Peterson Foundation Shows Long-Term Problems Remain Unsolved

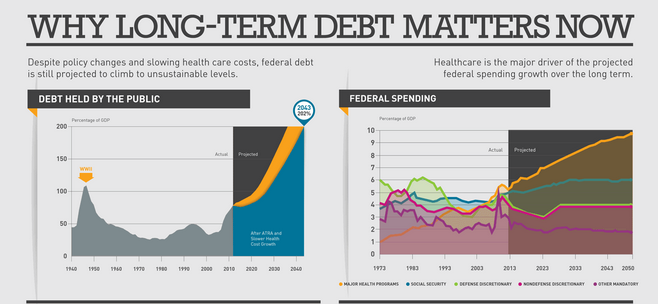

Why is the long-term debt problem important for the country? And why should lawmakers care about it now? Those are the two main questions the Peterson Foundation answers in its new report on the long-term outlook, Why Long-Term Debt Matters. The Peterson Foundation report shows where the problem came from, who is affected, and why the problem needs a solution in place now. They have also created an infographic capturing many of the notable facts and figures that characterize the long-term debt problem.

[Click to view full infographic]

Our CRFB Realistic Baseline projects debt to rise to over 100 percent by 2038, while the Peterson Foundation, using more pessimistic assumptions, projects even higher levels. Along with a point we made before on this blog, the Peterson Foundation argues that while recent developments have improved our medium-term outlook, much more is needed on the long-term front. Population aging and excess health care cost-growth will push debt up significantly over the longer term.

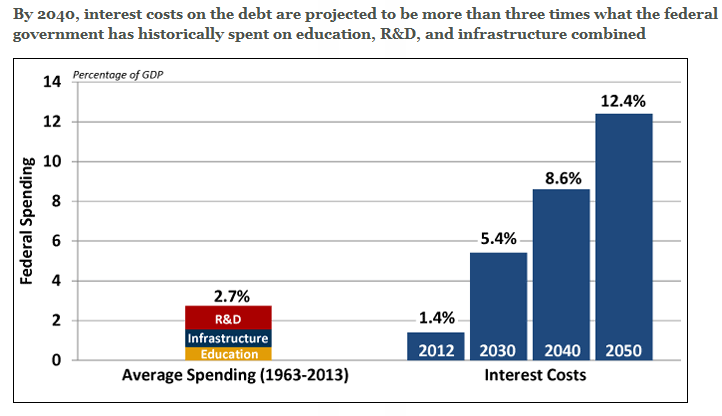

A result of that debt will be rising interest payments which will "crowd out" other government priorities. Under the Peterson Foundation's projections, interest payments will actually exceed total revenues by 2064. This should be a great concern to future generations since that would likely result in less research and development, infrastructure investment, and weaker economic growth.

Lastly, the Peterson Foundation makes the case for why we should solve the deficit problem now. The longer we wait, the larger and more abrupt the required changes will need to be. Agreeing upon a solution today allows for gradual, phased-in changes that can protect the vulnerable and give people time to plan. Given the size of the problem and the importance of a solution for long-term growth, that would be the right way to go.