Recreating the Second Decade: CBO's Immigration Numbers in the Long Term

In our paper on CBO's analysis of the Senate immigration bill, we used CBO's numbers to produce deficit and debt estimates for the next twenty years. Since CBO only produced rounded ten-year estimates for the second decade, however, we had to construct our own rough estimates for each individual year. Although we did not include each of these numbers in our paper, we did use them to construct overall debt and deficit paths. This paper shows how the numbers were constructed in the first place.

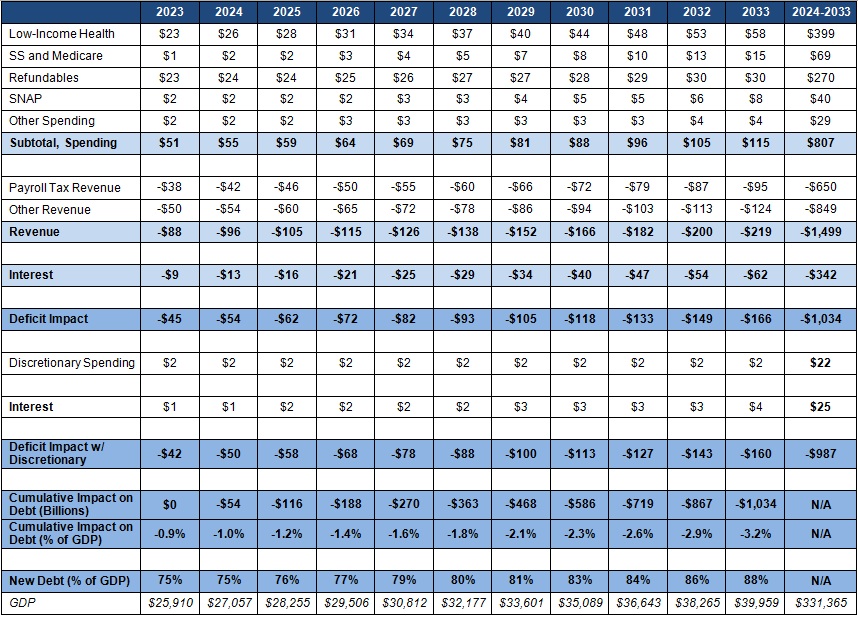

As CBO explains, their second decade estimates are very rough. Our year-by-year estimates are even more rough, and we had to make some relatively broad assumptions. Fortunately, CBO made our task easier by giving some information about the growth paths for many policy areas. Specifically, they tell us:

- Increased low-income health spending would grow by about 10 percent per year

- Increased refundable tax credit spending would grow by less than 3 percent per year

- Increased Social Security and Medicare spending would be slowing but growing by more than 20 percent by 2033

- Increased revenue would be growing by about 9 percent per year

With those facts in mind, we constructed the spending and revenue paths to match the 2024-2033 numbers that CBO laid out in its report. Here's what we came up with. Note that these numbers are only a rough approximation of what we think CBO's numbers would be.

Source: CBO, CRFB extrapolations

Click the picture to see the table in a Word document.

By 2033, we figure that the bill would have about $115 billion of increased spending, $220 billion of increased revenue, and $60 billion of interest savings for a total deficit impact of around $165 billion. Debt would be about three percentage points lower.

As we already showed in our paper, the current Senate immigration bill would improve the deficit and debt situation on paper, but obviously it cannot be relied on to take care of the problem by itself. More broadly, this exercise shows the value of looking at longer-term numbers. In some cases, lawmakers have enacted policies that looked like savings upfront but ended up likely costing the government over the long run (such as easing rules for converting to Roth retirement accounts). Looking at the long term is important, considering the large fiscal issues the federal government in that timeframe.

This blog has been updated from its original posting.