Fix the Debt Paper on Camp's Tax Reform Proposal

Yesterday, House Ways & Means Chairman Dave Camp released a tax reform discussion draft, and we commended him for the level of detail and consideration provided. We'll continue to cover the interesting aspects of the draft throughout the week.

Our partners at Fix the Debt yesterday released an overview of the Tax Reform Act of 2014 in which they provided summary information of the Camp proposal's many provisions, budgetary impacts, and revenue effcts.

Overview of the Draft

Individual Tax Reform:

- Replaces seven brackets from 10% to 39.6% with three brackets of 10%, 25%, and 35%; phases out the 10% bracket for higher earners.

- Repeals the Alternative Minimum Tax and Pease provisions.

- Taxes capital gains and dividends as ordinary income with a 40% exclusion (effective rates of 6%, 15%, and 21%); leaves 3.8% ACA surtax in place.

- Eliminates state and local tax deduction, limits mortgage interest deduction to $500,000 of loans, puts 2% of AGI floor on charitable deduction.

- Limits value of various tax preferences (including mortgage interest deduction, employer health exclusion, retirement contributions, and municipal bond interest exclusion) to 25% bracket.

- Repeals personal exemptions but expands standard deduction and child tax credit; phases out these provisions at higher income levels.

- Indexes elements of the tax code to the more accurate chained CPI.

- Reforms and makes permanent higher education tax credits.

- Limits tax-deferred 401(k) contributions to half current level w/ Roth-style contributions allowed up to current limits.

- Reduces or repeals various other tax expenditures and loopholes.

Business Tax Reform:

- Reduces corporate tax rates from top rate of 35% to a flat 25%.

- Lengthens depreciation schedules to approximate economic depreciation.

- Requires companies to amortize research and development and certain advertising expenses rather than expensing them in first year.

- Phases out domestic production activities deduction.

- Moves to a territorial tax system with base erosion protections and a one-time deemed repatriation tax.

- Reduces or repeals various other tax expenditures and loopholes.

Other Changes:

- Imposes a .035% tax on large financial institutions.

- Repeals medical device tax.

Impact of Reforms:

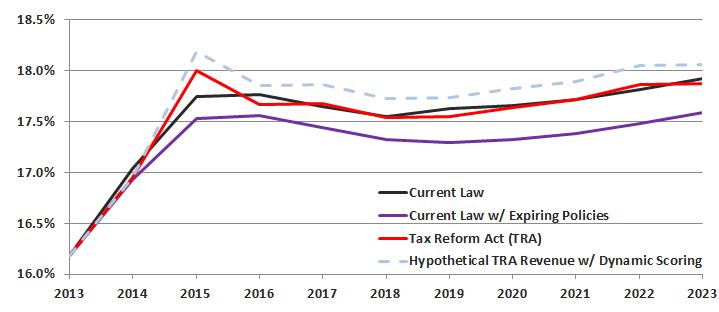

- Roughly revenue neutral over ten years but adds to the deficit in 2023, and would likely do so over the long run under conventional scoring.

- Roughly maintains distribution of the tax code over ten years.

- Reduces taxpayers needing to itemize from one-third to 5%.

- Increases the size of real GDP by between 0.1% to 1.6% by 2023, according to JCT, largely driven by increases in labor supply and consumption.

- With macroeconomic feedback (or “dynamic”) effects, would raise an additional $50 billion to $700 billion in revenues over ten years.

Messaging Points on the Draft

Top Line Messaging:

- Importantly, Chairman Camp’s draft would move the ball forward on comprehensive tax reform.

- The draft recognizes the tough choices and trade-offs involved in tax reform, and Chairman Camp shows true leadership in taking on the special interests in favor of a better tax code.

- Tax reform is vital to long-term fiscal and economic sustainability.

- Tax reform should: reduce and reform tax preferences, lower rates, improve simplicity, promote competitiveness, protect the most vulnerable, encourage economic growth, and contribute to medium and long-term deficit reduction.

