The "Low Hanging Fruit" of the Budget Debate

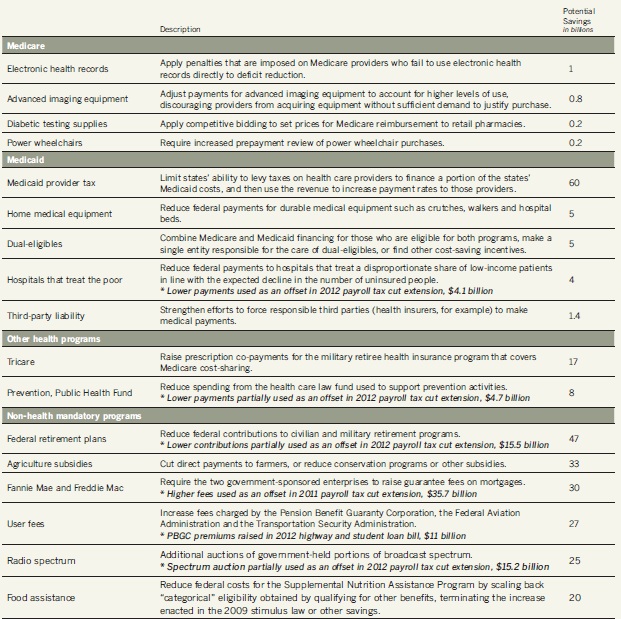

The latest edition of CQ Weekly has a piece on the "low-hanging fruit" of the budget debate -- provisions that have been proposed or negotiated by members of both parties. A table from the article is a very welcomed addition to our own overlapping policy grid, which also shows a surprising level of commonality between some budget plans and discussions.

The type of policies featured in the CQ article are generally in health spending and other mandatory spending. They include reductions to health provider payments and other measures to lower health care utilization that have been discussed by groups such as the Medicare Payment Advisory Commission (MedPAC). Also, there are changes to beneficiary cost-sharing and premiums, such as restricting Medigap coverage and raising premiums for high-income earners in Medicare. In terms of non-health policies, the list includes some policies that have been partially or fully enacted -- increasing federal employee retirement contributions and increasing PBGC premiums -- or policies that are currently under discussion, such as cuts to farm subsidies and food stamps.

In a similar vein as this article, our comparison grid of prominent budget plans also includes many of the same mandatory spending policies, but also larger health savings policies and some revenue-raisers as well. Some of the options we included may be more controversial but have seen support in at least a few of the major plans out there.

While there is indeed substantial overlap on various deficit reduction measures, many of these options are being harvested as offsets in various extension bills -- for example, the payroll tax cut extension or the recently-passed transportation/student loan bill. If more and more of these type of temporary extension bills are passed instead of a larger package that seeks to put debt on a downward path, these policies will dwindle in number. Second, while these policies can help bring down future deficits and debt, they cannot tackle the debt sufficiently to put it on a downward path. For that, lawmakers will have to look at a full range of health care, Social Security, and tax reforms that do not have consensus yet.

Still, with regards to steps beyond reining in discretionary spending, the low-hanging fruit are a good starting point to build off of, and they will certainly be important in any budget deal. But the true success of a deficit reduction plan will hinge on the more contentious areas of debate.