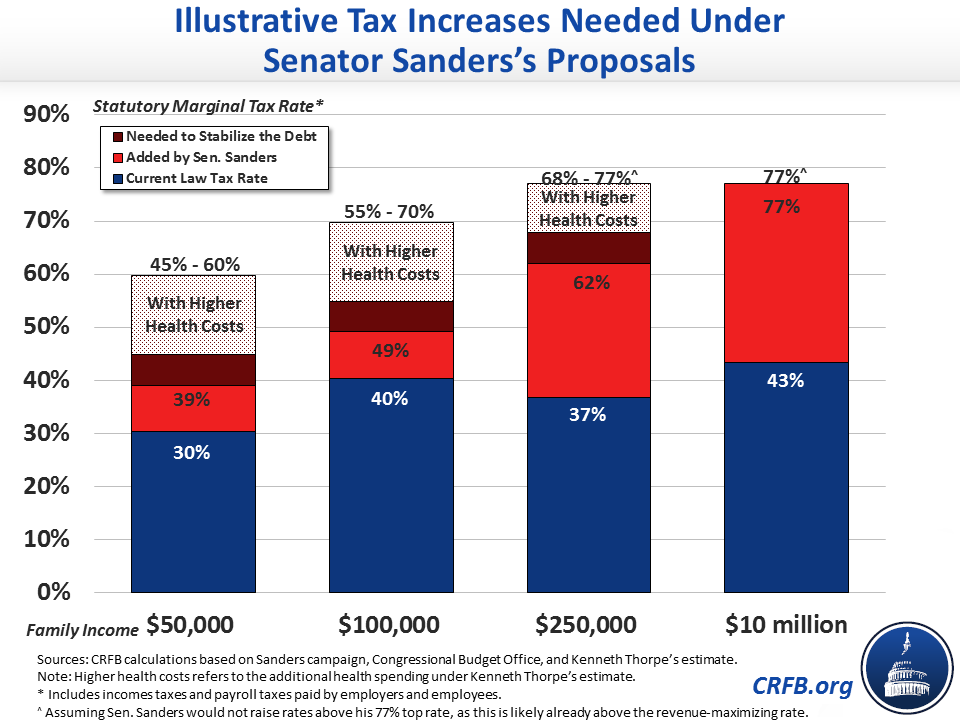

Furthermore, the tax increases proposed to pay for such an ambitious agenda leave far fewer options available to reverse the growth of the debt.

In terms of income tax increase, Senator Sanders has already proposed increasing the top statutory federal tax rate from about 43 percent to 77 percent – which, after accounting for interactions and state and local taxes, is most likely above the revenue-maximizing level. Although more revenue could be raised from high earners other than those at the very top, we estimate it would likely be very difficult for Senator Sanders to fix the debt simply through income tax increases on higher earners alone. Rather, significant broad-based tax increases would likely be required simply to keep the debt at its current post-war record-high levels.

The Budgetary Impact of Senator Sanders’s Proposals

Senator Sanders’s website includes a large list of issue areas and numerous policy recommendations. Among the recommendations with significant fiscal implications are:

- Expand infrastructure, offset by reducing business tax breaks.

- Provide free college, offset with a financial transaction tax.

- Expand Social Security while eliminating the "tax max" and taxing passive income.

- Provide paid family and medical leave, funded with a new payroll tax. Read more about this plan.

- Enact a carbon tax while investing in clean energy initiatives.

- Provide "Medicare for all," offset with numerous taxes. Read our full analysis on the single-payer proposal's offsets.

- Reform the immigration system.

- Fully fund the Individuals with Disabilities Education Act (IDEA).

- Provide universal child care and preschool.

- Increase investments in affordable housing.

In addition to these policies, Senator Sanders has proposed numerous additional policies that, in our assessment, would each cost or save less than $50 billion each over ten years but could on net result in significant further costs and modestly higher revenue.

Each of Senator Sanders’s major proposals are described in more detail below in Appendix I.

