Medicare Trust Fund Exhaustion Now Set for 2026

Along with their report on the financial status of the Social Security trust fund, the Social Security and Medicare Trustees on Friday released a separate analysis on the Medicare program. With federal health spending growth being the primary driver of the debt in the upcoming decades, the analysis is an important reminder of the need to reform Medicare and put it on a more sustainable path.

The Hospital Insurance (HI) trust fund, which funds Part A of Medicare mostly through the 2.9 percent payroll tax (3.8 percent for income over $250,000), has been running cash-flow deficits for years. The Medicare Trustees now project it will become insolvent in 2026, two years later than last year’s projection. At that point, benefits would be cut by 13 percent. The 75-year actuarial imbalance of the HI trust fund has decreased slightly to 1.11 percent of payroll, about 0.25 percentage points lower than last year. Cash flow deficits will improve from a 0.5 percent of payroll deficit in 2012 to a tiny 0.02 percent surplus in 2017 before the program goes back into deficits for the foreseeable future.

The slight improvement in the projected shortfall can be attributed to: (1) lower than expected spending in 2012, which lowers the base spending off of which projections are based; (2) lower Medicare Advantage (MA) costs due to certain changes made under the Affordable Care Act reducing MA spending by more than expected; and (3) methodological refinements. Meanwhile, lower than expected levels of tax revenue partially offset some of these improvements on spending.

| Changes in HI Actuarial Imbalance (Percent of Payroll) | |

| 75-Year Actuarial Balance | |

| 2012 Report Balance | -1.35% |

| Shifting the 75-Year Window | -0.03% |

| 2012 Actual Spending Levels | +0.05% |

| Private Health Plan Assumptions | +0.07% |

| Hospital Assumptions | +0.02% |

| Other Provider Assumptions | +0.11% |

| Economic and Demographic Assumptions | +0.02% |

| 2013 Report Balance | -1.11% |

Source: Medicare Trustees Report

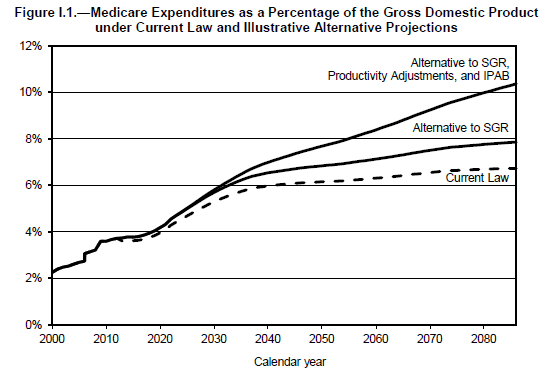

While the solvency of Part A remains a concern and is important in the policy debate on reforming Medicare, a more useful metric is total Medicare spending. This includes other spending on patient care and prescription drugs funded by beneficiary premiums and general revenue. Even under rosier current law projections, which assume various cost control measures stay in effect longer than some other sets of projections, total Medicare spending is on course to rise from about 3.6 percent of GDP in 2012 to about 5.8 percent by 2040. Thereafter, it would rise more slowly to 6.5 percent by 2086.

Under their illustrative alternative projections, the Trustees adjust for a few current law assumptions that are unlikely to occur. The alternate assumptions include (1) assuming Congress will continue to enact legislative fixes for the 25 percent physician payment cut under the Sustainable Growth Rate (SGR) formula; (2) accounting for potential changes to productivity adjustments enacted under the ACA which policymakers might feel pressured to override; and (3) the mandate that the Independent Payment Advisory Board (IPAB) enact other Medicare savings if spending growth exceeds a certain target. IPAB may not be much of a factor under current law, but it could have a substantial effect if the other two scheduled payment reductions do not happen. Under these assumptions, the 75-year actuarial deficit for Part A would be 2.17 percent of taxable payroll (compared to 2.43 percent last year) and Medicare spending would rise to 9.8 percent of GDP by 2087.

Source: Medicare Trustees Report

Health care spending is projected to rise in the coming decades, although much of that increase can be avoided if various cost-control measures in current law are allowed to work. However, given the recent history of doc fixes and concerns the Trustees have raised over the sustainability of other mandated provider cuts, this may be a difficult task for lawmakers. A better approach would be to look at some of the many health care savings options available that would be easier to sustain, including those designed to "bend" the health care cost curve and improve quality of care.

Health care projections are particularly uncertain, as it remains to be seen how much of the recent slowdown is due to a poor economy or efficiency gains from the Affordable Care Act and other structural changes to the health care system. But under what one would think are realistic assumptions, projections look unsustainable. Instead of waiting to see if the best case or worst case scenario comes true, lawmakers should take a prudent approach and undertake entitlement reform to make sure health care spending remains on a sustainable path and beneficiaries will be able to rely on the security these programs provide.