Adding Up Senator Cruz's Campaign Proposals So Far

Update, 3/8/16: Since this analysis was posted, the Tax Policy Center added an additional policy of Sen. Cruz’s tax plan to their analysis that increases the revenue loss by just under $150 billion. We’ve updated our central estimate to reflect this.

Republican presidential candidate Senator Ted Cruz (R-TX) has, by our count, put forward seven sets of policy proposals on his campaign website covering areas such as immigration, military spending, and tax reform. By our very rough and initial estimates, these major initiatives could add anywhere from $3 to $21 trillion to the debt over the next decade, with our central cost estimate being that they would add $12.5 trillion to the debt, including interest.

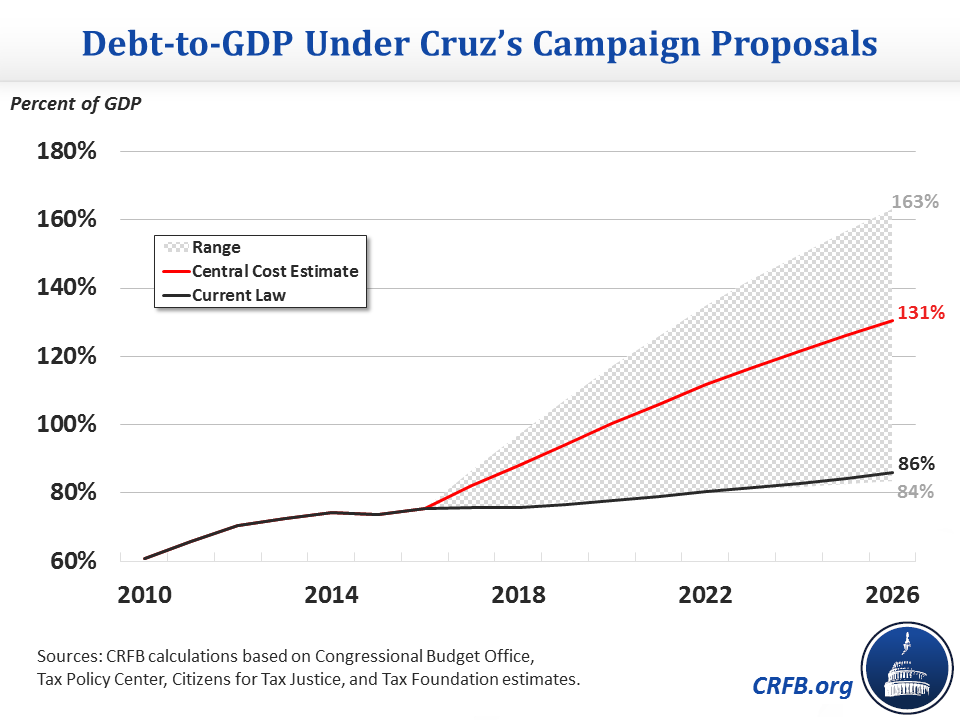

Assuming this central cost estimate, debt held by the public would increase from nearly $14 trillion today to about $36 trillion by 2026 (compared to $24 trillion under current law).1 As a share of the economy, debt under these policies would grow from roughly 75 percent of Gross Domestic Product (GDP) today to 131 percent of GDP in a decade (compared to 86 percent of GDP under current law). Under our high-cost estimate, debt could reach as high as 163 percent of GDP, and under our low-cost estimate – assuming significant economic growth – debt would remain on roughly its current course relative to the economy and reach 84 percent of GDP.2 Even this lowest estimate leads to an unsustainable result.

Since the 2016 presidential campaign began, the Committee for a Responsible Federal Budget has analyzed a number of campaign proposals through our Fiscal FactCheck project. The analysis below represents our second analysis of a candidate’s policies in full (see our analysis of Donald Trump’s campaign proposals), based on the proposals currently available on Sen. Cruz’s website. We have aimed to incorporate all major policy proposals on Sen. Cruz’s website (TedCruz.org) as of 2-24-2016; however, Sen. Cruz may support additional policy changes not listed on his website. We intend to follow up with further analyses of other Presidential candidates – as well as updates to our analysis of Sen. Cruz’s proposals as more are added to his campaign website. Estimates provided in this analysis are both rough and rounded.

