Good News But Also Warning Signs in the Medicaid Actuaries' Report

The Chief Actuary for the Center for Medicare and Medicaid Services (CMS) recently released the 2014 Medicaid Actuarial Report forecasting Medicaid enrollment and spending for the next ten years. The report contains some good news, showing lower spending projections than last year's, but also some signs that the program may increasingly strain federal and state budgets in the coming years.

Medicaid spending is projected to grow on average by 6.2 percent per year over the next ten years, increasing total spending from $499 billion in 2014 to $835 billion by 2023. This growth rate is somewhat faster than GDP growth, thereby increasing spending as a share of GDP from 2.9 percent in 2014 to 3.1 percent in 2023. Enrollment is projected to grow by about 2 percent per year, meaning that per-person costs will rise by about 4 percent per year, roughly in line with the actuaries' projections of GDP per capita growth. Enrollment growth is concentrated more in the early years of the projection window as the Medicaid expansion covers more and more people.

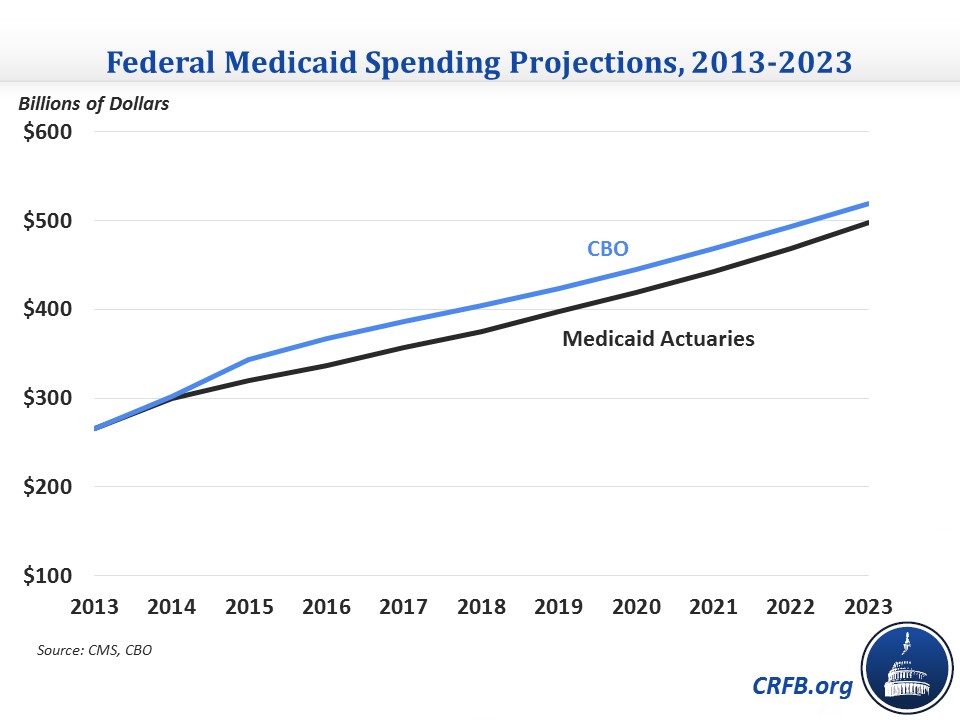

The federal government will account for 60 percent of this spending each year, up from the historical share of about 57 percent that prevailed prior to the Affordable Care Act (ACA). Federal Medicaid spending is projected to grow from $300 billion in 2014 to $497 billion by 2023. The $3.9 trillion of total spending projected over the 2014-2023 period is $237 billion less than the Congressional Budget Office (CBO) expects for the same time period.

This year's projection for total Medicaid spending is also $341 billion lower than last year's actuarial report over the 2013-2022 period, a difference of more than 5 percent, and in 2022 alone, spending is $67 billion, or 8 percent, lower. The Chief Actuary attributes the difference to several factors, including lower per-person spending than expected in 2014, the incorporation of slower utilization growth assumptions, and lower enrollment due to the incorporation of more recent data and an assumption that fewer states will adopt the ACA's Medicaid expansion. The decreases are partially offset by increased spending for those covered by the Medicaid expansion (more on that below).

Beneath the totals, there are some interesting trends and observations that can be gleaned from the Medicaid report.