The Sanders campaign estimates that each of his proposals is at least fully paid for and on net would reduce deficits over the next decade (including interest) by $2.8 trillion. However, based on estimates from TPC and other independent sources, it appears that in most cases the offsets would fall short of the costs.

There is one major exception for Social Security, where the campaign is actually overstating costs and understating revenue. Whereas the campaign estimates its plan would cost and raise $1.2 trillion over ten years, we estimate that in the first decade it would generate $1.5 trillion of revenue while spending $200 billion – though the spending would rise significantly over time.

Overall, rather than $2.8 trillion of deficit reduction, we estimate at least $2 trillion and as much as $15 trillion of higher deficits under Senator Sanders’s policies – depending on whether one uses the campaign’s single-payer estimates (developed by economist Gerald Friedman) or outside estimates from economist Kenneth Thorpe. (See our discussion of the differences.)

| Senator Bernie Sanders's Campaign Proposals, As Featured on his Campaign Website | ||||

|---|---|---|---|---|

| Major Initiative | Estimated 10-Year Net Cost / Savings (-), Trillions | |||

| Sanders Campaign | CRFB Estimates | |||

| Expand infrastructure, offset by reducing business tax breaks | $0.00 | $0.05 | ||

| Provide free college, offset with a financial transaction tax | -$2.25 | $0.20 | ||

| Expand Social Security while eliminating the "tax max" and taxing passive income | $0.00 | -$1.30 | ||

| Provide paid family and medical leave, funded with a new payroll tax | $0.00 | * | ||

| Enact a carbon tax while investing in clean energy initiatives | -$0.05 | $0.35 | ||

| Provide "Medicare for All," offset with numerous taxes | -$0.10 | $1.95 | ||

| Reform the immigration system | n/a | -$0.10 | ||

| Fully fund the Individuals with Disabilities Education Act (IDEA) | n/a | $0.20 | ||

| Provide universal child care and preschool` | n/a | $0.35 | ||

| Increase investments in affordable housing | n/a | $0.20 | ||

| Other proposals† | * | * | ||

| Subtotal, Proposals | -$2.40 | $1.90 | ||

| Net Interest Costs / Savings (-) | -$0.40 | $0.30 | ||

| Budgetary Impact of Senator Sanders's Major Proposals with Low Health Cost Assumption | -$2.80 | $2.20 | ||

| Additional cost assuming Thorpe's estimate of single-payer plan | n/a | $12.75 | ||

| Budgetary Impact of Senator Sanders's Major Proposals with High Health Cost Assumption | -$2.80‡ | $14.95 | ||

The differences between our estimates and the campaign’s are driven largely by a few policy areas. In the case of Senator Sanders’s financial transaction tax and taxes to pay for his health care plan, we believe revenue collection will be significantly lower than the campaign estimates. In addition, at least one respected economist – health economist Kenneth Thorpe – has argued that the campaign is significantly understating the cost of Senator Sanders’s health plan. Furthermore, the campaign has put forward several major policies that it has yet to account for or provide offsets, such as fully funding IDEA, providing universal child care and preschool, and increasing investments in affordable housing. Partially offsetting these differences, the Sanders campaign appears to be overstating the ten-year cost and understating the revenue from his Social Security plan.

Note that our analysis excludes a number of smaller initiatives that we believe would cost or save less than $50 billion over ten years, such as Senator Sanders’s proposals to promote youth jobs, protect pensions, and expand veterans’ benefits. A full explanation of our cost estimates and how they differ from those from the campaign is available in Appendix II.

Attaining Fiscal Sustainability under Senator Sanders’s Plan

Senator Sanders’s commitment to offsetting the cost of his spending initiatives with corresponding revenue is very encouraging and an important step towards fiscal responsibility. However, given the extensive nature of the proposals, there is a high risk that he has exhausted much of the potential available revenue for putting the debt on a more sustainable path – particularly if his existing proposals already fall short of being paid for.

