Interest Rates Drive Changes in CBO's Latest Outlook

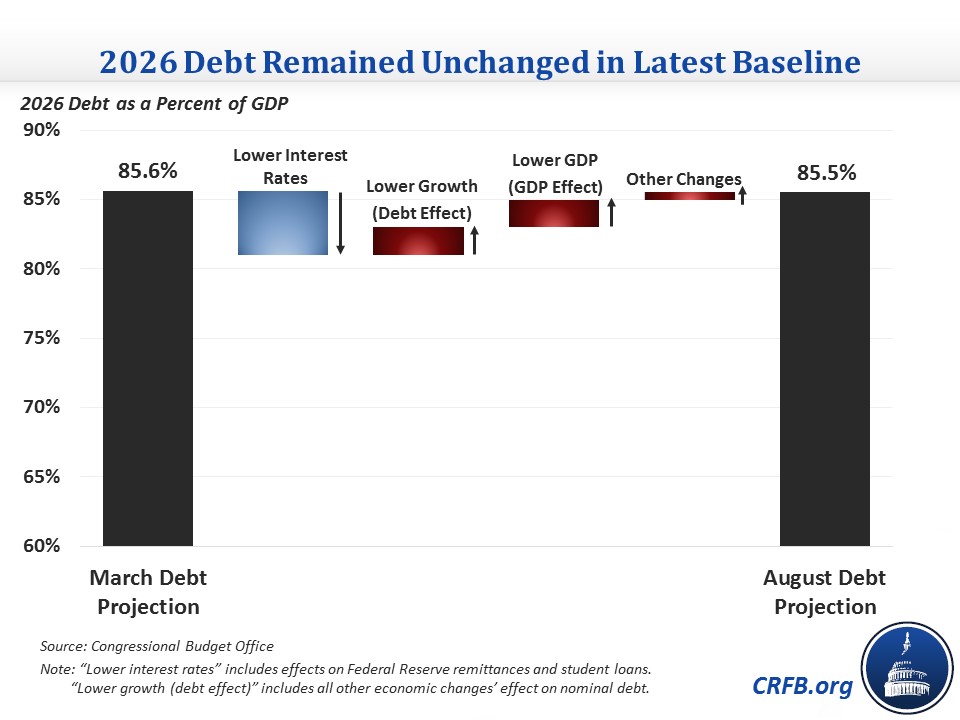

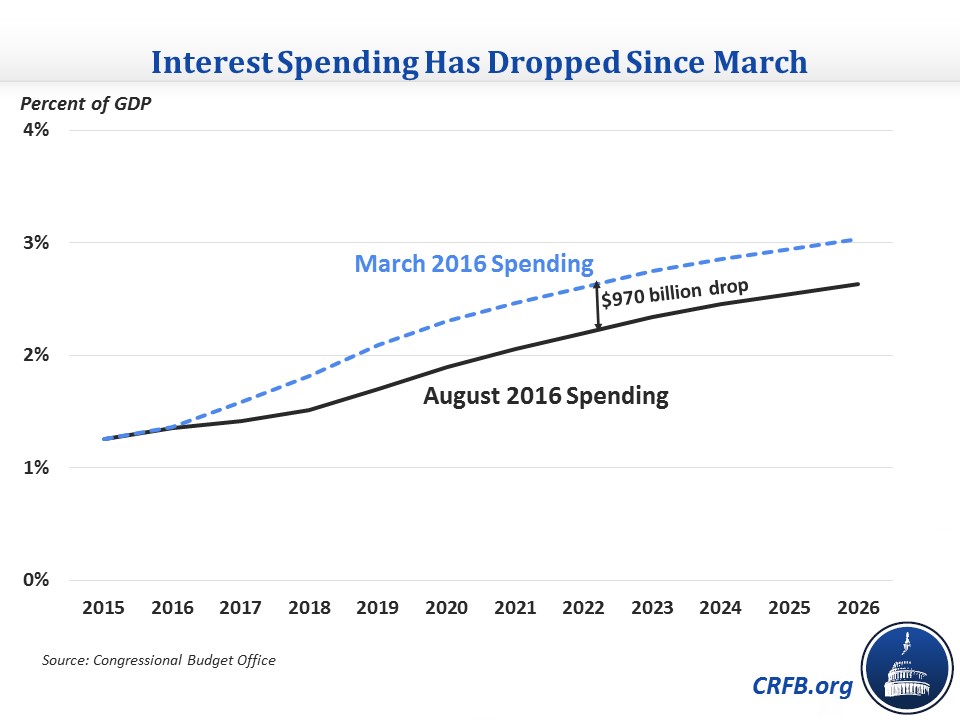

By far the biggest revision to the Congressional Budget Office's (CBO's) latest ten-year budget projections are the lower projected interest rates. Downward revisions to rates resulted in $910 billion less interest spending through 2026 since CBO's last economic forecast in January. In addition, the lower rates will reduce federal costs for student loan programs by $32 billion, lower debt service by an additional $165 billion, and boost remittances from the Federal Reserve by $155 billion by reducing the amount of interest the Fed has to pay on bank reserves. This $1.3 trillion change might have been enough to reduce the debt-to-GDP ratio from 85.6 percent of GDP in 2026 to 81 percent, but slower economic growth will cause debt to grow even higher, completely offsetting this savings.

