Governor Bush Releases Tax Reform Plan

Presidential candidate Governor Jeb Bush (R-FL) announced his tax reform plan to trim deductions and lower tax rates yesterday. It is one part of his self-described plan to raise economic growth to 4 percent per year. The "Reform and Growth Act of 2017" cuts taxes for both individuals and corporations, lowering tax rates while reducing or eliminating some deductions. According to four different estimates, the plan would reduce taxes on net and would increase deficits over a decade by between $1.2 and $7.1 trillion, depending how it is estimated.

Individual Income Tax Reform

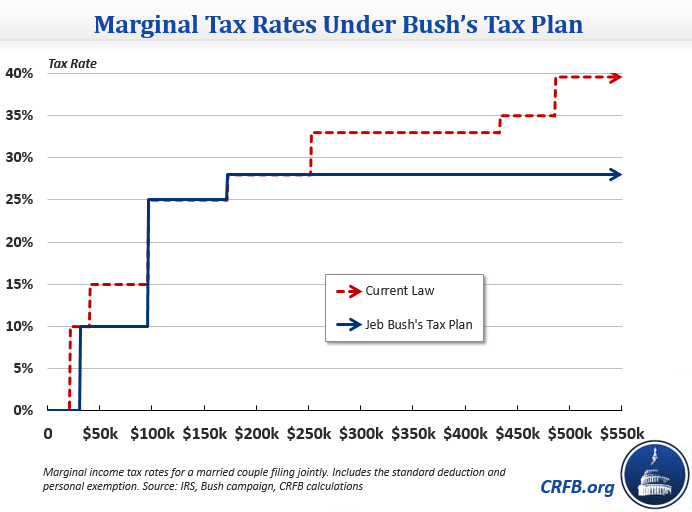

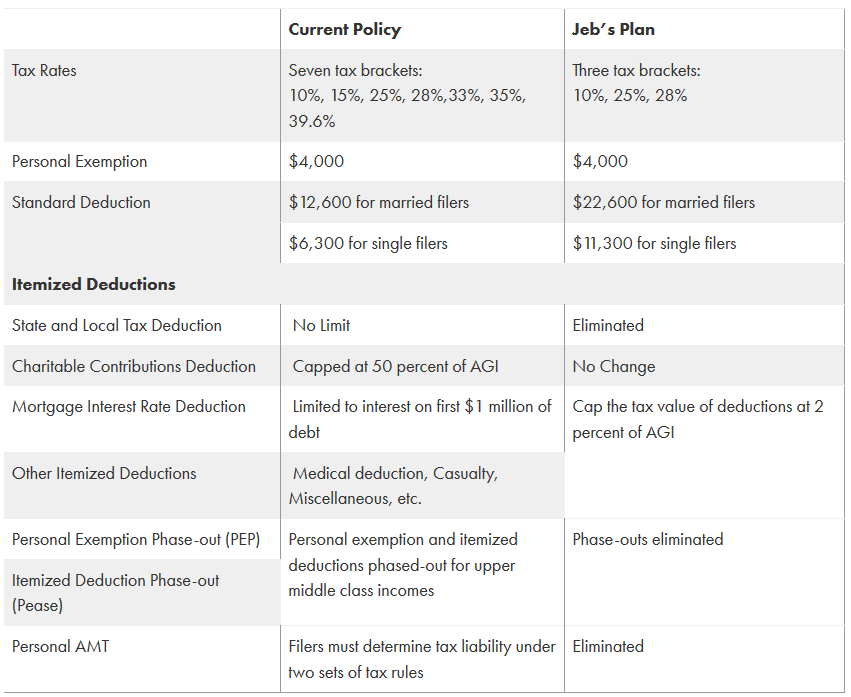

On the individual (and "pass-through" business) tax side, Gov. Bush's plan would reduce the number of tax brackets from seven rates between 10 percent and 39.6 percent to three rates of 10 percent, 25 percent, and 28 percent.

In addition to the lower rates, the plan has several other tax cuts, including:

- Repeal of the Alternative Minimum Tax (AMT)

- Near doubling of the standard deduction

- An increase in the Earned Income Tax Credit (EITC)

- A reduction in the top capital gains and dividends rates from 23.8 to 20 percent (interest would also be taxed at 20 percent, instead of as ordinary income)

- Repeal of two provisions that limit tax benefits for high earners – the Personal Exemption Phase-out (PEP) and the Pease limitation on itemized deductions

To partially offset these tax cuts, the plan eliminates the state and local tax deduction and caps the value of other itemized deductions – other than the charitable deduction – to 2 percent of income. This is quite similar to a proposal by CRFB president Maya MacGuineas to limit the value of a broad swath of tax breaks to 2 percent of income. Gov. Bush's plan would also close the "carried interest" loophole which currently allow some hedge fund managers to pay capital gains taxes on their income; CRFB put forward a similar proposal in our PREP Plan last year.

