Will Tax Increases Cripple Economic Growth?

One common argument against increasing tax revenue is that it requires raising marginal tax rates, which could severely damage economic growth by discouraging work, investment, and business formation. While economic theory and evidence largely supports the idea that tax rate increases would slow economic growth, the effect is likely to be small. Indeed, evidence surveyed by Gale and Samwick suggests the impact of a tax increase on economic growth might be negligible. One of the main reasons for this is that while higher tax rates would reduce the incentive to work, higher revenue would also reduce debt levels which would promote growth.

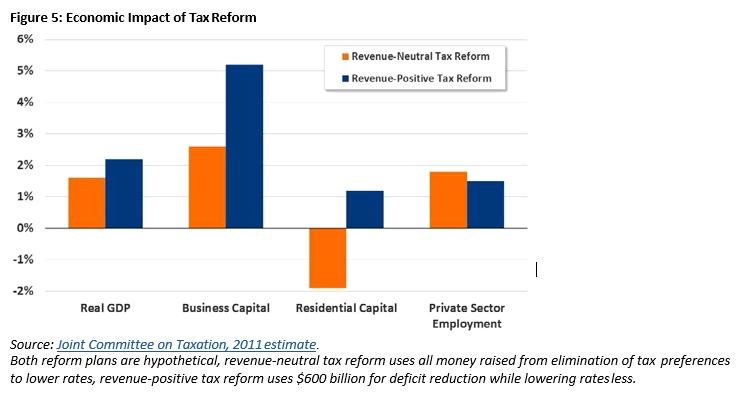

Furthermore, it is actually possible to raise revenue without increasing tax rates by instead repealing or limiting various tax breaks. Many policymakers and outside groups have proposed aggressively reducing these breaks in order to both increase revenue and reduce overall tax rates. The non-partisan Joint Committee on Taxation (JCT) has found that this style of tax reform could increase the size of the economy significantly over the long run. And in fact, JCT has estimated that revenue-positive tax reform could provide an even bigger economic boost than revenue-neutral reform.

Ruling: False