Relative to current law, it would require nearly $3.2 trillion of ten-year deficit reduction (inclusive of interest) simply to stabilize the debt at its current near record-high level relative to the economy (74 percent of GDP as of the end of 2015). Assuming the enactment of Senator Sanders’s proposals – and assuming they had no negative impact on GDP – it would require between $5.4 and $18.2 trillion of deficit reduction to hold the debt to its current levels, including interest. And ideally we should put the debt on a downward path towards more historical levels in order to be prepared for future economic disruptions or downturns, which would cost trillions more.

Yet Sen. Sanders has opposed most types of spending cuts, already assumes health spending is cut very dramatically, and has already proposed raising the top tax rate to above its revenue-maximizing level.

That means achieving this level of deficit reduction would be quite difficult. For example:

- To stabilize the debt through reduced military spending, Senator Sanders would have to cut the defense budget by more than two-thirds assuming the campaign's estimates of their health plan.

- Assuming Kenneth Thorpe's estimates of Senator Sanders's health plan are correct, even eliminating all defense spending would cover only two-fifths of what would be needed to stabilize the debt.

- Raising income taxes to the revenue-maximizing rate for all income above $250,000 (which Senator Sanders would already do on income above $10 million) would only cover between one-tenth and one-third of what is needed to stabilize the debt.4

Realistically, in order to stabilize the debt without reducing Social Security and other domestic spending, Sen. Sanders would probably have to pursue further tax increases for most taxpayers.

As an illustrative example, he could increase income tax rates across the board but not higher than his current top rate (which is likely above the revenue-maximizing level). By our estimates, in this illustrative example, all income tax rates other the top rate would need to be increased beyond Senator Sanders’s proposed tax hikes by at least 6 and as much as 21 percentage points, roughly speaking and depending on the cost of Senator Sanders’s health plan, to stabilize the debt. For a typical household making about $50,000 a year, this means a top statutory tax rate of between 45 and 60 percent (including employer-paid taxes). For a household making $250,000, it means a top statutory tax rate of between 68 and 77 percent.5

As a second illustrative example, Senator Sanders could impose a Value-Added Tax (VAT), similar to what is in place in most developed countries. We estimate that, based off of CBO’s past evaluation of the revenue a VAT could attain, Senator Sanders would need to institute a (narrow-based) VAT of 12 to 40 percent in order to stabilize the debt, assuming the campaign’s health costs and Thorpe’s health costs, respectively.6 This would be on top of Senator Sanders’s other proposed tax increases.

Importantly, although under these scenarios taxes would rise for the middle class, pre-tax wage income and government benefits would also grow as a result of Senator Sanders’s single-payer health plan and other new spending.

Theoretically, the debt could also be reduced through faster economic growth. Based on macroeconomic feedback analysis from the Tax Foundation (which estimates Senator Sanders’s tax increase would reduce the size of the economy by 9.5 percent over a decade), we estimate simply stabilizing the debt under Senator Sanders’s plan would require real annual economic growth of between 3.2 and 4.9 percent. Either would be significantly higher than the average projected growth rate of 2.1 percent, and it would be difficult to reach these growth rates – particularly at the higher end – over a sustainable period of time.

Importantly, the Sanders campaign has cited one macroeconomic analysis that finds Senator Sanders’s policies would lead to 5.3 percent annual growth and actually produce budget surpluses at the end of the ten-year budget window. However, this analysis has been widely criticized by many economists (including four former Democratic chairs of the Council of Economic Advisors), and a serious study of the analysis by respected economists Christina and David Romer found the analysis to be “highly deficient.”

In fact, while Senator Sanders’s plan would likely provide a near-term boost to the economy, most standard economic models (including those used by the Congressional Budget Office and Joint Committee on Taxation) would likely find that Senator Sanders’s policies, outside of immigration reform,7 would slow long-term economic growth as a result of huge increases in effective marginal tax rates on capital and labor as well as the expansion of various entitlement programs that are likely to discourage work and savings.

***

We applaud Senator Sanders’s efforts to pay for his ambitious policy proposals through serious and specific tax increases. However, based on our estimates, these offsets will fall short of paying the full cost of Senator Sanders’s proposals, and they certainly fall short of putting the debt on a sustainable path. This is particularly troubling given that the magnitude of Senator Sanders’s tax increases leave few options available to further tackle the debt.