While Sen. Cruz has called for a Balanced Budget Amendment to “save future generations from additional crippling debt,” the policies listed on his website to date would, on net, add to the national debt over the next decade and beyond. In order to balance the budget under his plan, aggressive spending cuts or substantial rates of economic growth would be necessary. By our estimates, spending would need to be cut by half, or economic growth accelerated four fold, in order for his plan to balance the budget.

The Budgetary impact of Sen. Cruz’s Proposals

Although Sen. Cruz’s website includes a large number of issue areas, only a few of them include policy recommendations. The sets of proposals on his campaign website include:3

- Rein in Washington through a “Five for Freedom” Plan

- Defend Our Nation and Rebuild America’s Military (Read more details on this plan in our full explainer)

- Secure Our Border

- Stand with Israel

- Repeal Obamacare

- Enact a Simple Flat Tax (Read our full explainer on this plan)

- Promote Growth through Regulatory Reform, An Energy Renaissance, and a Stable Dollar

We’ve provided more details on each of these areas in Appendix I.

Of these seven areas of proposals on Sen. Cruz’s website, we believe four are likely to have significant fiscal implications that total more than $100 billion over a decade: repealing Obamacare, rebuilding the military, enacting a flat tax, and reducing domestic spending through the “Five for Freedom” plan. Other policy areas would either have relatively small effects, or – as is the case for Sen. Cruz’s immigration proposals – largely offsetting effects.

Overall, we estimate these policies could add anywhere from $2.7 trillion to $21.3 trillion to the national debt over the next decade. We explain the details of our cost estimate in Appendix II. This broad range largely reflects a very wide variation of revenue estimates for Sen. Cruz’s consumption tax (VAT) and, to a lesser extent, differences in economic growth projections and uncertainty surrounding the details of Sen. Cruz’s veterans plan. However, even under the lowest cost estimate, debt remains on an unsustainable path.

Under our central estimate for Sen. Cruz’s proposals, debt would increase by $12.5 trillion as a result of $8.4 trillion of tax cuts, $2.4 trillion of defense spending, $0.4 trillion from repealing Obamacare, and $1.8 trillion of interest costs; this is partially offset by $0.5 trillion of domestic spending cuts. As a result, debt would rise from 75 percent of GDP today up to 131 percent of GDP in 2026 – 45 percentage points higher than current projections.

| Senator Ted Cruz’s Campaign Proposals, As Featured on his Campaign Website | ||||

| Major Initiative | CRFB Estimated Ten-Year Cost / Savings (-) | |||

| Low Cost | Central Est. | High Cost | ||

| Rein in Washington through “Five for Freedom” Plan | -$0.5 trillion | -$0.5 trillion | -$0.5 trillion | |

| Defend Our Nation and Rebuild America’s Military | $2.4 trillion | $2.4 trillion | $2.9 trillion | |

| Secure the Border | * | * | * | |

| Stand with Israel | * | * | * | |

| Repeal Obamacare | $0.2 trillion | $0.4 trillion | $0.4 trillion | |

| Promote Growth through Regulatory Reform, An Energy Renaissance, and a Stable Dollar |

* | * | * | |

| Enact the “Simple Flat Tax” | $0.2 trillion | $8.4 trillion | $15.6 trillion | |

| Subtotal, Tax and Spending Proposals | $2.3 trillion | $10.7 trillion | $18.4 trillion | |

| Net Interest Costs | $0.4 trillion | $1.8 trillion | $2.9 trillion | |

| Total Cost of Sen. Ted Cruz’s Major Proposals to Date | $2.7 trillion | $12.5 trillion | $21.3 trillion | |

*Likely to cost or save less than $100 billion over ten years.

