Wonkblog Rolls Out Individual Tax Reform Calculator

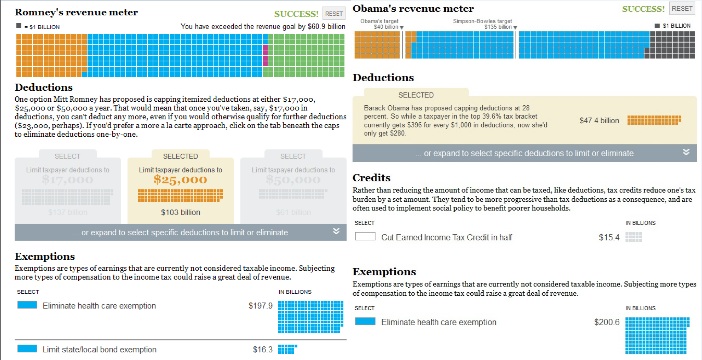

Over at Wonkblog, Dylan Matthews and Ezra Klein have worked with analysts at Citizens for Tax Justice and the Institute for Taxation and Economic Policy to create an individual tax reform calculator. The calculator comes in versions for both Governor Mitt Romney's plan and President Obama's plan. In the Romney version, one must find revenue sources in the tax code to offset extending the Bush tax cuts, reducing tax rates across the board by 20 percent, eliminating the AMT, and reducing corporate tax rates. In the Obama version, one must find additional revenue above allowing the upper-income tax cuts to expire to meet either his revenue target (an additional $500-$600 billion over ten years, or $1.5 trillion total) or the Simpson-Bowles revenue target (about an additional $1.35 trillion over ten years, or slightly above $2 trillion total).

The user is given the option of choosing a broad-based tax expenditure reduction, specifically Gov. Romney's proposed itemized deduction cap and President Obama's limitation on deductions and exclusions for upper-income taxpayers. Beyond that, the user can also reduce or eliminate other tax expenditures, including a few large provisions such as the health care exemption and preferential rates for dividends and capital gains. The calculator also allows additional taxes like a VAT or a carbon tax, or returning the estate tax to pre-2001 levels.

Here's a sample of both of them.

Both calculators tell a similar story--that enacting comprehensive tax reform is very hard. This is especially true if one tries to a base-broadening rate-reducing tax reform that raises revenue. This is also apparent on the corporate side for those who have tried our own corporate tax calculator. We hope lawmakers look at tax reform as an opportunity to improve the tax code, but more importantly to raise the revenue we need to stabilize our debt.

We've shown before that it is possible to make the math add up, but not unless lawmakers are willing to make some difficult choices. We can reform the tax code to raise more revenue, be more progressive, and better promote growth, but it is going to require that every tax expenditure--and some non-tax expenditures--be given a serious look.