Adding Up Donald Trump's Campaign Proposals So Far

NOTE: This is an archive version of this analysis and contains out-of-date estimates. The most up-to-date analysis can be found here: https://fiscalfactcheck.crfb.org/how-do-donald-trumps-campaign-proposals-so-far-add-up/

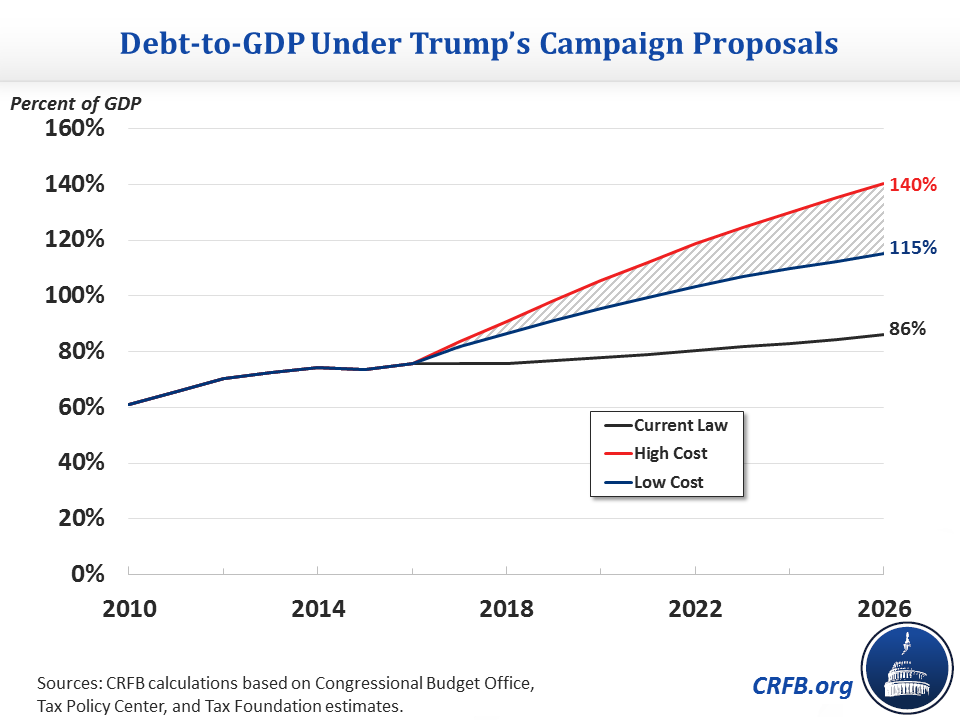

Republican presidential candidate Donald Trump has put forward five major sets of initiatives on his campaign’s website in the areas of U.S.-China trade relations reform, protecting second amendment rights, immigration reform, Veterans Administration reform, and tax reform. By our very rough and initial estimates, these five initiatives together would add between $11.7 and $15.1 trillion to the debt over the next 10 years, including interest. This would increase debt held by the public from nearly $14 trillion today to between $35 and $39 trillion by 2026 (compared to $23.8 trillion in 2026 without these proposals).1 This means debt would grow from 75 percent of Gross Domestic Product (GDP) today (and headed to 86 percent by 2026) to as high as 140 percent by 2026, or to as low as 115 percent assuming his plans also lead to significant economic growth.2

Since the 2016 presidential campaign began, the Committee for a Responsible Federal Budget has analyzed a number of campaign proposals through our Fiscal FactCheck project. The analysis below represents our first analysis of a candidate’s policies in full, based on the proposals currently available on Mr. Trump’s website.3 Although the limited number of issue areas currently listed (as of 2-12-2016) on DonaldJTrump.com makes this analysis relatively straightforward, we intend to follow up with further analyses of other Presidential candidates – as well as updates to our analysis of Mr. Trump’s proposals as more are added to his campaign website. Estimates provided in this analysis are both rough and rounded.

While Mr. Trump has voiced a commitment to reducing the deficit and our national debt, the policies listed on his website to date would add to the national debt over the next decade and beyond. Moreover, statements from Mr. Trump suggesting he would not change Social Security and Medicare – two of the government’s largest programs – make it difficult to envision how he would pay for these costs of this magnitude, let alone achieve his goal of balancing the budget.

Below we explain Mr. Trump’s initiatives as outlined on his website.