We look forward to analyzing Senator Sanders’s further proposals, and we hope that he continues to commit to paying for them, remains willing to make adjustments when costs exceed revenue, and, importantly, begins to develop policies targeted toward addressing our growing debt rather than simply paying for new initiatives.

1 Our estimates have been developed using a variety of outside sources – most notably the Tax Policy Center – as well as our own calculations when necessary. Details are available in Appendix II.

2 With the exception of immigration reform, we use TPC’s estimates for all revenue policies since they represent the most comprehensive calculations of Senator Sanders’s tax policies and provide for consistency between estimates. In the past, we have produced our own estimates of many of Senator Sanders’s tax policies. In the case of the offsets for Senator Sanders’s health plan, our numbers are almost identical to TPC’s except for a difference in our estimates of taxing capital gains at death.

3 Projected debt in 2026 under current law is $23.7 trillion, or about 86 percent of GDP, according to the Congressional Budget Office.

4 Revenue-maximizing refers to a theoretical rate at which point further taxation would result in revenue loss due to negative economic and behavioral feedback effects. For the purposes of this analysis, we rely on estimates from economists Peter Diamond and Emmanuel Saez, which suggest a total revenue-maximizing rate of 73 percent. Many other estimates are much lower. As we’ve shown before, Senator Sanders’s proposals would lead to a top statutory federal rate of 77 percent. But when state and local taxes are included and interactions are accounted for, this shrinks to about 73 percent.

5 We assumed linearity and that raising the rates by 10 points would raise 10 times the amount as raising rates by 1 point. However, in actual practice, less revenue would be raised as rates near the revenue-maximizing rate. We also assumed that rates would not increase (or at least no revenue would be generated) beyond Senator Sanders’s top rate of 77 percent, considering it is likely beyond the revenue-maximizing level.

6 We calculated this estimate by adjusting CBO’s 2011 estimate of a narrow-base VAT, including extrapolating it to the current budget window and scaling it up or down as necessary. In reality, we believe a narrow-base VAT in conjunction with Senator Sanders’s other tax policies would raise less since it would result in a greater loss of income and payroll tax revenue; however, this loss could be made up for by broadening the base of the VAT to somewhere between CBO’s narrow- and broad-base VAT.

7 Although immigration reform would significantly increase economic growth, most of the revenue feedback effects of this growth are already incorporated in our budgetary estimates.

Appendix I: Summary of the Sanders Campaign’s Policy Proposals with Fiscal Implications

Senator Sanders has put forward numerous policies on his campaign website. As of May 4, 2016, we found ten sets of policies which we believe would have a substantial budgetary impact (as defined by at least $50 billion of costs or savings over ten years). Those are:

- Expand Infrastructure, Offset by Reducing Business Tax Breaks – Senator Sanders would commit to investing $1 trillion in new infrastructure spending by doubling funding of the Highway Trust Fund, investing $75 billion in rebuilding railways, $12.5 billion in upgrading airports, $17.5 billion for air traffic control, $15 billion to improve waterways, $12 billion per year to fix dams and levees, $6 billion per year to maintain safe drinking water, $6 billion per year to improve wastewater handling, $10 billion per year to upgrade the electrical grid, and $5 billion per year for broadband expansion, among other details. Senator Sanders would implement this investment over five years while paying for it over ten years by enforcing a worldwide taxation system on U.S. corporations’ profits abroad.

- Provide Free College, Offset with a Financial Transaction Tax – Senator Sanders would offer all four-year public colleges and universities grants that amount to two-thirds of the cost of tuition with states responsible for the remaining third, given that the institutions meet a variety of requirements imposed for the funding. Additionally, Senator Sanders would return the calculation of student loan interest rates to the previous formula used to calculate them until 2006, which would immediately cut interest rates by about half, and then set an upper limit on the maximum interest rate over time. He would allow individuals with student loans to refinance their loans under this lower interest rate. He would also institute a number of reforms to work study and student aid applications to make them simpler and more widespread. This plan would be paid for by a tax on financial transactions, with different rates on transactions for stocks, bonds, and derivatives.

