Design Your Own Corporate Tax Plan!

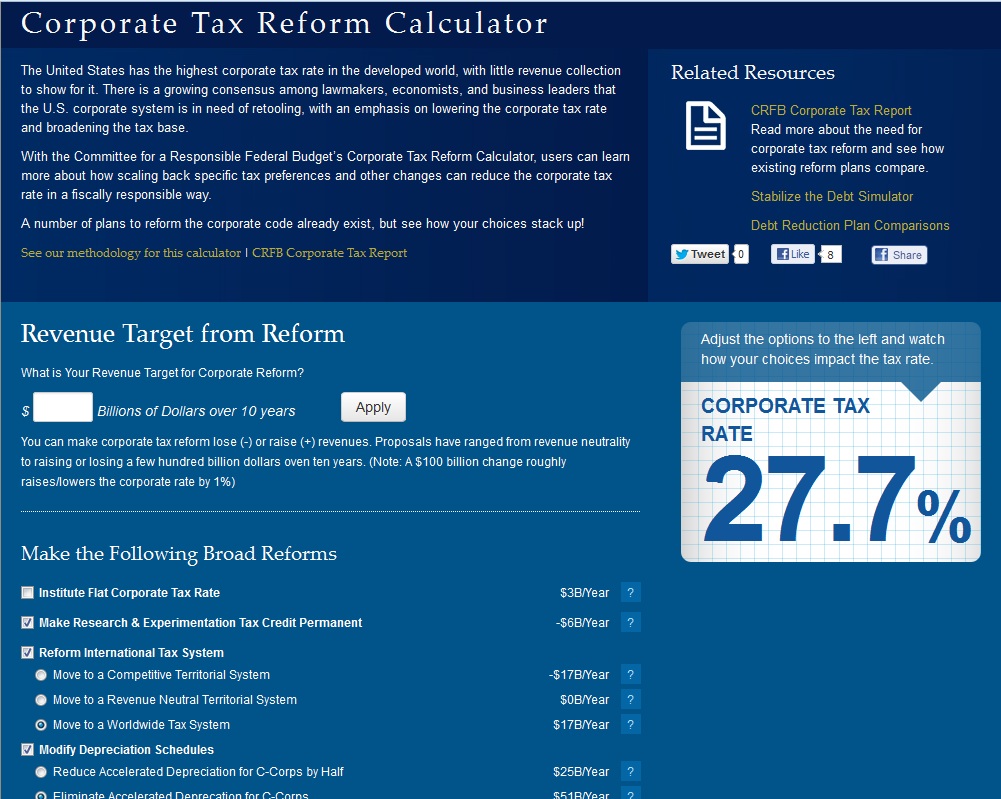

If you've ever wanted to design your own corporate tax reform, now you can with our new Interactive Tax Reform Calculator.

There is no question that the U.S. corporate tax system is badly in need of reform, and leaders in both parties have been pursuing this goal.

President Obama has put forward a framework to reduce the corporate tax rate from 35 percent today (among the highest rates internationally) to 28 percent while broadening the corporate tax base to ensure revenue neutrality. Meanwhile, Republican Ways & Means chairman Dave Camp (R-MI) has proposed a revenue neutral reduction to a 25 percent rate, and a number of bipartisan plans, including Simpson-Bowles, Domenici-Rivlin, and Wyden-Coats, have proposed similar reforms. Today, CRFB discusses these issues and various proposals in a new paper, Reforming the Corporate Tax Code, which makes the case for fiscally responsible corporate tax reform.

The Corporate Tax Reform Calculator, however, lets users write their own corporate tax reform. Options range from eliminating very small preferences such as those for corporate jets, to scaling back very large preferences like accelerated depreciation schedules, to changing the way we treat certain business expense deductions, such as advertising.

Based on the revenue target a user sets and the options they choose, the corporate tax rate will go up or down automatically. It's a very fun tool and sheds light on what needs to be done to reach different revenue and rate combinations. The calculator has already been featured on Ezra Klein's Wonkblog.

To see how the calculator works, we've shown a few examples below based on actual plans out there.

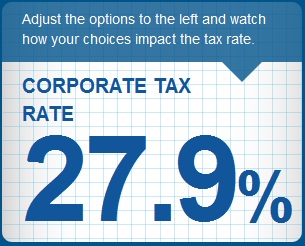

Simpson-Bowles Illustrative Plan

In their illustrative plan, the Simpson-Bowles Commission calls for eliminating all corporate tax expenditures, moving to a competitive territorial system, and reducing the corporate tax rate to 28 percent.

Sure enough, running those options yields a rate very close to that. We focused only on reforms aimed at C-Corps, presuming that "pass-through entities" (businesses that pay taxes on the individual side) would be dealt with through individual reforms. By eliminating accelerated depreciation and the domestic production deduction for C-corps, having a flat corporate tax rate, moving to a competitive territorial system, and eliminating all other tax expenditures, we were able to get the rate down to 27.9 percent.

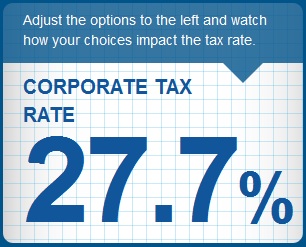

President Obama's Business Tax Reform Framework

Though President Obama hasn't offered all the details of his plan, his framework gives us a good starting point. We know he raises revenue on the international side by moving in some ways toward a worldwide system. We know he eliminates the domestic production deduction for oil and gas companies as well as other preferences for those companies, repeals preferences for corporate jets, taxes carried interest as ordinary income, eliminates last-in first-out (LIFO) accounting, eliminates insurance company preferences, and extends the R&E tax credit and clean energy provisions. We also know he wants to raise revenue from reducing the interest deduction and reducing accelerated depreciation, though we don't know how exactly. When we combine these options with the elimination of many of the tax expenditures he hasn't specified, such as the exclusion for private activity bonds and the exemption of credit union income, we get the rate down 27.7 percent -- compared to his target of 28 percent.

Chairman Camp's Discussion Draft

Chairman Camp's plan still has a lot of details to be worked out, but we know that he would move to a revenue-neutral territorial system and reduce the corporate rate to 25 percent. To achieve those goals with the options available -- presuming he wants to raise all the money from C-Corps, the Camp proposals would have to be quite aggressive. As an example, if he were to eliminate accelerated depreciation and the domestic production deduction for C-corps, cut all other tax expenditures listed, reduce the interest deduction by the amount of inflation, reduce deductibility of meals and entertainment expenses to 25 percent, and capitalizing 15 percent of advertising costs the rate could be reduced to 25.1 percent.

We encourage our readers to design their own plans. Descriptions of each option are available in the question mark boxes to the right of each option.

In addition, our latest tax reform paper can be a helpful guide. The paper makes the case for corporate tax reform, discusses options for reform, and compares the major reform plans that are out there currently. It is a very informative primer for anyone who wants to know the basics of how the corporate tax code works now and what is being considered to change it.

Check out the Corporate Tax Reform Calculator and the analysis at https://crfb/corporate.