The Basics of Mr. Trump’s Campaign Website Proposals

The five proposals featured on Mr. Trump’s website seek to address many of the issues that he has highlighted on the campaign trail over the past year. These proposals do not include what the Trump campaign has mentioned in interviews, debates, and campaign rallies. Only proposals on his campaign website have been estimated.

The Trump campaign website proposals include:4

- Reform the U.S.-China Trade Relationship – Mr. Trump would declare China a currency manipulator, end China’s theft of intellectual property, and clamp down on China’s ability to subsidize their exports in order to facilitate free and fair trade with China. Mr. Trump would also strengthen the U.S. negotiating position by reducing the corporate tax rate, reducing federal debt (by eliminating waste, fraud and abuse, ending redundant programs, and growing the economy), and strengthening the U.S. military presence in Asia.

- Protect Second Amendment Rights – Mr. Trump would defend the right to bear arms by enforcing existing gun laws, increasing access to mental health services, repealing gun and magazine bans, reforming the background check system, ensuring concealed carry permits are valid in all states, and reversing any bans on members of the military from carrying firearms on bases and at recruiting centers.

- Enact Immigration Reform – Mr. Trump has proposed a number of reforms designed to reduce illegal immigration, including building a wall on the U.S.-Mexico border, increasing immigration enforcement officers, mandating nationwide use of the “E-verify” program, mandating the deportation of all criminal aliens, ending birthright citizenship, increasing penalties for overstaying visas, defunding sanctuary cities, and eliminating tax credits for undocumented immigrants. Note that Mr. Trump’s website at the time of this report does not propose to deport all undocumented immigrants, as Mr. Trump has suggested in various speeches.

- Reform Veterans Affairs – Mr. Trump has proposed a number of reforms to improve the Department of Veterans Affairs (VA), including increasing funding for various mental health and job training programs, expanding and improving services for female veterans, reducing waste and fraud, improving technology and personnel, and – perhaps most significantly – allowing veterans to be treated by any doctor who accepts Medicare rather than only those at VA hospitals.

- Reform the Tax Code – Mr. Trump has proposed comprehensive corporate and individual income tax reform. His plan would replace the seven current individual tax rates ranging from 10 to 39.6 percent with three rates of 10 percent, 20 percent, and 25 percent, reduce the top corporate rate from 35 percent to 15 percent, apply the same 15 percent rate to pass-through businesses, eliminate the estate tax, and eliminate the 3.8 percent investment surtax from the Affordable Care Act. In order to finance some of the costs of these tax cuts, Mr. Trump would reduce or eliminate the value of deductions for the very rich, phase out tax benefits related to life insurance and carried interest, enact a one-time deemed repatriation tax, move to a worldwide tax system where foreign-earned business income is taxed by the U.S. as it is earned, and reduce various deductions and preferences for businesses.

The Budgetary Effect of Mr. Trump’s Campaign Website Proposals

Of the five policy areas addressed on Donald Trump’s website, only two – VA reform and tax reform – are likely to have fiscal implications that total more than $100 billion over a decade. Changes to gun laws and China trade policy, as outlined on the website, would likely have only minor fiscal implications. One exception is his call to reduce deficits by cutting waste, fraud, abuse, and redundant programs. However, without more detail as to what this means, it is impossible to provide an estimate or even a range of estimates of the savings.

On immigration, a number of Mr. Trump’s policies would have fiscal implications, but they would be to a large degree offsetting. For example, the Congressional Budget Office (CBO) has scored a national e-verify system as costing about $30 billion over ten years, while CBO and the Joint Committee on Taxation have estimated that policies intended to eliminate tax credits given to illegal immigrants could save about $30 billion. On net, we expect Mr. Trump’s immigration plan as posted on his website at the time of analysis would add to the debt, but by less than $100 billion over a decade.

More significant costs would come from Mr. Trump’s plan to reform the Veterans Affairs administration and the VA health system in particular. While most of his policy proposals would have relatively small and largely offsetting costs and savings, Mr. Trump’s plan to allow “all veterans eligible for VA health care [to] bring their veteran’s ID card to any doctor or care facility that accepts Medicare to get the care they need immediately” (emphasis in original) would come with significant cost. Last year, CBO estimated several similar but much less expansive bills would roughly double VA health spending – costing in the range of $500 billion over a decade. Unlike legislation that would limit private health care to those facing long wait times at the VA and based on VA contracts, Mr. Trump’s proposal would offer private health care to all veterans and allow them to see any doctor. As a result, his proposal could be significantly more expensive and ultimately cost between $500 billion and $1 trillion over ten years.