- Expand Social Security While Eliminating the "Tax Max" and Taxing Passive Income – Senator Sanders would expand Social Security in a number of ways, including by increasing initial benefits across the board, linking Cost of Living Adjustments (COLAs) to the experimental Consumer Price Index for the elderly (CPI-E), and increasing the current minimum benefit. On the revenue side, Senator Sanders would subject all income above $250,000 (unindexed) to the 12.4 percent payroll tax without providing any benefit credit, and he would also impose a 6.2 percent tax on investment income above $250,000.

- Provide Paid Family and Medical Leave, Paid for with a New Payroll Tax – Senator Sanders would support efforts to pass the FAMILY Act, introduced by Senator Kirsten Gillibrand (D-NY), which would institute a 0.2 percent payroll tax each on employers and employees on all wages in order to fund twelve weeks of paid family and medical leave. Read more about Senator Sanders’s paid family leave proposal.

- Enact a Carbon Tax While Investing in Clean Energy Initiatives – Senator Sanders has proposed a carbon tax that would tax carbon polluting substances at $15 per ton when first enacted, rising to $73 per ton by 2035. The direct revenue from this tax would be used to finance middle-class tax rebates as well as roughly a quarter trillion of clean-energy oriented government spending. (On net, this would result in a revenue loss, since imposing a carbon tax would reduce income and payroll tax revenue). Senator Sanders would also invest approximately $110 billion in clean energy research over ten years, financed by closing tax breaks for oil, natural gas, and coal companies as well as changing how public lands and waters are used for energy extraction. Additionally, Senator Sanders would invest another $40 billion to train workers who work in the fossil fuel industry to ease the transition to clean energy.

- Provide "Medicare for All," Offset with Numerous Taxes – Senator Sanders has committed to enacting a single-payer, “Medicare for All” plan which would provide generous 100-percent government-provided health insurance to virtually everyone living in the country. The plan would be paid for through a mixture of taxes, including a 6.2 percent employer payroll tax, a 2.2 percent across-the-board income tax, significant tax rate hikes for high earners, estate tax reforms and increases, and changes to the tax treatment of capital gains and dividends so that both are taxed as ordinary income and capital gains are generally taxed at death. More detail on his plan, particularly on the offsets, can be found at Analysis of the Sanders Single-Payer Offsets and Additional Offsets for Senator Sanders’s Health Plan. Senator Sanders has also proposed numerous prescription drug reforms, though we assume these are subsumed in his single-payer health plan, which already assumes significant drug savings. Finally, Senator Sanders would increase funding for HIV/AIDS research.

- Reform the Immigration System – Senator Sanders would implement comprehensive immigration reform. This would include expanding the deferred action provisions currently in place under President Obama, allowing more people to become eligible to stay in the country under different parole-in-place programs, expediting immigration court processes, alter immigration enforcement protocol around detention and deportation, make citizenship a broadly attainable goal for current undocumented immigrants, restructuring current investments in border security to provide more surveillance and less militarization, reform pathways to future immigration, and various other proposals.

- Fully Fund the Individuals with Disabilities Education Act (IDEA) – Senator Sanders has called for funding the full scope of the federal government’s commitment to IDEA, which provides grants to states in order to help them fund education for people with disabilities. Fully funding IDEA involves increasing the federal government commitment from 17 percent of costs associated with educating students with disabilities to 40 percent. He has not offered any offsets for this spending thus far.

- Provide Universal Child Care and Preschool – Senator Sanders has called for providing universal child care and preschool, though he has not yet offered significant details.

- Increase Investments in Affordable Housing – Senator Sanders recommends a number of initiatives as part of his affordable housing proposal. Specifically, he would increase funding for the National Housing Trust Fund to at least $5 billion per year, return to discretionary housing spending to pre-2010 funding levels, allocate more funding for repairing public housing, fully fund project-based rental assistance contracts, and expand the housing choice voucher program. Additionally, Senator Sanders would make changes to regulations that help people buy homes, expand the tax benefit of homeownership to those not eligible for the mortgage interest deduction, and end the mortgage interest deduction for second homes and yachts. Finally, Senator Sanders calls for various initiatives to end homelessness, particularly among people leaving prisons.

