GAO Finds Low Effective Corporate Tax Rates

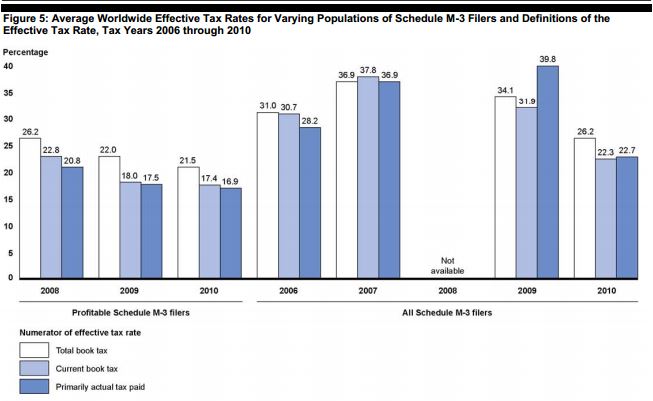

As the tax reform debate begins to heat up again, a new report released by the General Accountability Office (GAO) contributes some telling information regarding our outdated and inefficient corporate tax code. For tax year 2010, profitable corporations that filed a Schedule M-3 (those that have assets greater than $10 million) paid 12.6 percent of their reported worldwide income in U.S. federal income taxes. Including unprofitable corporations, the effective rate is 22.7 percent, but both pale in comparison to the top statutory marginal rate of 39 percent including state and local corporate taxes (35 percent is the statutory federal rate). Statutory rates differ from effective rates in that they only represent the rate that taxpayers pay on their taxable income (before credits) while effective rates incorporate the effects of deductions and credits.

While the U.S. possesses the highest marginal corporate tax rate among fellow OECD countries, the corporate code contains many tax expenditures so that the actual tax rate paid is much lower. These tax provisions are costly and cause business decisions to be made according to what will minimize tax burdens rather than what will maximize profits. This is the reasoning behind eliminating many or all of the corporate tax loopholes and exemptions, which would allow the overall rates to be lowered while still raising sufficient revenues.

Source: GAO

Granted, the recession may have put some damper on recent years' effective rates. Lawmakers have enacted some temporary tax breaks like bonus depreciation for certain investments which reduce effective rates upfront (although bonus depreciation has continued to be extended). In addition, even profitable corporations may have losses carried over from previous years which would reduce their effective rates. Still, 2006 effective rates are not all that much higher than 2010 rates.

The conclusion drawn from this GAO report therefore should lend support to the fact that our current tax code is woefully inadequate for the reasons mentioned above. With the elimination of the many economically distorting provisions which exist, it will open up the opportunity to lower statutory rates. Thus, the blank slate approach proposed by Senators Max Baucus (D-MT) and Orrin Hatch (R-UT) is a much welcomed sign. By starting from a blank slate, lawmakers will have to make their case as to the benefit of certain tax provisions and why they should be kept in the code.

Click here for the full report.

Click here to access our Corporate Tax Reform Calculator to reform the corporate tax code yourself.