A Detailed Look at the Debt Ceiling Situation

Last week, as reported on our "Debt Ceiling Watch" blog, the U.S. reached the statutory debt limit, and the Treasury Department began using extraordinary measures to postpone defaulting on our debt. Secretary Geithner has warned there is approximately $200 billion in headroom using these measures until we default on our debt. With the clock ticking, the Bipartisan Policy Center has released a very detailed and timely analysis of the debt limit and when the so-called “X Date” (or default date) could occur. The report is authored by Steve Bell, Loren Adler, Shai Akabas and Brian Collins .

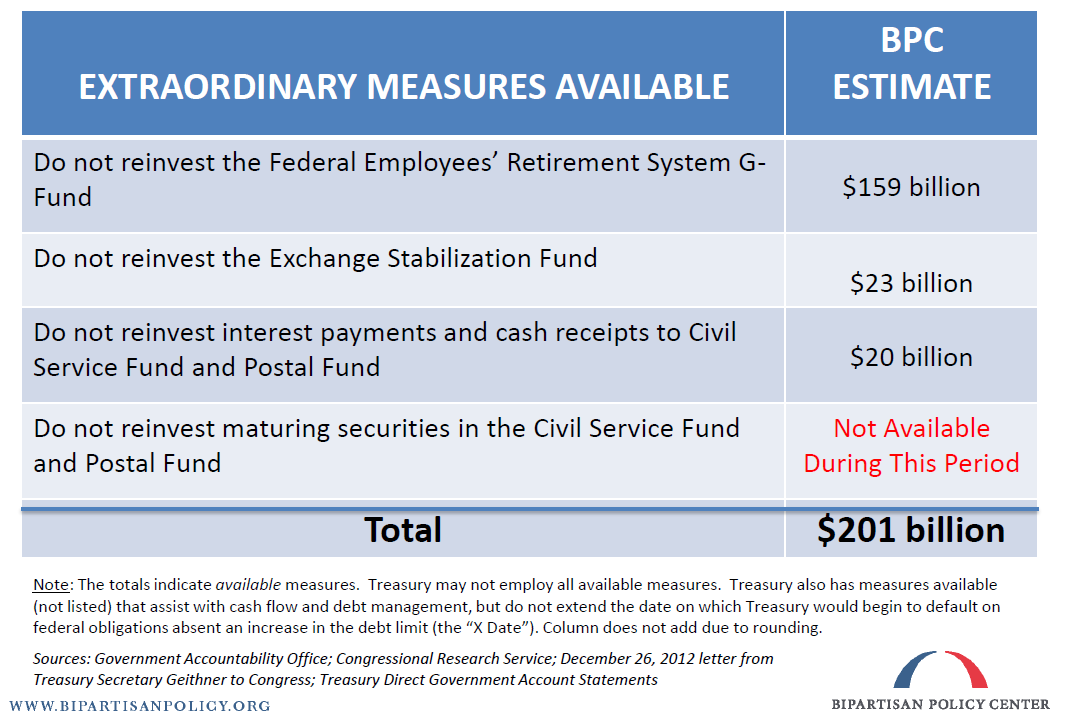

In their report, the authors highlight examples of the current extraordinary measures which the Treasury is currently taking to delay default. As we’ve discussed in great detail before, these include borrowing from the Federal Employees’ Retirement System G-Fund, the Exchange Stabilization Fund, interest payments and cash receipts to the Civil Service Fund and Postal Fund, and maturing securities in the Civil Services Fund and Postal Fund. BPC notes that these measures will not last as long as they did during the debt ceiling standoff in the summer of 2011. At that time, the Treasury was able to delay by over two and a half months. Unfortunately, the timing of this debt limit falls in the beginning of the year, which is a worse month for government finances than the summer.