- Chairman Wyden, President Obama, and other lawmakers and stakeholders should engage with Chairman Camp and work toward comprehensive tax reform.

What We Like:

- The draft is an important step in moving the tax reform process forward, representing the first comprehensive proposal from a tax-writing committee in a number of years.

- The draft significantly reduces the number and size of credits, deductions, and other tax preferences in the current code.

- The draft would promote growth and increase the size of the economy by 0.1 to 1.6 percent.

- The draft finds permanent solutions to expiring tax provisions without adding to the deficit, meaning it generates $560 billion more in revenues than if lawmakers were to continue various tax extenders and refundable credit expansions without offsets.

- Chairman Camp dedicates dynamic revenue gains to deficit reduction rather than using uncertain revenues for further rate reduction before the growth has actually occurred.

- The draft incorporates the chained CPI, a more accurate measure of inflation – a promising sign of support for measures than can save significant sums from across the federal budget.

Our Concerns:

- Tax reform should help to reduce deficits in order to slow the growth of our ever-rising national debt. This draft uses all of the revenue from base broadening to provide rate reduction, and none to improve our overall budgetary situation.

- The discussion draft generates some revenue from timing shifts and temporary revenue provisions to offset permanent rate reductions; given this, we are concerned the draft would add to the deficit over the long-term.

- The draft dedicates about $125 billion to the highway trust fund, removing the need to close that fund’s financial gap without providing any net new resources. Effectively, the same money is used twice to shore up the highway trust fund and achieve deficit-neutrality.

Summary Charts

Summary of Tax Reform Act of 2014

| Area | Current Law | Tax Reform Act of 2014 |

| Individual Income Tax | ||

| Tax Rates | 10% | 15% | 25% | 28% |33% | 35% | 39.6% | 10% | 25% | 35% (10% rate phases out at high incomes) |

| Standard Deduction | $6.2k/$12.4k | $11k/$22k (phases out at high income) |

| Personal Exemptions | $3,900, phased out at higher incomes | Eliminated |

| AMT | Alternative tax w/ 26% and 28% rates | Eliminated |

| Child Tax Credit | $1,000/child not indexed for inflation - phased out at higher incomes; more refundable through 2017 | Credit increased to $1,500 and indexed for inflation, refundability rate increased; phased out at higher incomes |

| Earned Income Tax Credit | $500-$6,000 credit, phased out at higher incomes; higher for families with 3 children through 2017 | Reduced credit rates to $100-$4,000, phase-outs begin at higher income levels; marriage penalties lessened |

| Mortgage Interest Deduction | Available to itemizers for up to $1 million of debt | Available to itemizers up to $500,000 of debt; value limited to 25% bracket |

| Charitable Deduction | Available to all itemizers | Subject to 2% of AGI floor |

| Health Insurance Exclusion | Available w/ 40% tax on high-cost plans | Value limited to 25% bracket |

| State & Local Tax Deduction | Available to all itemizers | Eliminated |

| Municipal Bond Exclusion | Available for public and private bonds | Value limited to 25% bracket; exclusion eliminated for certain private activity bonds |

| 401(k) Retirement Accounts | Up to $17,500 of employee contributions on a tax-deferred or Roth-style basis | Contributions above $8,750 allowed only in Roth-style accounts |

| Capital Gains and Dividends | Taxed at 0%, 15%, 20% with 3.8% surtax for income above $250K | Taxed as ordinary income w/ 40% exclusion (effective rates of 6%, 15%, and 21%); 3.8% surtax retained |

| College Tax Credit | $2,500 American Opportunity Tax Credit through 2017 ($1,000 is refundable); additional tax benefits available | AOTC extended permanently, refundability increased to $1,500, income eligibility range reduced; other benefits eliminated |

