Don't Take the Health Exclusion Off the Table

Recently, there has been some discussion of taking the employer-sponsored health exclusion off the table in tax reform. But for those interested in tax reform, health reform, or deficit reduction, doing so would be a mistake.

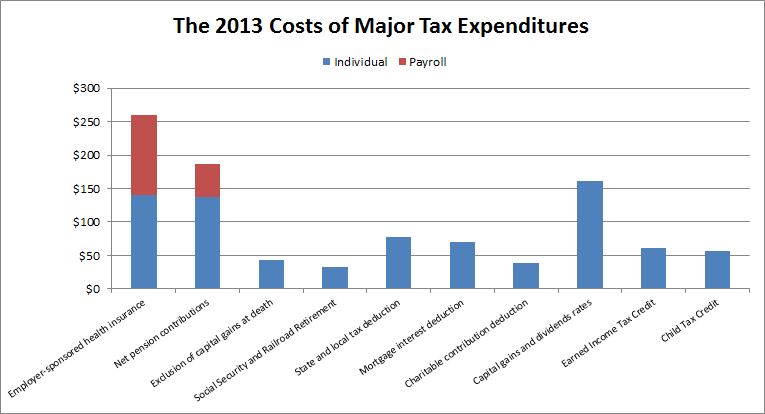

The exclusion of employer-paid health insurance premiums from the income tax is the single largest tax expenditure in the code. CBO estimates it will cost $250 billion in 2013 and $3.4 trillion over ten years. The income tax portion alone will cost $140 billion in 2013 and something in the range of $2 trillion over ten years. Out of $1.3 trillion of individual tax expenditures, this represents more than one tenth of the entire pie -- and a larger percent of the achievable pie when taking into account behavioral effects (for example, in the context of capital gains) or practical concerns (in the case of existing employer pensions). In other words, it would be difficult to get the necessary revenue for reform with the health exclusion off the table.

Source: CBO

The exclusion is important not just for the revenue potential but also for its effect on the health care system overall. In a June 2009 letter to then-Senate Budget Committee chairman Kent Conrad (D-ND), CBO director Doug Elmendorf cited reforming the health exclusion as one of two strategies -- the other being delivery system reforms -- the federal government could undertake to make health care more efficient.

Changes in the tax exclusion for employer-sponsored health insurance can affect the efficiency of health care financed by the private sector, by giving workers stronger incentives to seek lower-cost health insurance plans. Those steps could well have spillover effects on Medicare.

The Affordable Care Act does contain a provision which addresses the tax treatment of employment-based insurance in a roundabout way: it imposes a 40 percent excise tax on high-premium insurance plans starting in 2018. A recent New York Times article has indicated that insurers are already scaling back insurance plans in anticipation of the tax, demonstrating that these incentives do work as intended. However, limiting the exclusion would be a much more direct and transparent way to produce these incentives.

Notably, the question of what to do with the health exclusion, as with other provisions, is not just a case of keeping it or getting rid of it entirely. There are many options that would reform the exclusion to better target its benefits and/or encourage lower-cost plans. The President's budget would cap the value of the exclusion at 28 percent, limiting its value for higher earners. Both the Simpson-Bowles and Domenici-Rivlin plans would cap the exclusion at a certain level of premiums and phase it out. This policy could also be done without the phase-out -- in other words, keeping the cap in place -- or by having a phase-out based on income. The exclusion could also be turned into credit.

Even though these options are short of eliminating the exclusion, they still gain substantial revenue. For example, CBO estimated in December 2008 that replacing the income and payroll tax exclusions with a 25 percent credit would raise $600 billion from 2009-2018. Granted, the estimate would have changed since then due to the health care law, the fiscal cliff deal, the different timeframe evaluated, and the potential repeal or reduction of the 40 percent excise tax in conjunction with these reforms. Still, it is likely significant revenue can be gained from replacement policies.

There are many ways to reform federal health care spending to make it more efficient and slow the overall growth of it. Reforming the health exclusion may be a central element of both tax and health care reform. Taking it off the table would undermine efforts in both of those areas. And it would open the door to taking other treasured preferences off the table. Yet the more we take off the table, the less likely tax reform becomes. Failing to reform the tax code would represent a major lost opportunity.

Note: Blog updated at 7:00 PM on 7/9/2013.