Corporate Income Tax Reform

On the corporate side, the plan would cut the top corporate rate from 35 percent to 20 percent. It would also eliminate the current system of depreciation, moving to "full expensing," where businesses can write off the entire cost of a purchase in the first year. The proposal would also shift to a "territorial" system of taxation, where American companies would be largely exempt from taxation of overseas earnings when the earnings are brought back to the U.S. Finally, the plan would make permanent the Research and Experimentation tax credit.

To help finance these costs, the proposal calls for several changes. First, it would repeal most remaining corporate tax expenditures not made irrelevant by the international or expensing changes. According to our corporate tax calculator, repealing these tax breaks is sufficient to finance a 3 to 4 point rate cut (without counting the depreciation or territorial changes, which cost revenue and make the size of the potential rate cut smaller). Next, it would fully repeal the current deduction for interest expenses. Although this deduction is a Non-Tax Expenditure Base Provision, eliminating it can complement a move to full expensing and reduce incentives for companies to borrow. Finally, during the transition to a territorial system, the plan would include a one-time deemed repatriation tax of "up to 8.75 percent" on these companies' existing overseas earnings, similar to a change proposed in the Tax Reform Act of 2014.

Other Tax Changes

The plan would also change some non-income taxes. It would completely repeal the estate tax and eliminate step-up basis. It also eliminate employee payroll taxes for workers over 67 – a proposal similar to one put forward by Governor Christie.

Revenue Impact

Shortly after the release of Gov. Bush's tax plan, noted economists John Cogan, Martin Feldstein, Glenn Hubbard, and Kevin Warsh released an economic and revenue analysis of the plan. On the economic side, they estimate that the proposed tax reform would increase the size of the economy by at least 5 percent after a decade, and 8 percent when combined with yet-to-be-specified regulatory reforms. Importantly, these estimates are higher than all or nearly all Treasury and JCT estimates of tax reform plans.

On the fiscal side, they estimate the plan would reduce tax revenue by about $3.4 trillion over ten years under conventional scoring that assumes no additional effects from economic growth. Including the estimated growth impact of tax reform, the plan would cost nearly $2.1 trillion over ten years; adding growth from regulatory reform, the plan would cost $1.2 trillion.

The Tax Foundation also produced estimates, that showed a greater revenue loss without accounting for economic changes of $3.7 trillion. However, they predict twice as much economic growth – 10 percent over a decade – meaning that the revenue loss after 10 years would only be $1.6 trillion.

Further, Citizens for Tax Justice estimated that this plan would cost $7.1 trillion over ten years on a static basis. CTJ's model excluded the offset for carried interest and the tax breaks that allow separate filing for second earners and payroll tax cuts for seniors over 67.

Finally, the Tax Policy Center estimated this proposal would cost $6.8 trillion over ten years on a static basis. Tax Policy Center did not analyze the potential dynamic effects of this plan.

| Economic and Revenue Analysis of Gov. Bush's "Reform and Growth Act of 2017" | ||||

| Cogan, Feldstein, Hubbard, Warsh | Tax Foundation | Citizens for Tax Justice | Tax Policy Center | |

| Revenue Impact | Ten-Year Cost | |||

| Conventional Score (no economic growth) | $3.4 trillion | $3.7 trillion | $7.1 trillion | $6.8 trillion |

| Dynamic Score | $2.1 trillion | $1.6 trillion | N/A | N/A |

| Dynamic Score including regulatory reforms | $1.2 trillion | N/A | N/A | N/A |

| Economic Growth from Tax Reform Alone | ||||

| Increase in GDP by the 10th Year | 5% | 10% | N/A | N/A |

| Average Increase in GDP over the next 10 years | 2.6% | 5% | N/A | N/A |

Sources: Cogan et al., Tax Foundation, Citizens for Tax Justice, Tax Policy Center, CRFB calculations

The plan could consider many changes to mitigate the increased deficits. For instance, the 2% limit on tax expenditures would raise more revenue if it also applied to the largest tax break – the exclusion of employer-provided health insurance – as the version proposed by MacGuineas did.

Conclusion

It’s encouraging to see a prominent candidate for President putting forward specifics and endorsing tax reform. The framework Gov. Bush put forward would help meet the goals of promoting economic growth and prosperity, encouraging work and investment, increasing simplicity, and improving international competitiveness.

However, the plan would also add significantly to the debt when debt it is near record highs. And although the supplementary economic analysis implies that spending cut details will be forthcoming, giving tax cuts the "first claim" on budgetary savings will make it less likely that spending reductions will be sufficient to put the debt on a clear downward path.

Given the severity of the long-term fiscal situation, the United States will likely require a mixture of spending cuts, entitlement reforms, and revenue increases – not tax cuts. At minimum, we hope that any tax cut plan will be fully paid for. We look forward to seeing the campaign's proposed spending cuts in the hope they will be enough to pay for these tax cuts and more.

Update: This blog was updated to incorporate the Tax Foundation's estimate of the plan, which was released the morning of September 10. This blog was updated again to incorporate Citizens for Tax Justice's estimate, which was published on October 28.