The most costly proposal on Mr. Trump’s website is his tax plan. Three different outside groups – Citizens for Tax Justice, the Tax Policy Center, and the Tax Foundation – have estimated the net effect of Trump’s plan. Although all three organizations had to make a number of assumptions about the plan due to insufficient detail, they all came to similar conclusions about cost. Before accounting for economic impact, the three organizations estimated ten-year costs of $12 trillion, $9.5 trillion, and $12 trillion respectively. With “dynamic scoring” that accounts for potential economic feedback and assumes an 11.5 percent increase in GDP after a decade, the Tax Foundation estimated a cost of $10.1 trillion. After accounting for interactions with the most recent tax extenders deal, and absent more details, our best estimate is that Mr. Trump’s tax plan will cost between $9.5 and $11.9 trillion over a decade.

Adding these two proposals together and including the interest costs, we find that the total cost would be $11.7 trillion to $15.1 trillion over ten years. As a result, projected debt in 2026 would increase from 86 percent of GDP under current law to between 115 and 140 percent under the proposals on Mr. Trump’s website – with the lower end estimate assuming the debt-to-GDP ratio is lower as a result of GDP being 11.5 percent higher.

| Donald Trump’s Campaign Proposals, As Featured on his Campaign Website | ||

| Major Initiative | CRFB Estimated Ten-Year Cost | |

| Reform the U.S.-China Trade Relationship | * | |

| Protect Second Amendment Rights | * | |

| Reform the Immigration System | * | |

| Reform the Veterans Affairs (VA) System | $0.5 to $1.0 trillion | |

| Reform Individual and Business Taxes | $9.5 to $11.9 trillion | |

| Subtotal, Tax and Spending Proposals | $10 to $12.9 trillion | |

| Net Interest Costs | $1.7 to $2.2 trillion | |

| Total Cost of Donald Trump’s Major Proposals to Date | $11.7 to $15.1 trillion | |

*Likely to cost or save less than $100 billion over ten years.

Balancing the Budget under Mr. Trump’s Plans

On the campaign trail, Mr. Trump has been an advocate of fiscal responsibility, expressing concern about the nation’s $19 trillion gross debt and arguing that he would insist on a balanced budget relatively quickly.

However, reaching a balanced budget would be quite challenging assuming the enactment of Mr. Trump’s campaign website proposals – and even simply paying for these proposals would be difficult.

Roughly speaking, achieving a balanced budget by 2026 would require roughly $8 trillion of deficit reduction over ten years; and that figure would increase to between $19.7 trillion and $23.1 trillion over a decade assuming the enactment of Mr. Trump’s website proposals.5

To achieve this level of savings with spending reductions alone would require huge cuts. For example, cutting the entire budget (other than the VA and immigration enforcement, which are increased in his plans) across-the-board would require a reduction of 39 to 46 percent – a figure that is highly unlikely to be achieved.

Those cuts, however, include cutting Social Security benefits by nearly half – when Mr. Trump has argued multiple times that Social Security benefits should be left alone. Exempting Social Security, cuts would need to total 55 to 65 percent. Also removing Medicare, which Mr. Trump has called for protecting as well (though he has also proposed some small potential savings in the Medicare space), cuts would need to total 75 and 87 percent. And if defense were also exempted, as an area Mr. Trump has committed to strengthening, it becomes literally impossible to balance the budget with only spending cuts.

Simply paying for the initiatives on his website and keeping the debt on its current unsustainable course would also require large cuts – ranging from 23 to 30 percent for all spending other than the VA and immigration enforcement to 61 to 78 percent if Social Security, Medicare, and defense were also exempted.

