Spending on Children Compromised Unless We Address Entitlement Programs and the Debt

The Urban Institute last week released its eighth annual Kids’ Share report summarizing data and trends in federal, state, and local spending on children. The report’s findings highlight a troubling trend: unless we reign in growth in entitlement programs and control the debt, spending on entitlements and interest payments will squeeze out funding for most other programs in the next decade, including investments in children. As a result, spending in all other programs will decrease as a percentage of the total federal budget.

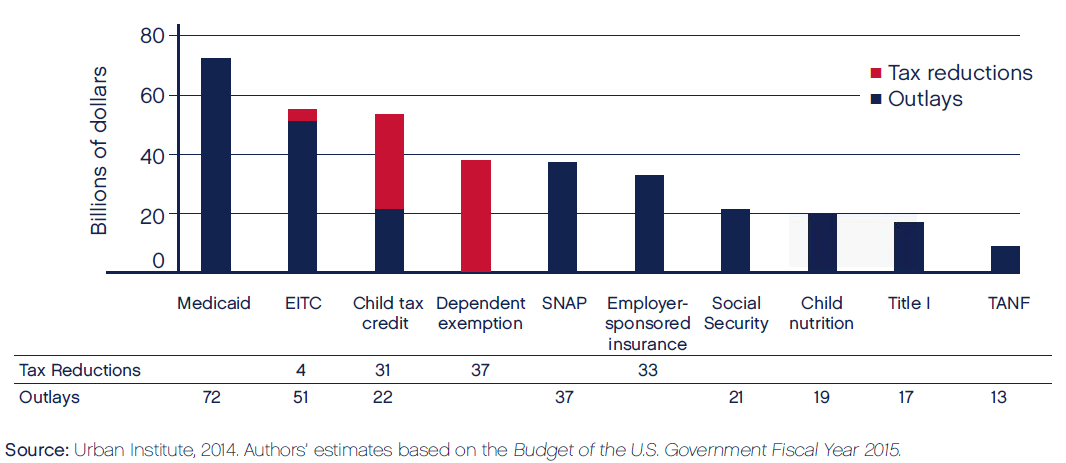

In 2013, the federal government spent $464 billion on children, mostly through Medicaid, tax provisions – such as the Earned Income Tax Credit (EITC), the child tax credit, and the dependent exemption – and the Supplemental Nutritional Assistance Program (SNAP, formerly known as food stamps).

Spending on Children in FY 2013

While federal funding for children increased slightly from the $460 billion (in 2013 dollars) spent in 2012, it is still 7 percent below the $499 billion spent in 2010, although that peak reflects some temporary spending in the 2009 stimulus. But trends show that under current law children’s programs will face significant pressure in the future.

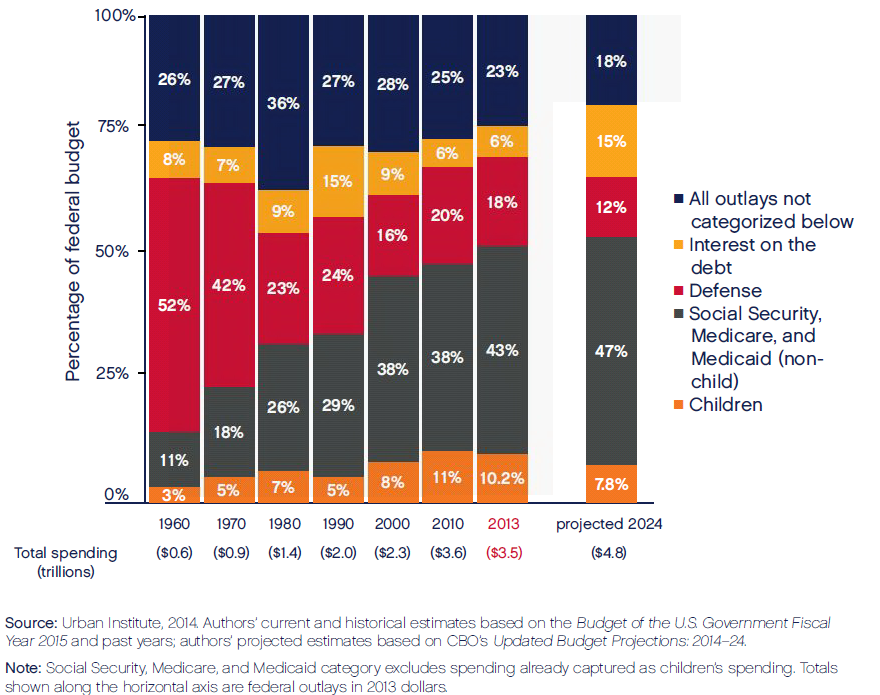

Spending on kids programs accounted for slightly over 10 percent of the federal budget in 2013 but is expected to decline below 8 percent in 2024. As a percent of GDP, the authors estimate that spending on children is expected to fall overall and in all major categories except for health care (due mainly to increases in Medicaid). The largest drop in federal funding is expected in K-12 education, with an expected 12 percent drop between 2014 and 2024.