| Other Tax Provisions | Various credits, deductions, exclusions, and other preferences available | Dozens of preferences repealed or reformed. Numerous loopholes closed. |

| Corporate Income Tax | ||

| Rates | Top Rate of 35% | Flat Rate of 25% |

| Accelerated Depreciation | Accelerated Depreciation (MACRS) | Economic depreciation, basis adjusted to account for inflation |

| Advertising Deduction | Costs fully expensed | Half of costs amortized over 10 years |

| Domestic Production Deduction | 9% of income deduction generally available | Deduction phased out by 2017 |

| Research & Experimentation | Costs fully expensed | Costs amortized over 5 years |

| Inventory Accounting | Last-in-First-Out Accounting allowed | Last-in-First-Out Accounting phased out |

| R&E Credits | 4 credits, all expired in 2013 | Alternative simplified credit reformed and permanently extended, others repealed |

| International Tax | Worldwide w/ deferral | Territorial w/ base erosion protections and one-time transition tax |

| Other Tax Provisions | Various credits, deductions, exclusions, and other preferences available | Dozens of preferences repealed or reformed. |

| Excise Taxes | ||

| Medical Device Tax | 2.3% tax on sale of certain medical devices | Tax repealed |

| Bank Tax | N/A | .035% quarterly tax on assets over $500 billion |

Source: JCT

| Provision | 2014-2018 | 2014-2023 |

| Individual Reforms | ||

| Reduce rates to 10%, 25%, and 35%, limit certain tax preferences to 25% bracket, phase out 10% rate, and index brackets to chained CPI | -$232 billion | -$544 billion |

| Tax Capital Gains/Dividends with 40% Exclusion | $15 billion | $45 billion |

| Consolidate, reform, and extend personal exemptions, standard deduction, CTC, and EITC | $18 billion | -$16 billion |

| Modify various itemized deductions | $309 billion | $858 billion |

| Require 401(k) contributions above half of current limit be placed in Roth-style accounts | $56 billion | $144 billion |

| Reform education tax preferences | $27 billion | $19 billion |

| Enact other changes | $76 billion | $237 billion |

| Repeal Alternative Minimum Tax | -$443 billion | -$1,332 billion |

| Subtotal, Individual Reforms* | -$174 billion |

-$589 billion |

| Business Reforms | ||

| Reduce corporate rate to 25% and repeal AMT | -$234 billion | -$791 billion |

| Reform accelerated depreciation schedules | $59 billion | $270 billion |

| Modify net operating loss deduction | $30 billion | $71 billion |

| Amortize R&E and advertising expenses | $152 billion | $362 billion |

| Phase out domestic production deduction | $44 billion | $116 billion |

| Repeal LIFO accounting rules | $6 billion | $79 billion |

| Reform international tax system | $20 billion | $68 billion |

| Enact other changes† | $103 billion | $359 billion |

| Subtotal, Business Reforms* | $180 billion | $533 billion |

| Excise Taxes | ||

| Impose .035% tax on large banks | $30 billion | $86 billion |

| Repeal medical device tax and other changes | -$12 billion | -$28 billion |

| Subtotal, Excise Taxes | $18 billion | $58 billion |

| Total Budgetary Impact | $24 billion | $3 billion |

| Addendum #1: Total impact w/ economic growth | Unknown | $50 to $700 billion |

Source: JCT

* For pass-throughs, the rate reductions are captured in individual reforms while base-broadening is captured in business reforms.

† Other corporate tax changes include revenue from tax-exempt entities and tax administration and compliance.

Net Revenue under Tax Reform Act of 2014

Notes: hypothetical revenue with dynamic scoring assumes $375 billion of additional revenue (the mid-point of JCT’s estimates) distributed from 2015 through 2023. Revenue levels compared to pre-reform GDP. Current law with expiring provisions assumes the extension of the normal tax extenders and expiring refundable tax credits. Net revenue refers to revenue minus refundable credits.