- Various Other Proposals – Senator Sanders would also enact many other proposals that would likely have smaller fiscal implications. These include his proposals for a youth jobs program, shoring up pensions, equal pay, a $15 minimum wage, new investments in veterans programs, criminal justice reform, increased funding for Native American and Hawaiian communities, further investments for people with disabilities, and provisions related to collective bargaining protection.

Note that this is not an exhaustive list of Senator Sanders’s proposals – there are many others – but it does represent the legislative policy proposals that would likely have a significant fiscal impact.

The Committee for a Responsible Federal Budget does not endorse any candidate or their policies.

Appendix II: Explaining Our Cost Estimates

Our estimates of Senator Sanders’s policy proposals come from a variety of sources, explained below.

For the campaign’s estimates, we used Senator Sanders’s campaign website’s estimate of how they would pay for their proposals that also cites the cost of them. When the campaign provided per-year costs or savings, we assumed costs would be ten times higher over a decade. We excluded policies that did not cost or save at least $50 billion over ten years.

For the independent estimates, we relied on a combination of respected outside analysts as well as our own estimates in a few cases.

On the tax side virtually all of our estimates come from the non-partisan Tax Policy Center (TPC), which has developed a comprehensive analysis of Senator Sanders’s tax policies. We relied on the TPC analysis even when it differs slightly from our own analysis in order to provide consistency across estimates. In some cases, we divided the TPC estimates into pieces to match the campaign’s spending and offset pairings.

| Senator Bernie Sanders's Campaign Proposals, As Featured on his Campaign Website | ||||||||

|---|---|---|---|---|---|---|---|---|

| Major Initiative | Estimated 10-Year Net Cost / Savings (-), Trillions | |||||||

| Campaign Estimates | CRFB Estimates | |||||||

| Spending | Revenue | Net | Spending | Revenue | Net | |||

| Expand infrastructure, offset by reducing business tax breaks | $1.00 | -$1.00 | $0.00 | $1.00 | -$0.95 | $0.05 | ||

| Provide free college, offset with a financial transaction tax | $0.75 | -$3.00 | -$2.25 | $0.80 | -$0.60 | $0.20 | ||

| Expand Social Security while eliminating the "tax max" and taxing passive income | $1.20 | -$1.20 | $0.00 | $0.20 | -$1.50 | -$1.30 | ||

| Provide paid family and medical leave, funded with a new payroll tax | $0.30 | -$0.30 | $0.00 | $0.25 | -$0.25 | * | ||

| Enact a carbon tax while investing in clean energy | $0.10 | -$0.15 | -$0.05 | $0.40 | -$0.05 | $0.35 | ||

| Provide "Medicare for All," offset with numerous taxes | $13.80 | -$13.90 | -$0.10 | $13.85 | -$11.90 | $1.95 | ||

| Reform the immigration system | n/a | $0.00 | -$0.10 | -$0.10 | ||||

| Fully fund the Individuals with Disabilities Education Act (IDEA) | n/a | $0.20 | $0.00 | $0.20 | ||||

| Provide universal child care and preschool | n/a | $0.35 | $0.00 | $0.35 | ||||

| Increase investments in affordable housing | n/a | $0.10 | $0.10 | $0.20 | ||||

| Other proposals† | * | * | ||||||

| Subtotal, Proposals | $17.15 | -$19.55 | -$2.40 | $17.15 | -$15.25 | $1.90 | ||

| Net Interest Costs / Savings (-) | -$0.40 | n/a | -$0.40 | $0.30 | n/a | $0.30 | ||

| Budgetary Impact of Senator Sanders's Major Proposals with Low Health Cost Assumption | $16.75 | -$19.55 | -$2.80 | $17.45 | -$15.25 | $2.00 | ||

| Additional cost assuming Thorpe's estimate of single-payer plan, including interest | n/a | n/a | n/a | $12.75 | n/a | $12.75 | ||

| Budgetary Impact of Senator Sanders's Major Proposals with High Health Cost Assumption | n/a | n/a | -$2.80+ | $30.20 | -$15.25 | $14.95 | ||

In terms of spending, we continued to rely on campaign estimates when they were consistent with the policy and outside estimates when no campaign estimate was provided.