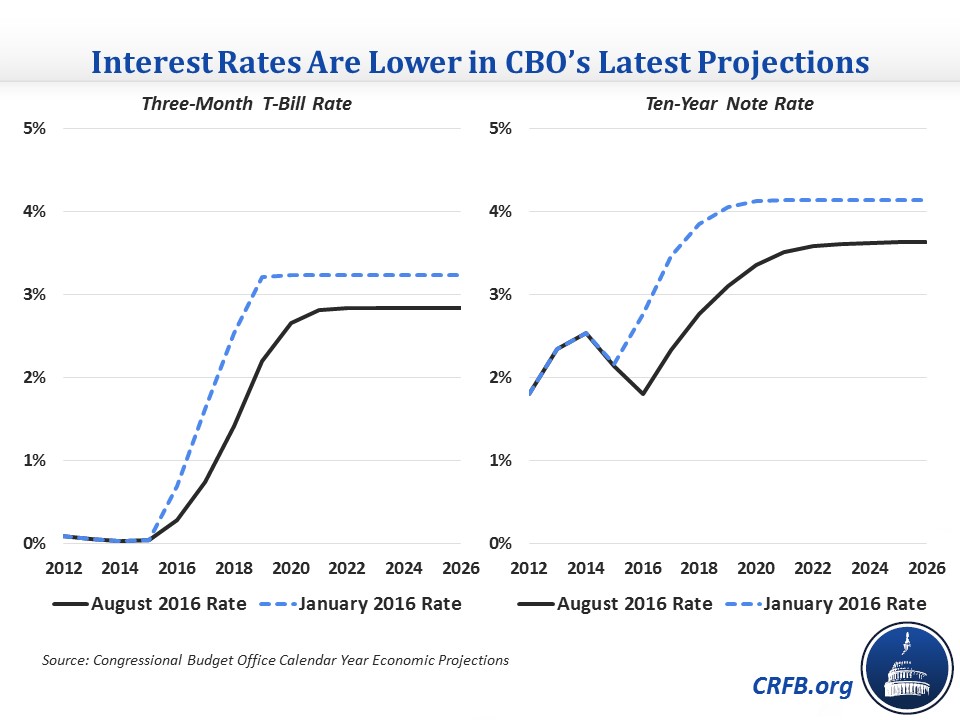

CBO's interest rate forecasts in recent years have expected interest rates to gradually rise from their low levels back to a higher steady state in the long run. However, between January and August CBO revised down interest rates in every year of the budget window, reducing both the path of the rate increases and the projected rates themselves. The three-month and ten-year Treasury security rates for calendar year 2016 are now expected to be 0.3 and 1.8 percent, respectively, down from 0.7 and 2.8 percent in January's forecast, partially as a result of the Fed not increasing the federal funds rate this year as anticipated. Interest rates are also lower by about 1 percentage point in 2017-2019, then will settle into three-month and ten-year rates of 2.8 and 3.6 percent, respectively, in 2022 and beyond, below the 3.2 and 4.1 percent rates CBO had in January. CBO attributes the reduction in longer-term interest rates to a higher risk premium that makes Treasury securities more attractive, and slower economic growth abroad resulting in more foreign investment in Treasuries.

These interest rate changes result in $1.04 trillion less in interest spending over the 2016-2026 period, partially offset by other changes so that interest spending is now nearly $970 billion lower than it was previously. Interest is now projected to average 2.1 percent of GDP over that time instead of 2.4 percent and will be 2.6 percent in 2026 instead of 3 percent. Still, interest spending is projected to nearly double as a percent of GDP between 2016 and 2026 from 1.4 percent to 2.6 percent and nearly triple in dollar terms from $248 billion in 2016 to $712 billion in 2026 even with the less steep interest rate increase now built in.

The revisions to interest rates are good news for the budget in the sense that less of the budget will be tied up paying interest on the debt. But since the lower interest rates were entirely offset by slower economic growth projections, the debt picture remains unchanged and needs to be dealt with.