Washington Post on the Proper Target for Debt Reduction

A recent editorial from the Washington Post takes on the "new school of thought on deficits" that believes that we do not have to go too much further with deficit reduction, with champions like the Center for Budget and Policy Priorities and Paul Krugman.

Specifically, the Editorial Board comments on the recent study from the CBPP, which argues that lawmakers need only to stabilize the debt as a share of the economy. This would require around $1.4 billion in additional deficit reduction relative to a current policy baseline (a baseline that does not include the sequester), at which point lawmakers could turn their attention elsewhere. The Editorial Board disagrees:

If only. A debt-to-GDP ratio “stabilized” at 73 percent would be a paltry achievement — a level of indebtedness 32 percentage points larger than the post-1950 average. A five-year plateau at that ratio would depart markedly from historical patterns, according to which U.S. debt surges during wars and/or recessions, then recedes in equal or near-equal measure amid renewed growth and fiscal consolidation.

The CBPP analysis assumes steady economic growth and no war. If that’s even slightly off, debt-to-GDP could keep rising — and stick dangerously near the 90 percent mark that economists regard as a threat to sustainable economic growth. “Those who argue against a further focus on prospective deficits” based on rosy scenarios “counsel irresponsibly,” President Obama’s former Treasury secretary, Lawrence H. Summers, wrote in The Post on Inauguration Day — and we agree.

Anyway, it’s not like Congress and the White House are close to agreeing on an alternative to the sequester. Many deficit doves would also decry the sequester’s cuts to domestic programs; few, however, have said exactly what tax hikes and spending cuts they would prefer. A memo circulated by the Senate Budget Committee’s Democratic majority alludes to closing tax loopholes but specifies nothing bigger or politically riskier than breaks for corporate jets and oil companies.

The big money is in entitlements, the source of our structural debt problem, which Democrats seem increasingly to treat as untouchable. The CBPP paper concedes that stabilizing debt at 73 percent of GDP by 2018 “would not be enough to address the longer-term budget problem.” Never mind, deficit doves coo, the problem is health spending generally — not a sustainable redesign of Medicare and Medicaid. And health spending is already easing, albeit for unknown reasons.

Given the economy’s fragility, we should not slam on the fiscal brakes, but even the short-term goal should be a downward trajectory for debt-to-GDP — not a high plateau. Regarding structural debt, our leaders can hardly be accused of rushing into things. They should be more ambitious, not less. The longer they wait, the more painful the process will be.

This is in line with what we said in our blog Putting the Debt on a Downward Path. We pointed out that while $1.4 trillion would technically be projected to keep the debt stable through 2022, that target was quite problematic. For one, just barely stabilizing the debt would leave no margin for error in case economic assumptions turned out to be off or politicians enacted new policies on a deficit-financed basis. In addition, leaving debt at such a high level would allow for little flexibility to respond to possible national disasters, economic downturns, or national security crisis that may demand additional resources.

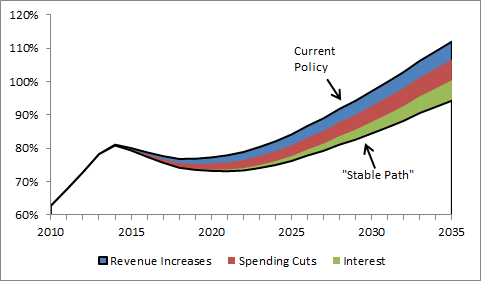

And finally, we pointed out that $1.4 trillion through 2022 is highly unlikely to be enough to keep the debt stable in future decades. In fact, we modeled an illustrative version of CBPP's $1.4 trillion and found that debt would still grow dramatically beginning in 2023.

Source: CRFB calculations

Note that CBPP president Bob Greenstein has already responded to the Washington Post editorial. He focused much of the response on discussion of the forecasts being based on "rosy scenarios," pointing out that their numbers are based off CBO estimates. We agree with Greenstein that there is a good chance that their estimates may prove to be too pessimistic as well as optimistic. Still, it is better to be prudent and prepare for the latter situation, since it is much more difficult to reverse a worse budget outlook than it is to deal with an improved outlook.

Nevertheless, the Washington Post editorial board gets the main argument right. These projections can quickly change for the worst, as the decade of the 2000s showed us. Lawmakers should focus on the long-term and should be conservative with deficit spending and putting debt on a downward path will provide needed wiggle room if anything goes wrong.