Rattner Testifies Before Senate Finance Committee on Tax Fairness

The Senate Finance Committee held a hearing Tuesday on how best to achieve "tax fairness" as a part of their larger focus on tax reform. Testifying before the committee included Steven Rattner, the chairman of Willett Advisors LLC and a current member of the steering committee for the Campaign to Fix the Debt. Rattner's testimony focused on using the tax code to address income inequality as well as the need to increase tax revenue to a level that makes the budget fiscally sustainable, principles shared by Fix the Debt's Case for Fundamental Tax Reform.

Also testifying before the committee were Dr. Lawrence Lindsey, President and CEO of the Lindsey Group; Deroy Murdock, Senior Fellow at the Atlas Network; and Dr. Heather Boushey, Executive Director of the Washington Center for Equitable Growth. Each witness came to the hearing with a different stance on how the tax code currently treats earners and how it ought to treat earners.

Rattner emphasized the tax code’s historical use as a way of alleviating income inequality. The decreasing marginal tax rate for top earners, the rampant exploitation of tax expenditures, and out-of-date corporate tax scheme all contribute to a code that fails to address adequately the changing circumstances among many Americans, according to Rattner. Despite his long career in the financial services sector, Rattner advocated increasing the capital gains tax rate, saying that he did not believe there would be any change in work ethic among his investment banking colleagues if there were a higher tax rate:

But in my 32 years on Wall Street, I have experienced top marginal Federal tax rates as high as 50% and as low as 28%, and I never detected any change in the motivation to work on the part of myself or any of my colleagues.

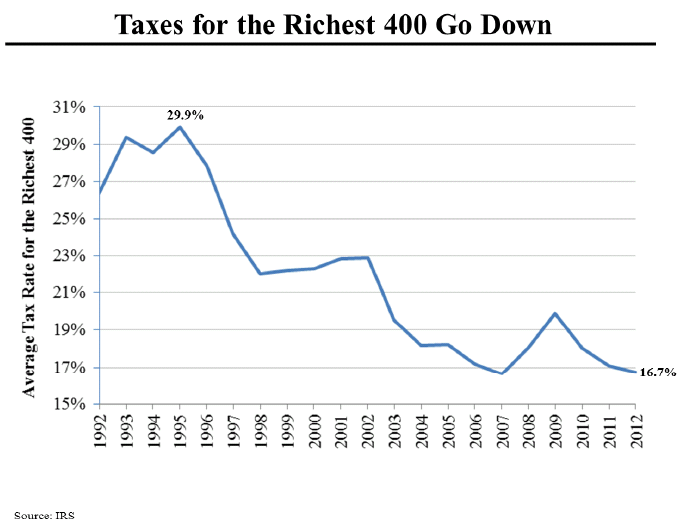

Rattner noted that the tax rate paid by the highest grossing 400 taxpayers has gone down substantially in the last 20 years, from almost 30 percent in 1995 to 17 percent in 2012.

Graph taken from Steven Rattner's testimony.

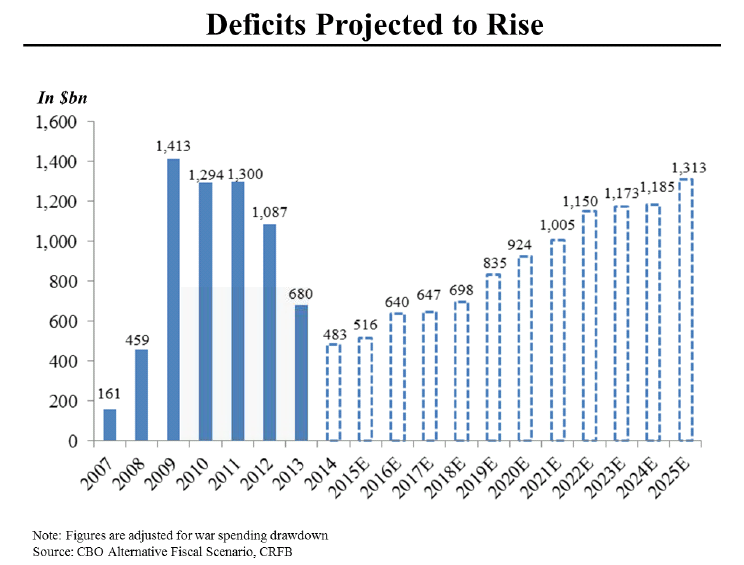

In addition to his specific tax recommendations of increasing the capital gains rate and ending tax avoidance loopholes, Rattner’s testimony discussed the dismal budget forecast, including the return of $1 trillion deficits as early as 2021, according to our projections of what a CBO Alternative Fiscal Situation could look like under the newest budget projections.

Graph taken from Steven Rattner's testimony.

He suggested the first step is revisiting previous work on tax reform:

A good starting off point for the committee would be the exhaustive work of the Simpson-Bowles Commission, which much like the 1986 law, proposed reducing the number of tax rates to three, erasing the special treatment of capital gains and dividends, and eliminating most other tax deductions.

The other witnesses' testimony offered differing opinions on tax fairness and solutions to overcome inequality. While Lindsey emphasized that the tax system does a poor job in fixing income inequality and would be better served as a tool for economic growth, Murdock advocated for a complete simplification of the system by replacing it with a flat 10 percent tax on income without any deductions. On the other hand, Boushey shared Rattner's concerns about income inequality and voiced support for many of the administration's proposals such as eliminating stepped-up basis on inheritances and expanding the child tax credit.

Senator Dean Heller (R-NV) asked each witness to describe how to make a fair tax code. Rattner responded that such a question requires answering two different questions: first, what level of revenue is adequate for the United States to function, and second, who ought to pay for the increasing need for revenue created by growing entitlement spending. He reiterated that taxing capital gains at a lower rate than labor is “patently unfair,” noting the progressive income tax structure has served us well thus far and ought to be adjusted as income inequality grows.

Rattner’s conclusion was that Congress should not look at tax reform in a vacuum, deciding beforehand the amount of revenues it should raise. Instead, Congress should examine how much revenue it will take to keep the government running and pay for growing entitlement spending, then use tax reform to achieve that amount of revenue.

You can read Rattner's full testimony here and find details about the full hearing here.