How Alternative Policies Could Push Debt Higher

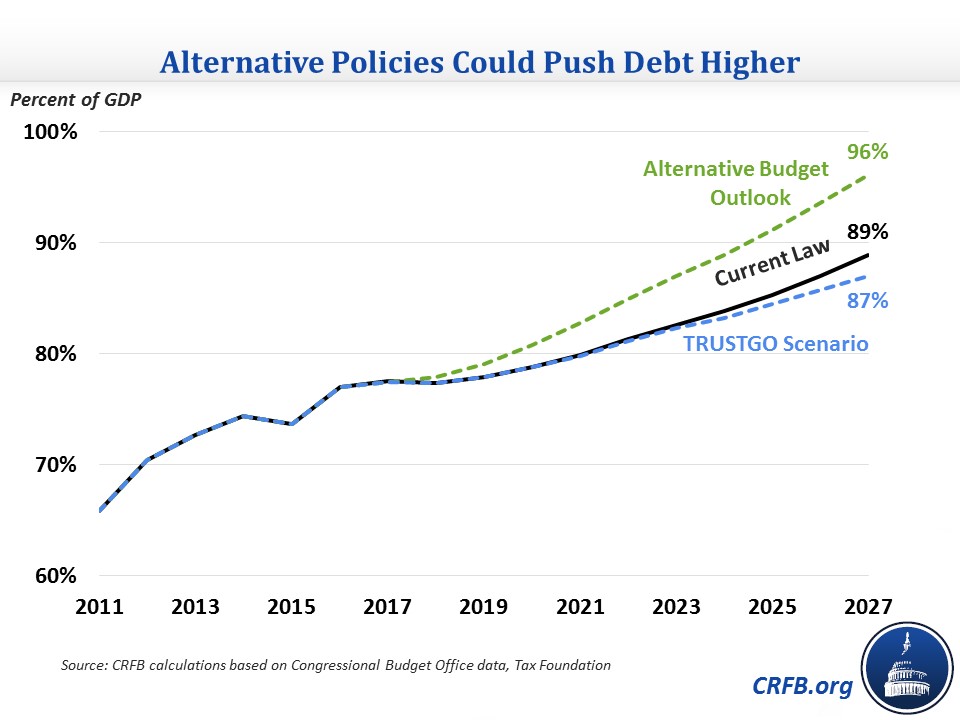

The Congressional Budget Office's (CBO) Budget and Economic Outlook shows debt rising from its current level of 77 percent of Gross Domestic Product (GDP) to 89 percent by 2027, the highest level since 1947 and fourth-highest in history. But CBO's projections could get more pessimistic depending on the policies that lawmakers adhere to.

CBO's default budget projection is "current law," which means that lawmakers don't pass any further laws to affect the budget other than ones that keep the federal government functioning as is. This means that temporary tax or spending provisions are generally assumed to expire unless they are made permanent. Lawmakers can and have deviated from this path in the past, so CBO provides alternative policy options that allow us to construct an "Alternative Budget Outlook" that assumes some of these provisions are made permanent. Our scenario assumes:

- The sequester on appropriated spending and certain mandatory programs is repealed permanently starting in 2018.

- All tax breaks that either expired at the end of 2016 or will expire over the next ten years are extended permanently (many of these provisions were extended through 2016 or 2019 in the 2015 tax cut).

- Bonus depreciation, which allows businesses to deduct 50 percent of the cost of investments in the year they are made, is extended permanently. It is currently scheduled to phase down to 30 percent by 2019 and expire after that.

- Three taxes in the Affordable Care Act (ACA) – the medical device tax, Cadillac tax, and health insurer tax – that were delayed in the 2015 tax cut are repealed permanently.

Budgetary Effect of Policies in the Alternative Scenario

| Policy | 2018-2027 Deficit Effect |

|---|---|

| Current Law Deficits | $9.426 trillion |

| Repeal Sequester | $989 billion |

| Extend Temporary Tax Breaks | $199 billion |

| Extend 50% Bonus Depreciation | $247 billion |

| Extend ACA Tax Delays | $311 billion |

| Interest | $259 billion |

| Alternative Budget Outlook Deficits | $11.431 trillion |

Source: Congressional Budget Office, CRFB calculations

These policies would increase debt by an additional $2 trillion through 2027, which would result in debt of 96 percent of GDP in that year instead of the 89 percent in CBO's current law projection. The 96 percent number would be the third-highest in history after 1945 and 1946. By contrast, policymakers could improve the budget outlook by making the Highway, Social Security Disability Insurance, and Medicare Hospital Insurance trust funds solvent (a "TRUSTGO Scenario"), which would result in debt of 87 percent in 2027 (and would about stabilize debt over the long term).

Of course, the policies in our Alternative Budget Outlook are only some possibilities for deficit-increasing legislation. Many of the priorities being discussed currently – ACA "repeal and replace", tax reform, and infrastructure for example – have the potential to increase deficits by varying amounts as well.

CBO's debt projection is concerning enough that it should spur lawmakers to action, but at the very least, it should be a reminder that digging the debt hole even deeper is not acceptable. They must ensure that new legislation does not add to an already adverse fiscal situation.