Balancing the Budget under Sen. Cruz’s Plans (this section has not been updated to reflect the new information mentioned at the top, but remains very similar)

Throughout the campaign, Sen. Cruz has advocated fiscal responsibility, going so far as to propose a Balanced Budget Amendment to the constitution.

Unfortunately, reaching balance under Sen. Cruz’s campaign website proposals would be quite difficult, and simply paying for them would prove challenging as well.

Using the Congressional Budget Office’s (CBO) latest budget projections, we estimate that balancing the budget in ten years would require roughly $8 trillion in deficit reduction relative to current law – which suggests more than $20 trillion of savings would be necessary to also pay for Sen. Cruz’s various policy proposals (based on our central cost estimate).4

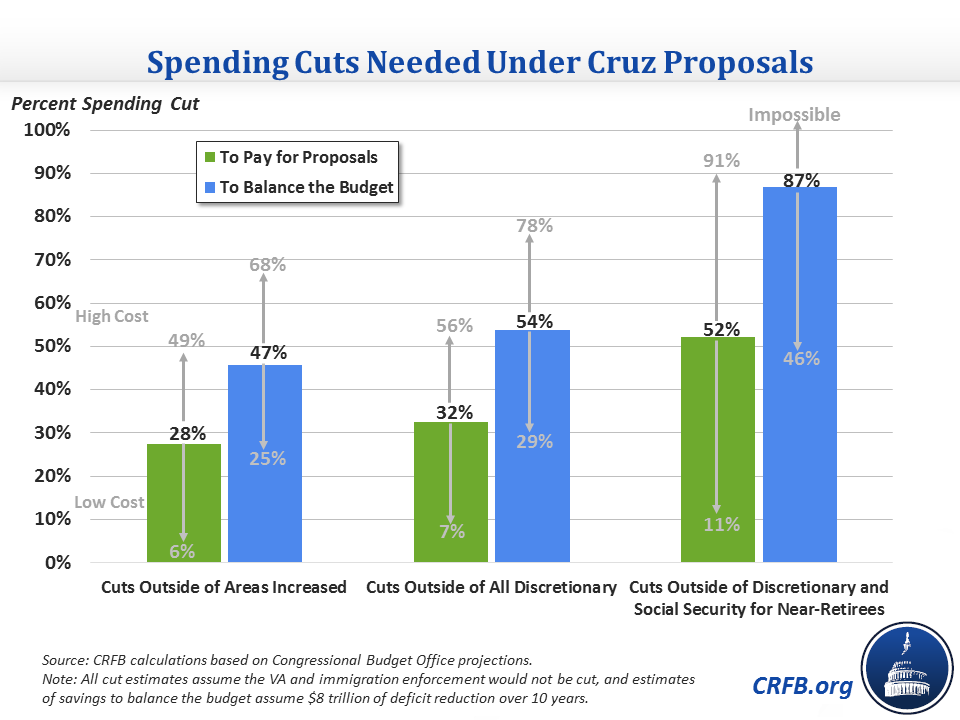

Balancing the budget with spending cuts alone could therefore require massive decreases in spending levels. For instance, if Sen. Cruz were to cut from the entire budget (excluding the areas in which he has increased spending – defense, Veterans Affairs, and immigration enforcement), it would require across-the-board reductions of about 47 percent under our central estimate, and 54 percent if Sen. Cruz’s “Five for Freedom” plan represented the entirety of his domestic discretionary cuts.

Sen. Cruz has also stated that he would “honor the commitments” we’ve already made to seniors nearing retirement for Social Security. Assuming this means exempting those over age 55 from any changes, the remainder of the budget would need to be cut by 87 percent.

Under our low-cost estimate, necessary cuts would range from 25 to 46 percent and under our high-cost estimate from 68 to over 100 percent.

In fact, simply paying for the cost of new initiatives, and leaving the debt on its unsustainable long-term path, would necessitate large spending cuts – ranging from 28 percent to 52 percent under our central cost estimate.