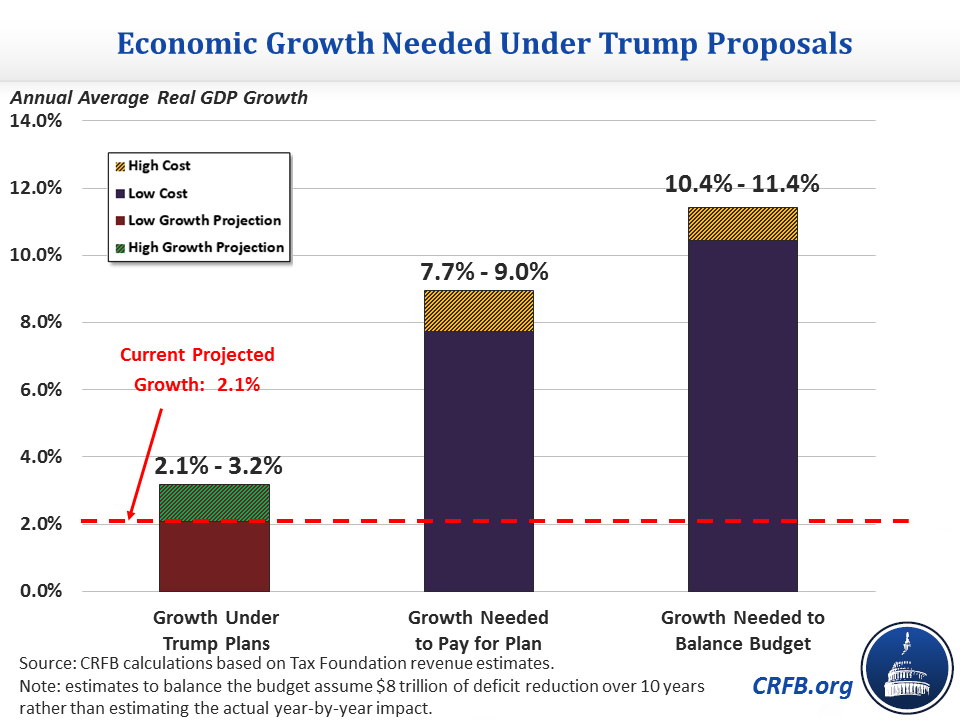

To be sure, Mr. Trump has argued he would address the deficit not just by cutting spending but also by promoting economic growth. Yet here, too, the solution is likely out of reach. Under current law, the Congressional Budget Office estimates real economic growth of 2.1 percent per year over the next decade. Excluding the negative impact of higher debt, the Tax Foundation estimates Mr. Trump’s tax plan would effectively increase annual growth to 3.2 percent over the next decade, and in doing so produce more than $1.8 trillion of additional revenue from feedback effects.

Assuming Tax Foundation’s economic feedback estimates are linear relative to GDP growth after 10 years, it would require 7.7 to 9.0 percent real annual growth to simply pay for the initiatives on Donald Trump’s website, and 10.4 to 11.4 percent real annual growth to balance the budget within a decade. In other words, to balance the budget, growth would have to be roughly 5 times as large as projected, and twice as high as the fastest growth period in the last 60 years (which was between 1959 and 1968).6

* * * *

Mr. Trump should be commended for voicing a commitment to lowering our deficit and debt. However, based on the policies on his campaign website, it would be incredibly difficult to improve the nation’s fiscal outlook from spending cuts or economic growth alone. Assuming areas of the budget such as Social Security, Medicare, and defense are off the table, this goal becomes practically impossible.

In order to maximize the chances of achieving serious deficit reduction, we hope Mr. Trump will modify his tax and/or veterans proposals to be more affordable, and that he will make clear that Social Security, Medicare, defense, and revenue are all on the table for reform.

We look forward to seeing, and analyzing, more policy proposals as they are made available.

1 Projected debt in 2026 under current law is $23.8 trillion according to the Congressional Budget Office.

2 This debt projection assumes the most optimistic scenario of a lower-bound cost divided by a higher GDP that the Tax Foundation’s revenue estimate produces and an upper-bound of the Tax Foundation’s revenue estimate on a static basis.

3 We reached out to the Trump Campaign to clarify proposals to help us refine our estimates but have not received any further clarification.

4 CRFB reports the policies as true to the website as possible in summary (as of 2-12-2016). We do not endorse candidates or their policies.

5 The $8 trillion figure for balancing the budget is an approximation, and the actual amount it would take to balance the budget could be higher or lower depending on the years in which the savings take place and the timing of economic growth. Our previous estimate was $8 trillion if savings follow the same path as found in the FY 2016 Congressional Budget. These numbers include interest costs.

6 Empirical evidence suggests that higher economic growth is generally accompanied by higher interest rates. For simplicity, we assume that the cost to the government from higher interest rates is fully offset by the savings from lower debt service as a result of additional revenue. In reality, the net feedback effect of economic growth could be lower or higher depending on which of these factors dominated, but it would likely fall within 10 percent of our estimates in either direction.