TPC Releases Fiscal Cliff Tax Calculator

Yesterday, we discussed the myth that the poor would be spared by the fiscal cliff, with one of the reasons being the large tax increase at the end of the year. According to the Tax Policy Center, the poorest 20 percent of people would face a tax hike of $412, or a 3.7 percent reduction in their after tax income.

Now, the Tax Policy Center has released a new tax calculator for different taxpayers by income group, filing status, and how they would fare under the cliff or competing plans. The calculator then allows you to compare your tax burden under current law (the fiscal cliff), a complete extension of current policy, and the Senate Democratic and Republican plans.

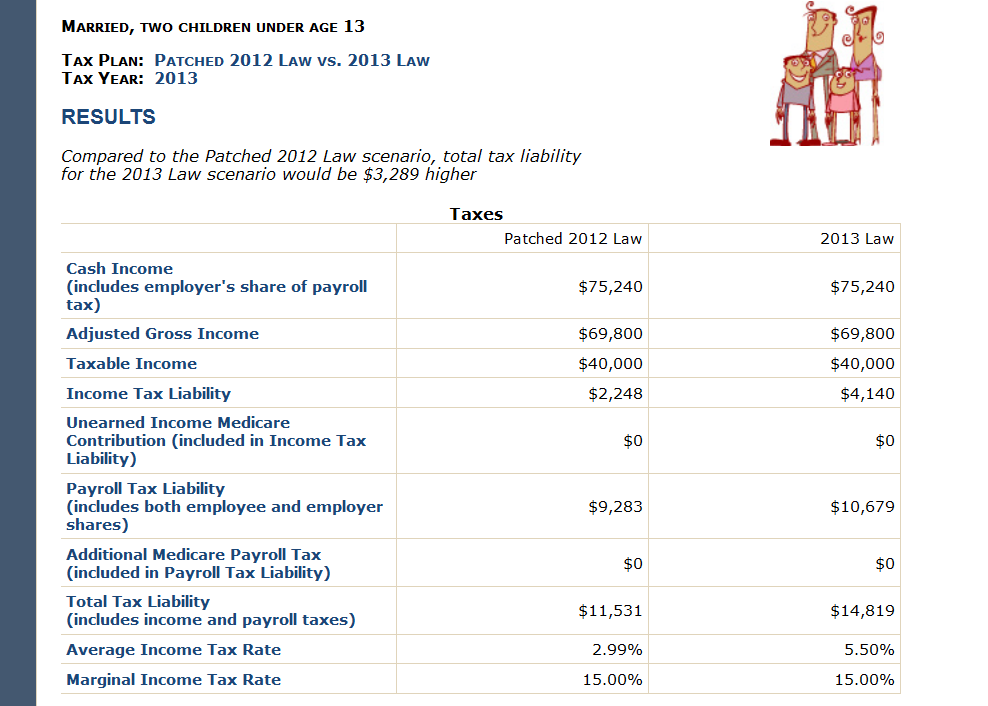

Below is a sample of what the calculator shows.

Of course, the Senate Democratic and Republican plans are not the only alternatives to the fiscal cliff. A better approach would involve comprehensive tax reform that could be equally or more progressive than the current code with lower rates and more revenue. Under the bipartisan proposals of Domenici-Rivlin and Simpson-Bowles, a far greater burden falls on the wealthy even with a lower top marginal rate. Tax reform can make the code simpler, fairer, and more conducive to growth. But lawmakers need to be willing to make the tough choices.

The tax calculator can be found here.