Alternatively, Sen. Cruz could close this gap by adjusting his tax plan. We estimate that to pay for his new initiatives under our central cost estimate would require raising his business flat tax (or VAT – see Appendix II) from 16 percent to 24 percent – or to 29 percent to balance the budget.

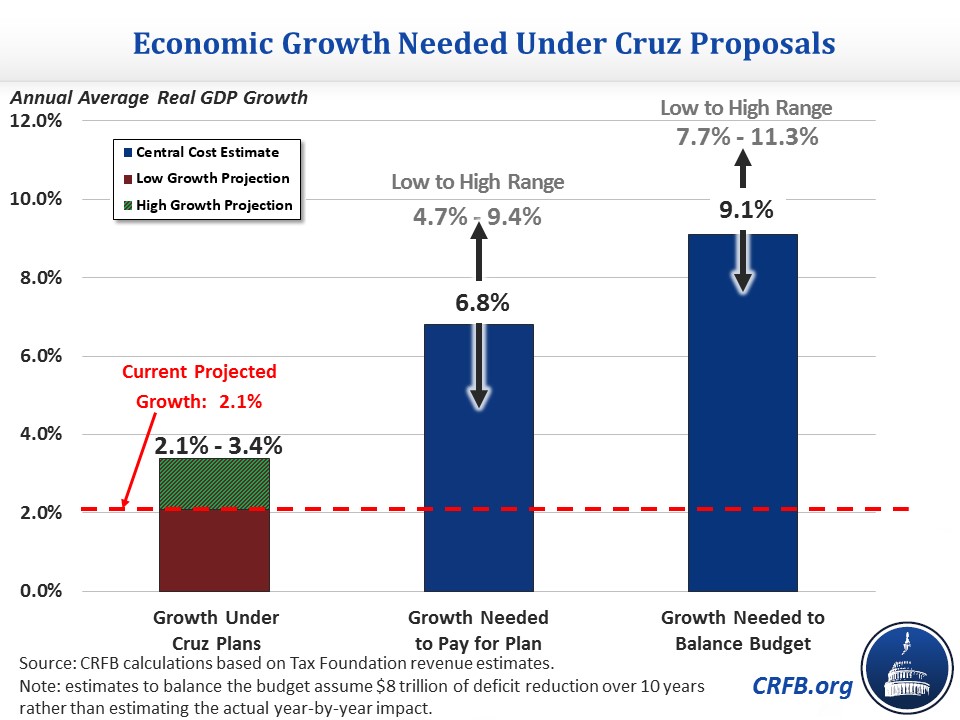

Sen. Cruz has also argued he could pay for much of his proposals (particularly his defense plan) by increasing economic growth, resulting in higher tax revenue. By our estimate, this would require unprecedented levels of sustained economic growth.

Real economic growth over the next decade is projected to average about 2.1 percent per year, according to CBO. The Tax Foundation’s analysis of the Cruz campaign’s tax plan and CBO’s estimates of the macroeconomic effects of repealing Obamacare suggest his plan could increase annual growth by about 1.4 percent (a generous estimate relative to what official scoring agencies are likely to find), producing about $3 trillion in additional revenue.

We estimate that, assuming the Tax Foundation’s economic feedback estimates are linear, it would require 6.8 percent real annual growth to simply pay for our central cost estimate of the initiatives on Sen Cruz’s website, and 9.1 percent real annual growth to balance the budget.5 In other words, bringing the budget to balance would require growth more than 4 times as large as projected, and close to twice as high as the fastest growth period in the last 60 years (which was between 1959 and 1968).

* * * *

Sen. Cruz’s standing commitment to returning our country to a fiscally sustainable path is encouraging. Unfortunately, Sen. Cruz’s policies so far would worsen the nation’s fiscal picture by increasing the national debt. Alternatively, they would require sizeable but still unidentified spending cuts or very high rates of economic growth just to offset their cost. Reaching the stated goal of a balanced budget under these conditions would be extremely difficult.