For Senator Sanders’s infrastructure proposal, we continued to assume the campaign’s estimated $1 trillion cost. Based on TPC estimates, the Sanders campaign's proposals would generate about $0.95 trillion to pay for this – though the offsets would be somewhat back-loaded, leading to additional interest costs.

For Senator Sanders’s college plan, we combine the campaign’s estimate of $750 billion of costs ($75 billion per year) with their additional commitment to establish a $30 billion fund for Historically Black Colleges and Universities and other minority-serving institutions. While the campaign believes their financial transaction tax would generate $3 trillion over ten years and thus more than pay for their plan, TPC has estimated the most that could be raised from any financial transaction tax is about $800 billion, and Senator Sanders's tax in particular would raise less than $600 billion.

In terms of Social Security, the Sanders campaign estimates costs and revenue of $1.2 trillion. However, we believe Senator Sanders’s campaign is actually significantly overestimating costs and modestly underestimating revenue. Although his plan would require about $120 billion per year of new spending when fully phased in, the spending phases in quite slowly. Based on recent estimates from the Social Security Chief Actuary, actual costs over the next decade are likely to be closer to $200 billion. In terms of revenue, we relied on TPC (estimates from the Actuary would not account for income tax effects). TPC estimates Senator Sanders’s plan to raise the taxable maximum would generate nearly $1.2 trillion of revenue; although TPC does not separate out Senator Sanders’s 6.2 percent tax on passive income, it appears that would generate roughly $300 billion of additional revenue.

With regards to Senator Sanders’s paid family and medical leave proposal, we relied on TPC’s revenue estimate of about $270 billion for a 0.4 percent payroll tax. Because Senator Sanders would finance the plan directly with this payroll tax and operate the program under a trust fund system in which total benefits paid are restricted to the revenue received, we assumed a roughly equal amount of new spending. However, an estimate from the American Action Forum suggests actual costs could be higher than $1.6 trillion if not bound by trust fund income. Read more about Senator Sanders’s paid family and medical leave proposal.

For Senator Sanders’s clean energy policy, our estimates rely on several sources. Senator Sanders does not offer much detail on how he would “put a price on carbon,” but he references a carbon tax proposal he has sponsored in the Senate. That plan would generate significant revenue but use more-or-less all the revenue raised directly from the carbon tax to provide for tax rebates and increase clean energy spending. However, for every dollar raised from a carbon tax (or any other kind of excise tax), the official scoring agencies believe about 25 cents of income and payroll tax revenue will be lost – and this loss does not appear to be accounted for under Senator Sanders's carbon tax plan. After incorporating this offset, TPC estimates a small net revenue loss, which when combined with the spending in the bill would result in about $250 billion of net costs over a decade. Senator Sanders proposes a further $110 billion of spending on clean energy investments and also calls for the passage of the Clean Energy Worker Just Transition Act and the American Clean Energy Investment Act of 2015, which brings total additional spending to about $150 billion. According to TPC, ending fossil fuel tax breaks will raise less than $50 billion. Taken together, we estimate all of these provisions cost roughly $350 billion on net.

Two very different cost estimates exist for Senator Sanders’s “Medicare for All” single-payer health plan. University of Massachusetts-Amherst economist Gerald Friedman, whom the campaign cites, estimates the plan would cost about $13.8 trillion over a decade. On the other hand, Emory University economist Kenneth Thorpe estimates the plan would cost $24.7 trillion. We have previously discussed their differences, and for the purpose of this analysis show Senator Sanders’s plan under both set of estimates. We also add a further $50 billion of costs for Senator Sanders’s HIV/AIDS research initiative and expanding the veterans’ caregivers program. We do not incorporate Senator Sanders’s prescription drug or veterans health reforms, which we assume are subsumed in the overall single-payer estimate (which assumes dramatically lower prescription drug costs).