The shrinking share of spending on children occurs as healthcare and retirement programs take up more and more of the budget. The federal budget is expected to increase in 2013 dollars from $3.5 trillion in 2014 to $4.8 trillion in 2024. Yet, most of that increase will go towards entitlement programs and debt payments, while discretionary programs, which include funding for many programs benefitting children, will remain essentially flat. In fact, 58 percent of the almost $1.4 trillion increase in spending will go directly to Social Security, Medicare and Medicaid (excluding benefits for children) and 36 percent will be allocated to interest on the debt. Only 2 percent of the budget increase, or $26 billion, will be devoted to children. Defense will see a 3 percent, or $43 billion, reduction due to the discretionary spending caps.

Share of Spending by Category

This highlights a critical disparity in the budget: we are spending a lot more on the elderly than on children. In 2013, federal, state, and local governments spent on average $12,770 per child and $28,754 per senior, or 2.3 times as much. This difference is even larger when you only take federal funding into account. The federal government spent 5.7 times more on seniors than on children in 2013, excluding tax expenditures.

Federal Spending Per Capita by Demographic

Spending on the over-65 population has greatly increased over time because of the elderly's growing share of the population, health care cost growth, new programs, and automatic spending increases in Social Security. Federal outlays for the elderly totaled 7.5 percent of GDP in 2011, up from 2.1 percent of GDP in 1960. During the same period, outlays for children (excluding tax expenditures) went from 0.6 percent of GDP in 1960 to 2.5 percent in 2011 and 2.1 in 2013. By 2014, federal outlays are projected to reach 22 percent of GDP for the elderly but only 1.7 percent of GDP for children.

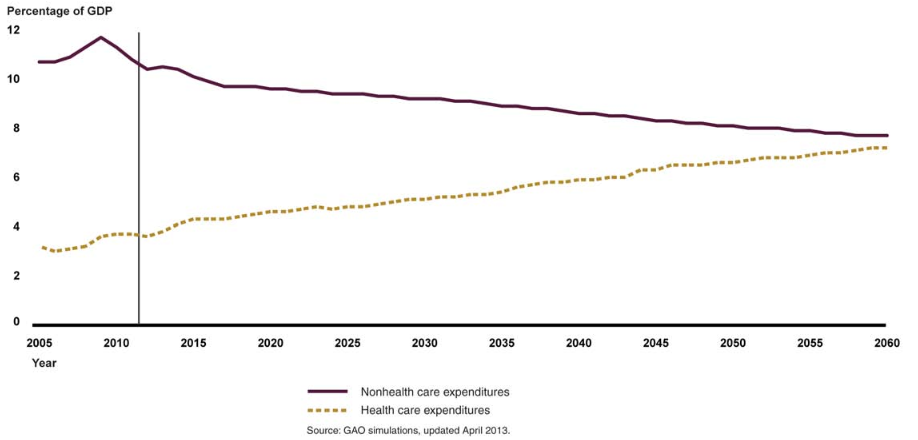

Most investments in children are done by state and local governments through public education. But Dan Crippen, executive director of the National Governors Association and former CBO director, expressed concern in 2012 that increasing healthcare costs, particularly in Medicaid, will put pressure on state budgets at the expense of other spending areas. The Government Accountability Office projects that state and local government expenditures in health as a share of GDP will increase consistently though 2060, resulting in a steady decline in non-health spending.

State and Local Spending as a Percent of GDP

As a result, state and local investments in education are likely to fall. Since the federal government’s budget for education and discretionary programs is also projected to shrink, the total share of resources dedicated to future generations will likely decline.

During an event held last week to release the 2014 report, the authors urged attendees to wonder how the small and declining share of public funding devoted to children will affect our future. Finding ways to reform entitlement programs and taking serious action to reduce the federal debt are necessary steps to enable us to have the resources and fiscal space to make investments in future generations.