Does Rubio's Tax Plan Both Help the Poor the Most and Help the Rich More Than the Middle Class?

In the third Republican debate, moderator John Harwood and Senator Marco Rubio (R-FL) had a small squabble about the distributional impact of the tax plan Rubio released as a senator along with felllow Senator Mike Lee (R-UT). The dispute centered around an analysis by the Tax Foundation.

They said:

HARWOOD: Senator Rubio, 30 seconds to you.

The Tax Foundation, which was alluded to earlier, scored your tax plan and concluded that you give nearly twice as much of a gain in after-tax income to the top 1 percent as to people in the middle of the income scale.

Since you're the champion of Americans living paycheck-to- paycheck, don't you have that backward?

RUBIO: No, that's -- you're wrong. In fact, the largest after- tax gains is for the people at the lower end of the tax spectrum under my plan. And there's a bunch of things my tax plan does to help them.

(Transcript from the Washington Post)

There's two claims embedded in this argument:

- Harwood claims that the plan gives a much bigger boost to the top 1 percent than the taxpayers in the middle of the income spectrum.

- Rubio claims that the plans gives the biggest boost to people at the lower end of the spectrum.

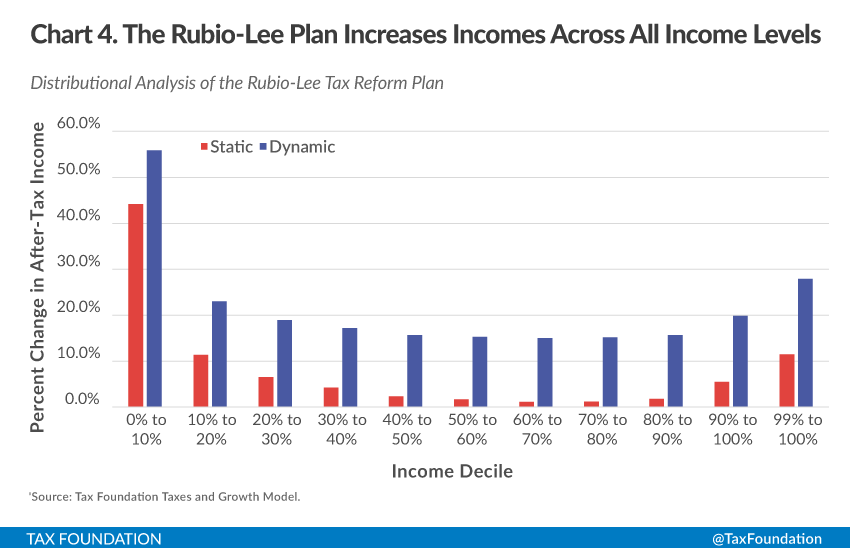

As it turns out, both are right. The poorest get the biggest boost, with after-tax income increases of 44 percent or 56 percent under traditional “static” scoring and under the Tax Foundation’s “dynamic” estimates that include rosy projections for economic growth, respectively. (The dynamic estimates were the ones quoted in the debate).

The top 1 percent also get a much larger boost than folks in the middle, with a percentage boost that's six times larger for the top 1 percent than those between 50 and 60 percent of the income spectrum under static scoring (11.5 percent vs. 1.7 percent). Under dynamic scoring, the gains for the top are a little less than twice as large. (27.9 percent vs. 15.3 percent).

All of these numbers are based on a tax plan that Rubio released as a senator in March. He has recently released a new plan through his presidential campaign with a few modifications. That plan has not yet been analyzed by the Tax Foundation.