In either case, we believe Senator Sanders’s offsets will fall short. We believe the revenue in Senator Sanders’s health care plan will raise between $11.0 and $11.2 trillion (see our initial analysis and follow-up analysis). For consistency, this analysis does not rely on our estimate and instead uses TPC’s. By our tally, the various tax provisions in Senator Sanders’s single-payer health plan will raise $11.9 trillion according to TPC. The difference between our estimates and TPC’s is almost entirely attributable to a late-addition offset from the campaign to tax capital gains at death, which we believe the Joint Committee on Taxation will score as raising significantly less revenue than TPC estimates.

In terms of immigration reform, the campaign’s proposal shares some details in common with the 2013 Senate-passed immigration bill. We assume that, net of Senator Sanders’s other proposals (in terms of taxes, health care, Social Security, etc.), it will save a similar amount – $100 billion on net, according to CBO’s most recent take on the immigration reform proposal in the President’s budget. Technically, this proposal contains roughly $400 billion more in taxes and $300 billion more in spending, chiefly from a larger labor force. However, we show the net impact as revenue, to better reflect how the government’s size would change in relation to the economy, which would also be larger.

For our estimate of the cost of fully funding the Individuals with Disabilities Education Act (IDEA), we relied on cost estimates from the New America Foundation, which found that it would cost roughly $200 billion over the next decade. We came to a similar conclusion through our own estimates based on projected school enrollment and per pupil spending estimates used in calculating IDEA funding levels.

Perhaps our estimate with the greatest degree of uncertainty (other than health care) is for Senator Sanders’s plans for universal child care and preschool. Although he has called for both, his website includes no details as to how either would be achieved, and the campaign provided no clarification. Given the lack of detail, we searched for outside proposals which might be similar. One such set of proposals came from President Obama’s budget proposals, which would partner the Department of Education with states to ensure access to preschool for all four-year-olds, offer high-quality child care to three-year-olds and younger of low- and middle-income families, and expand the child care tax credit. Together, these changes would cost about $190 billion over a decade. A more aggressive approach for universal child care comes from a proposal from the Center for American Progress, which proposes a much larger tax credit at a cost of $400 billion. In combination with the universal pre-K plan, total costs could exceed $500 billion. Since we have no way to know what approach Senator Sanders would take, our current estimates represents a midpoint of $350 billion.

In April 2016 (after our original analysis), Senator Sanders's proposed a new affordable housing policy. We specifically focused on three policy changes we believe would have the most significant fiscal impact: an expansion of funding to the National Housing Trust Fund (NHTF), reforms to the mortgage interest deduction, and returning housing funding to pre-2010 levels. Since Senator Sanders proposes to increase funding for the NHTF to at least $5 billion per year and current funding is only $174 million, we estimated this policy would cost about $50 billion over a decade. In terms of Senator Sanders’s call to “expand homeowner mortgage interest benefits to the 19 million otherwise eligible homeowners who do not itemize their taxes,” we assumed this would be achieved through a relatively modest policy (put forward by then-candidate Barack Obama in 2008) to offer a 10 percent mortgage interest credit. We also netted out the savings from ending the mortgage interest deduction for yachts and second homes. Finally, to estimate restoring affordable housing spending to pre-2010 levels, we found the gross discretionary spending (ignoring offsetting collections) of the Department of Housing and Urban Development’s funding in FY 2009 and assumed those levels were indexed to inflation going forward. In all three cases, we had to make a variety of assumptions due to lack of policy detail. Our assumptions generally fall on the lower end of potential costs.

Senator Sanders also has a number of other proposals, as we’ve mentioned above, that would not likely result in costs or savings above $50 billion over the next ten years on an individual basis. For the sake of this analysis, we’ve excluded them in the calculations, but it is possible that they would bring additional costs or savings that alter the fiscal impact of Senator Sanders’s proposals – and our initial assessment suggests they are more likely to result in additional costs.

We will continue to update our estimates as the Sanders campaign unveils more details of its proposals.