Fed Mortgage-Backed Security Purchases Reached a New Record

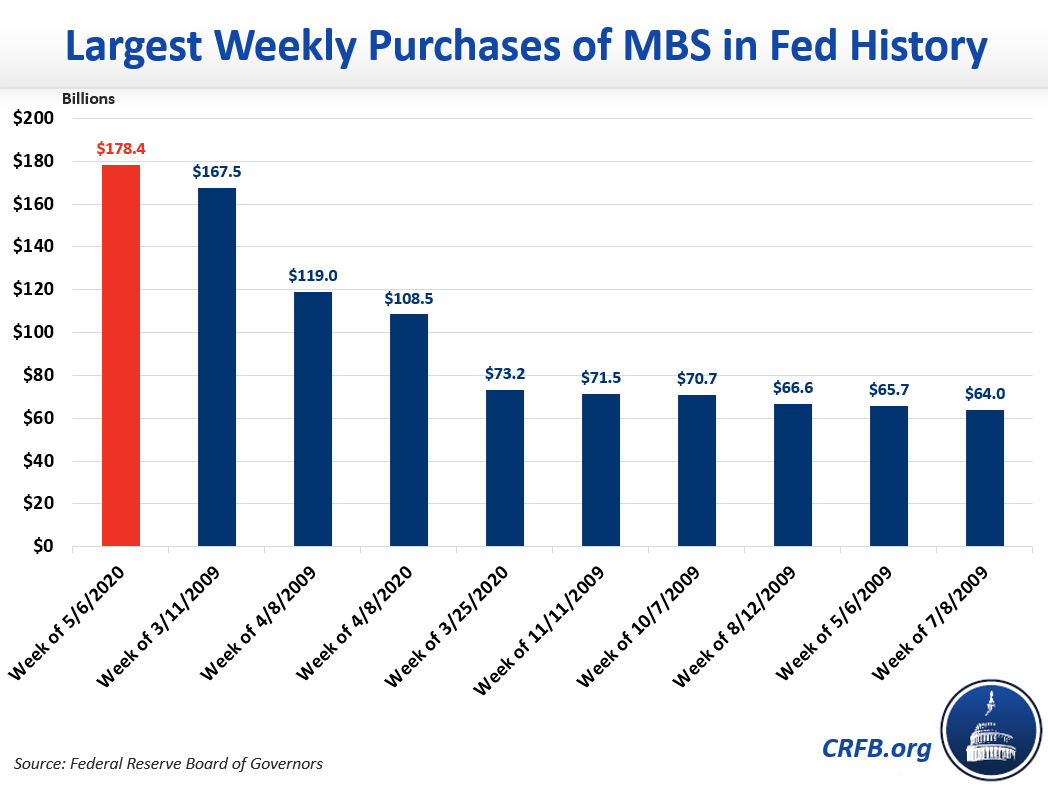

The Federal Reserve purchased nearly $180 billion in Mortgage-Backed Securities (MBS) last week, more than any week in history — including during the housing crisis.

The Federal Reserve first began purchasing MBSs back in 2008 in an effort to stabilize the housing and financial markets. Since then, MBS purchases have also been used as a quantitative easing tool.

According to the latest data, the Fed increased its MBS holdings by more than $178 billion from May 6 to May 13 of this year (Fed weeks end on Wednesdays). That purchase is substantially larger than the prior record in the current crisis of $109 billion, set roughly one month ago. It also easily surpasses the previous all time record of $167.5 billion, set during the week of March 11, 2009, amid the 2008-2010 housing and financial crisis.

This blog post is a product of the COVID Money Tracker, a new initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.

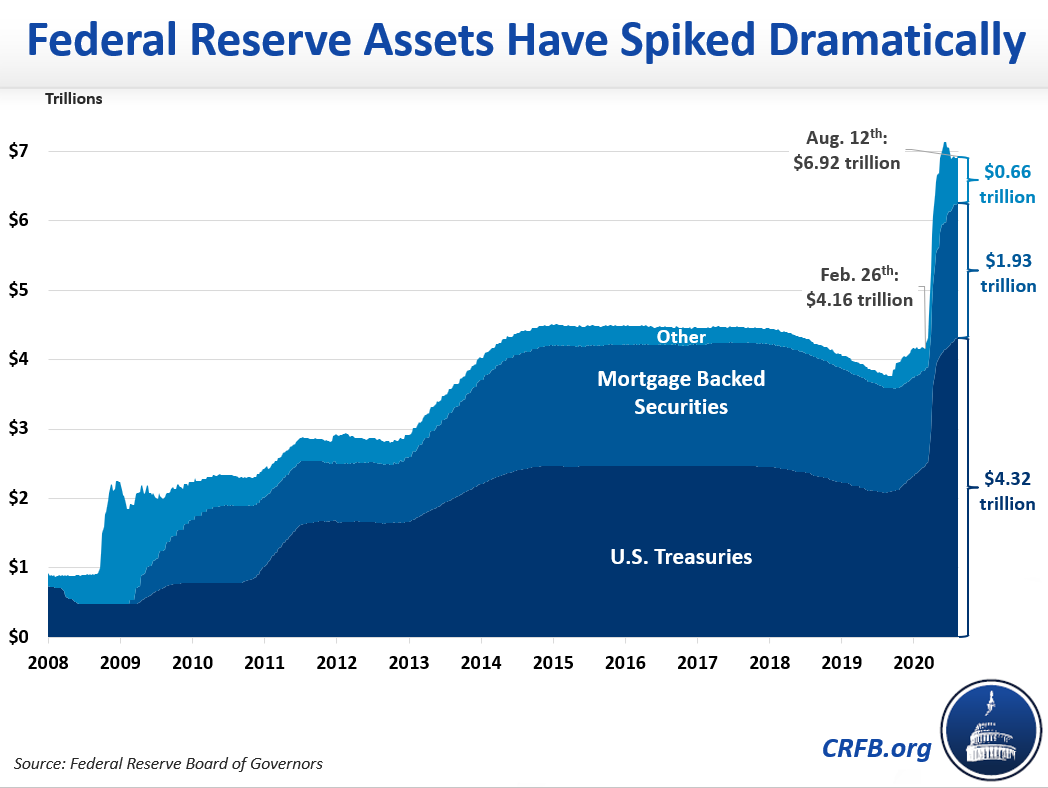

In fact, three of the five largest week-over-week increases in the Fed’s MBS holdings have come since the beginning of April. These large-scale purchases show the challenge the Federal Reserve faces in ensuring liquidity and preserving financial stability given the rapid onset of the current economic crisis related to the novel coronavirus outbreak. Currently, the Federal Reserve owns almost $1.8 trillion in MBS, over $4 Trillion in Treasuries, and over $1 trillion of other assets. We'll continue to track Fed actions at CovidMoneyTracker.org.