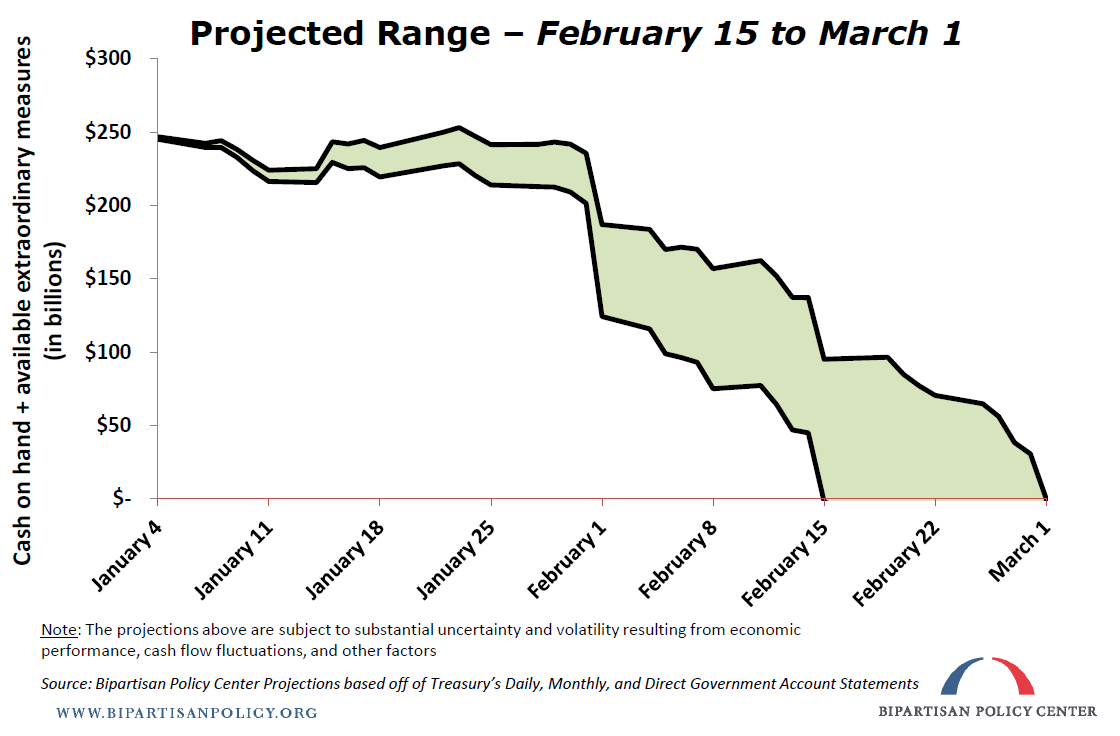

After the Treasury depletes its extraordinary measures, the authors explain that the government will only be left with daily cash revenue and cash on hand. The BPC concludes that the “X date” -- when both extraordinary measures, daily revenue, and cash on hand are all exhausted -- will occur sometime between February 15 and March 1. This means the US will default on its outstanding obligations around the same time that the sequester is scheduled to take effect (March 1) and less than a month before the current Continuing Resolution funding the government expires (March 27).

Since there is no precedent for defaulting on our debt, the BPC walks through several scenarios for what could happen if lawmakers cannot agree to raise the debt ceiling. Under one scenario, the Treasury might choose to pay some bills and not others, causing a great deal of uncertainty and questions of fairness. This would lead to prioritizing some payments over others, and could even mean not making Social Security payments, Medicare payments, and taxpayer refunds. Under another scenario, the Treasury might wait until it has collected enough daily revenue to pay off a day’s worth of payments. The report goes into further detail, analyzing daily expenditures and revenue during the projected default time frame. The breakdown demonstrates how much more the U.S. will have in obligations each day than they will have in revenue, making it difficult to even pay off one day’s worth of spending with two days’ worth of revenue.

Above all, the most serious risk of these sudden cuts to spending obligations will be the impact on the economy. BPC’s analysis warns of high interest rates, additional credit rating downgrades, and the potential for serious harm to the entire global financial system. Last year, the Government Accountability Office found that higher interest rates caused by the debt ceiling debate and last-minute solution cost $1.3 billion in 2011. As lawmakers continue to delay a deal on raising the debt ceiling, we face a repeat of incurring unnecessary borrowing expenses while jeopardizing the economy. What’s even more detrimental this time is that the potential debt ceiling breach will coincide with the sequester going into effect. The BPC report assumes the sequester will not go off, but should lawmakers not act on both issues, that would add insult to injury in terms of the economic impact and uncertainty of federal payments.

To get us through the next few years, the BPC projects the debt limit will need to be raised by $1.1 trillion through the end of this year or $2.1 through the end of 2014. After yet another disappointing round of budget negotiations last week, the BPC analysis reminds us why it is critical that lawmakers use the next few weeks wisely to come together in a bipartisan manner to raise the debt ceiling and enact a plan to bring down deficits in the future.

For more information, you can find our primer on the debt ceiling here.