Sen. Cruz wants to address our nation’s massive debt, and we hope he does so – but he will need to either modify his current proposals or enact significant additional deficit-reducing reforms to get there.

We look forward to analyzing Sen. Cruz’s further proposals, particularly in the area of entitlement reform, as they become available.

Related Reading

- How Sen. Ted Cruz Would Increase Defense Spending

- Senator Ted Cruz’s Tax Reform Plan

- How Do Donald Trump’s Campaign Proposals So Far Add Up?

- John Kasich Has a Plan to Balance the Budget in Ten Years

1 Projected debt in 2026 under current law is $23.8 trillion according to the Congressional Budget Office.

2 This debt projection assumes the most optimistic scenario of a lower-bound cost divided by a higher GDP that the Tax Foundation’s revenue estimate combined with the economic effects of repealing Obamacare produces and an upper-bound of Citizens for Tax Justice’s revenue estimate, which is on a static basis.

3 CRFB reports the policies as true to the website as possible in summary (as of 2-24-2016). We do not endorse any candidate or their policies.

4 The $8 trillion figure for balancing the budget is an approximation, and the actual amount it would take to balance the budget could be higher or lower depending on the years in which the savings take place and the timing of economic growth. Our previous estimate was $8 trillion if savings follow the same path as found in the FY 2016 Congressional Budget. These numbers include interest costs.

5 Empirical evidence suggests that higher economic growth is generally accompanied by higher interest rates. For simplicity, we assume that the cost to the government from higher interest rates is fully offset by the savings from lower debt service as a result of additional revenue. In reality, the net feedback effect of economic growth could be lower or higher depending on which of these factors dominated, but it would likely fall within 10 percent of our estimates in either direction.

Appendix I: Summary of the Cruz Campaign’s Policy Proposals With Fiscal Implications

Senator Ted Cruz (R-TX) has, by our count, put forward seven sets of policy proposals on his campaign website as of 2-24-2016. Those sets of proposals are:

- Rein in Washington through a “Five for Freedom” Plan – Sen. Cruz would reduce domestic discretionary spending by eliminating four cabinet departments – Commerce, Education, Energy, and Housing and Urban Development – and the Internal Revenue Service, along with 25 “ABCs” (agencies, bureaus, and commissions). He would reduce the cost of the federal workforce through lower pay increases and a reduction in hiring, establish a “Grace commission” to identify government waste, and sign a Balanced Budget Amendment.

- Defend Our Nation and Rebuild America’s Military – Sen. Cruz would increase the size of the military in terms of personnel, capabilities, and equipment; he would target defense spending levels of about 4 percent of GDP per year. Read more details on this plan in our full explainer. Sen. Cruz would also reform the Veterans Affairs health system to improve accountability and increase choice.

- Secure Our Border – Sen. Cruz would make a number of changes to reduce illegal immigration, including by completing the fence along our southern border, tripling the number of Border Patrol forces, establishing a biometric entry-exit tracking system, and increasing the use of border surveillance technology. He would also end federal support for sanctuary cities, increase deportations, create a nationwide E-Verify system, and reverse President Obama’s executive actions on immigration. In addition, he would reduce legal immigration by auditing the H-1B visa program for abuse, disallowing immigration when unemployment is high, prohibiting public assistance to immigrants, and ending birthright citizenship.

- Stand with Israel – Sen. Cruz would reinforce the U.S. relationship with Israel by relocating the U.S. embassy to Jerusalem, possibly ending U.S funding to the Palestinian Authority, supporting missile defense efforts, and potentially withholding funds to the United Nations as well as universities that plan to boycott Israel.

- Repeal Obamacare – Sen. Cruz would “repeal every word of Obamacare,” which would include the Affordable Care Act’s coverage provisions, taxes, and Medicare cuts. In its place, Sen. Cruz has said “we need to enact reforms that make health care personal, portable, and affordable. Specifically, we need open insurance markets across state lines, expand Health Savings Accounts, and delink health insurance from employment.”

