You Can't Pay for Tax Reform with Health Reform

In an interview yesterday on the Fox Business Network, President Trump described how it is better to do health care reform before tax reform because he claimed the savings from health care could be used to further reduce taxes. Among the things he said included “[On health care] we will save perhaps $900 billion dollars…that’s all going back into the taxes.” While it is true that the American Health Care Act (AHCA) itself reduces both taxes and spending, that money cannot be used a second time to pay for tax reform.

Recently, we explained that what health reform does to the "revenue baseline" has little bearing on what would happen in tax reform – you can read our full analysis here.

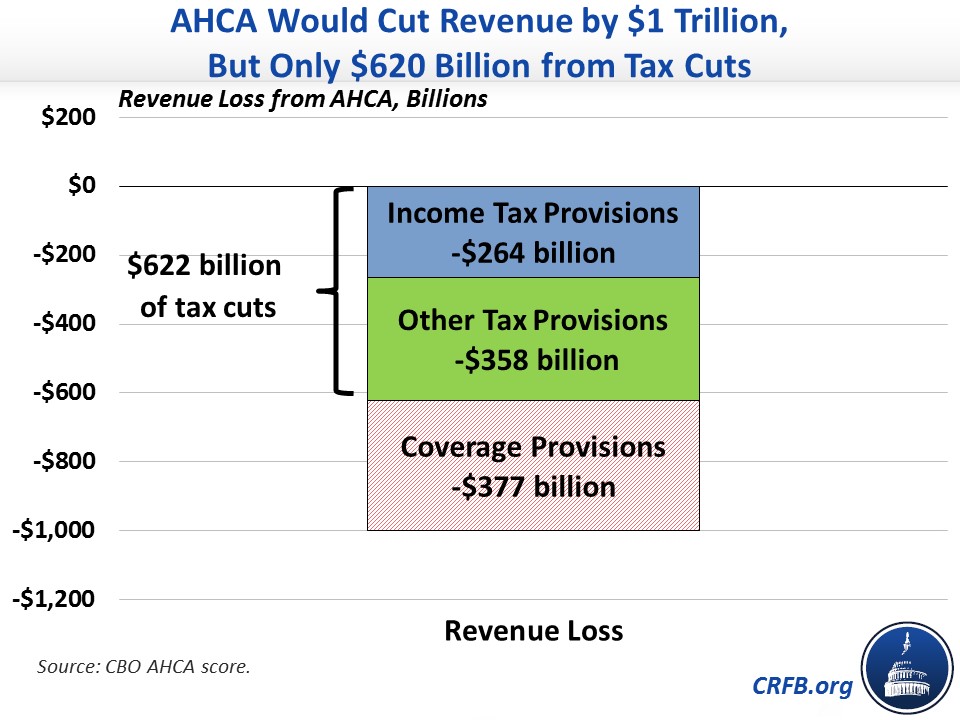

If in his most recent comments the President's argument is that health reform reduces spending by $900 billion in order to pay for tax cuts, he is right – at least right in terms of order of magnitude. The most recently scored version of the AHCA would cut total outlays by $1.15 trillion over a decade and use most of those savings to repeal the Affordable Care Act’s (ACA or “Obamacare") taxes and mandates, reducing revenue by $1 trillion. (For a detailed breakdown of the AHCA's changes to revenues and outlays, view our analysis).

However, these outlay savings are used within the AHCA to offset the cost of its tax cuts, so they aren’t available for further cuts in tax reform. The last scored version of the AHCA only created $150 billion of net savings – not $900 billion or $1 trillion. Moreover, under reconciliation rules, those savings must go to deficit reduction and cannot legally be used to offset future legislation cutting taxes or increasing spending.

We have heard a lot of folks talking about how health reform makes tax reform $1 trillion easier by “changing the revenue baseline” – but this is largely a red herring. Health reform might make tax reform easier, but it has nothing to do with baselines. Health reform could make tax reform easier if the failure of health reform leads policymakers to want to eliminate the ACA's taxes in tax reform instead.

It is not clear this is the case. Speaker Ryan has said "Obamacare taxes will stay with Obamacare." But even if the Obamacare taxes move to tax reform, they total only $620 billion – not $1 trillion. The other $380 billion of the AHCA's revenue loss comes from "coverage provisions" that have nothing to do with taxes at all. And even among that $620 billion, most of the provisions are unrelated to the income tax and likely wouldn't appear in tax reform.

Sadly, there's also a chance that health reform's failure opens up a huge budget gimmick, making tax reform easier by giving policymakers an excuse to make it less fiscally responsible. We hope this doesn't happen. As we've explained before, tax reform should be paid for.

Responsible and thoughtful tax reform can help to grow the economy and improve the lives of Americans. And that is true whether or not health reform passes first.

If policymakers want to enact tax reform, they do not need to enact health reform – and enacting health reform would not make tax reform any easier. The only reason this would change is if tax reform were inclusive of health taxes.