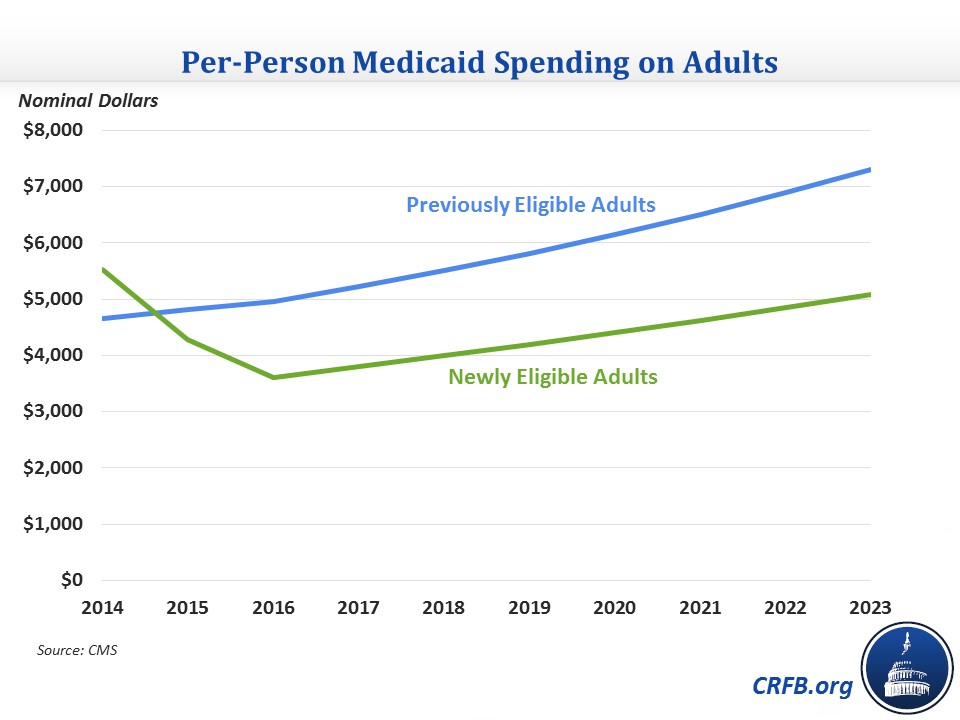

- Medicaid expansion costs: In what is perhaps the most headline-grabbing part of the report, the Medicaid actuaries estimate that per-person costs for those newly covered by Medicaid as a result of the ACA's expansion were significantly higher than they previously thought. In 2014, per-person expansion spending was 19 percent higher than for previously-eligible adults in contrast to the expectation that expansion spending would be 1 percent lower. The report explains that payments to managed care plans ended up being higher than expected, reflecting states anticipating the newly insured to be more costly in the first year and use more services. The actuaries note that the 2014 data is preliminary and is still subject to change as risk-sharing arrangements may result in plans paying back states and the federal government, so they do not assume a lasting impact other than adjusting upward their projection for 2015 spending. As it stands, the actuaries expect per-capita spending on the expansion population to fall by one-third by 2016 as these adjustments are made and relatively healthier people gain coverage under the Medicaid expansion. Given the uncertainty surrounding the early data, though, it is certainly a development worth keeping an eye on.

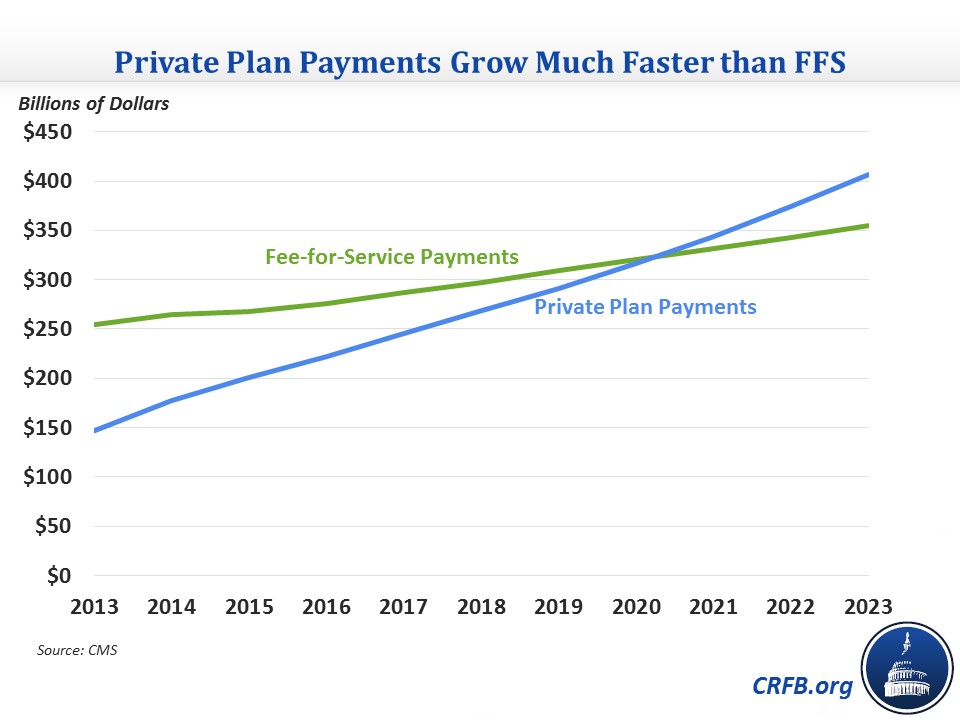

- Moving away from fee-for-service (FFS): One trend that is very clear in the data is a rise in the role of private health plans in Medicaid. Medicaid has increasingly used managed care plans to control costs, and some states that have expanded Medicaid have used funds to pay premiums for beneficiaries above the poverty line to purchase private insurance on the health exchanges. Currently, of the three main categories for benefits (acute care FFS, long-term care FFS, and private payments), private payments are currently the largest but only slightly larger than each of the other two categories. Over the next ten years, private payments are expected to more than double, while FFS payments will only grow by about one-third. As a result, the majority of payments will be through managed care or to health exchange plans by 2021, and that share will continue to grow through 2023.

- Pick-up in per-person spending growth: After 2014, the first year the Medicaid expansion took effect, total Medicaid annual spending growth is relatively stable at 6 percent for the rest of the projection period. However, the composition of this growth changes over time. Through 2016, per-person spending is expected to remain relatively flat at around $6,900 while enrollment grows quickly as the Medicaid expansion takes greater effect. After that, though, enrollment growth will fall back down to more normal levels and per-person spending growth will rise to around 5 percent per year, in excess of GDP per capita growth. This bounce-back in excess cost growth is consistent with that projected for other health care spending by the Medicare trustees, CMS, and CBO, and shows the importance of being aggressive on cost control rather than rolling back progress.

Overall, the actuaries show an improved outlook for Medicaid, but also one characterized by high uncertainty surrounding developments with the coverage expansion and per-person spending growth soon picking back up.