- Enact a Simple Flat Tax – Sen. Cruz would reform the tax system by replacing the current individual income tax with a 10 percent flat tax while replacing the corporate income tax and payroll taxes with a 16 percent “business flat tax” – essentially a value-added tax (VAT). Read our full explainer on this plan.

- Promote Growth through Regulatory Reform, An Energy Renaissance, and a Stable Dollar – In addition to tax reform, Sen. Cruz has proposed a number of changes designed to promote economic growth. On the regulatory front, he would end various Environmental Protection Agency regulations and sign the REINS act, which would require Congress to approve regulations that would have a significant economic impact. On the energy front, Sen. Cruz would approve the Keystone XL Pipeline and other similar infrastructure investments. And on monetary policy, he would push for an audit of the Federal Reserve and support a rules-based monetary system.

Note that Sen. Cruz has a number of other issue areas on his website – ranging from “restore the constitution” to “religious liberty.” However, they do not include legislative policy proposals. You can read more about Sen. Cruz’s defense plan here and his tax plan here.

The Committee for a Responsible Federal Budget does not endorse any candidate or their policies.

Appendix II: Explaining Our Cost Estimates

Our estimates of Sen. Cruz’s policy proposals come from a variety of sources and are explained below.

Of his seven sets of proposals, two of them – including defending Israel and promoting growth via regulatory reform, an energy renaissance, and a stable dollar – are likely to have little significant fiscal impact. Another set of proposals related to protecting the border is likely to have significant budgetary implications, but in different directions resulting in a net cost of (likely) less than $100 billion.

In terms of spending cuts, Sen. Cruz has estimated his “Five for Freedom” plan would save $500 billion over a decade – an estimate we find plausible when considering the potential savings from his workforce reforms (roughly $100 billion) and reviewing the size of the cuts to agencies and departments Sen. Cruz specifies.

For Sen. Cruz’s plan to “Rebuild America’s Military,” our estimated $2.4 trillion of cost is based on Sen. Cruz’s call to increase defense spending to 4.1 percent of GDP for the first two years of his administration and target 4 percent thereafter. (For more detail on this calculation, see How Sen. Ted Cruz Would Increase Defense Spending.) In our high-cost estimate, we added an extra $500 billion of costs based on Sen. Cruz’s somewhat vague call to “expand options for our service members’ health care” (see our analysis of CBO’s score of a 2014 proposal to expand veterans’ health care choices).

With regards to Obamacare repeal, our estimates are based on a 2015 CBO score of repealing the Affordable Care Act starting in 2016, with adjustments made to account for enacted legislation and a new budget window. Our high- and medium-cost estimates of $400 billion are based on CBO’s conventional score, while our low-cost estimate is based on the dynamic score that includes economic impact. Absent more information, we assume Sen. Cruz’s additional health policies would have largely offsetting effects; they could have substantial effects in either direction when more detail is provided.

Our numbers on Sen. Cruz’s tax plan are based on estimates from outside tax groups. As we’ve explained, estimates of Sen. Cruz’s tax plan vary widely, with Citizens for Tax Justice finding a $16.2 trillion cost, the Tax Policy Center an $8.7 trillion cost, and the Tax Foundation a $3.7 trillion cost – or $800 billion when economic impact is included. Our low-cost estimate is based on the Tax Foundation’s estimate that includes economic growth, adjusted for enacted legislation and tax policies already accounted for in our Obamacare repeal estimate. Our middle-cost estimate is based on the Tax Policy Center’s estimate with similar adjustments. And our high-cost estimate is based on the Citizens for Tax Justice estimate. Our numbers estimating the business flat tax rate needed to either balance the budget or pay for his proposals is based on the Tax Policy Center estimate of the 16 percent business tax.

Note that none of our estimates account for the effect of a balanced budget amendment.