The OECD and Robert Solow on the Effects of Debt

As our national debt and deficit continue to rise, a question that continues to be on many people’s minds is how rising debt levels impact the economy, especially as the American economy remains far from a full recovery. A report from the Organization for Economic Cooperation and Development (OECD)’s Economics Department on Debt and Macroeconomic Stability explains how rising public and private debt levels are related to macroeconomic instability.

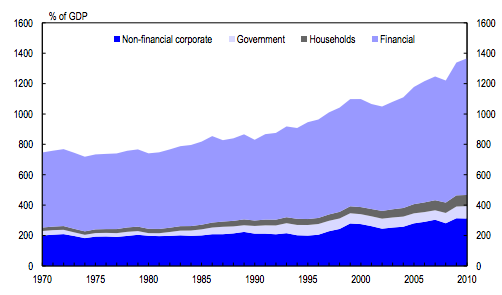

Noting that both public and private debt levels in OECD countries are currently high relative to historical averages, the report lists a number of findings, most notably that high debt levels can exacerbate macroeconomic vulnerability and the likelihood of an economic downturn increases when private sector debt levels rise above trend. The report’s authors cite a trend of rising debt as a share of GDP in OECD countries since the mid-1990s, peaking now with average total economy financial liabilities—public and private debt taken together—over 1300 percent of GDP following the financial crisis.

The chart below shows the rise in OECD area financial liabilities as a percentage of GDP:

Source: OECD

The report argues that higher debt could lead to a higher likelihood of recession, especially high levels of houshold debt. But government debt is also important, especially for limiting the effects of large shocks to the economy. Fiscal policy, one tool that governments can use to respond to crises, is limited when governments carry high levels of debt. From the report:

Government borrowing rises during a downturn due to the automatic stabilisers and, possibly, discretionary fiscal policy, thereby damping the propagation of the shock. In this context, temporarily increasing government debt helps ensure macroeconomic stability. However, there appear to be limits to the ability to stabilise the economy, when government debt is high. In fact, government financial liabilities and output volatility are correlated which suggests that the stabilising role of fiscal policy becomes weaker at higher levels of debt. This reflects that debt dynamics may threaten to become unstable and that household behaviour – expecting that greater government debt will eventually result in higher taxes – will reduce the effectiveness of fiscal policy in smoothing economic fluctuations. When debt levels are high,fiscal policy may even be forced to become pro-cyclical.

Hence the need to bring down government debt levels to prudent levels during good times. Institutional frameworks, such as fiscal rules and fiscal councils, can help maintain prudent government debt levels, which allow fiscal policy to react to shocks.

Limited flexiblity in the face of a crisis is not the only downside to high levels of debt. In a recent New York Times column, MIT economist Robert Solow argues that one of the concerns of high debt levels is that it may "crowd out" private investment, therefore slowing growth. Although he says that Treasury debt is only soaking up excess private savings right now with the economy facing an output and employment gap, the crowding out will become a factor when the economy recovers. Writes Solow:

The real burden of domestically owned Treasury debt is that it soaks up savings that might go into useful private investment. Savers own Treasury bonds because they are seen as safe, default-free assets, and the government can borrow at lower rates than corporations can. If there were less debt, and fewer bonds for sale, savers seeking higher returns would invest in corporate bonds or stocks instead. Business investment would expand and be more profitable.

Solow concludes that we need a long-term plan to reduce the deficit. Such a plan could put debt on a sustainable, clear downward path and phase in most of the deficit reduction so it occurs after the economy has had time to recover.

In the long run we need a clear plan to reduce the ratio of publicly held debt to national income. But for now the best chance to reinvigorate the economy, spur business investment and encourage consumer spending is through public borrowing and spending. Instead, we’re heading into an ill-advised, across-the-board austerity program.

As Solow's argument highlights, sequestration is not the right way to reduce the deficit. It is mindless, abrupt, frontloaded, too heavily concentrated on cutting investments, and not focused enough on addressing entitlements. But simply repealing the sequester would send the message we are not serious about controlling our debt, which is why it should be replaced with a much smarter deficit reduction plan.