CRS: Carbon Tax Would Take a Chunk Out of the Deficit

Efforts to curb greenhouse gas emissions have fallen out of favor since the attempted passage of a cap-and-trade program in 2009 and 2010. Still, the idea of a carbon tax or cap-and-trade remains out there as a way to both curb GHGs and raise revenue. A new Congressional Research Service (CRS) report discusses the pros and cons of a carbon tax and how it would impact households, the economy, and the debt.

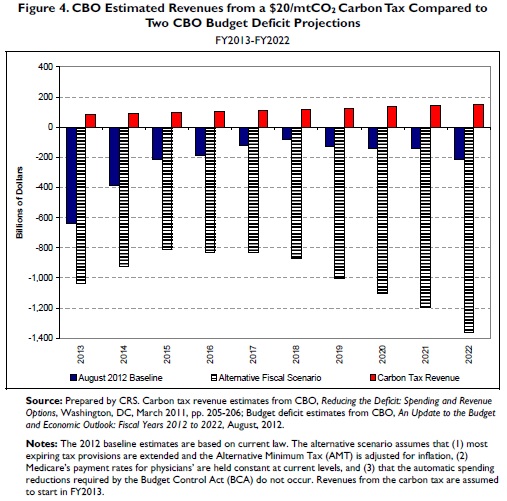

Taking CBO's estimate of a cap-and-trade program that would price CO2 emissions at $20 per metric ton ($1.2 trillion over ten years), CRS estimates that it would cut CBO's estimated current law 2013-2022 deficit from $2.3 trillion to $1.1 trillion (1.1 percent of GDP to 0.5 percent) and the estimated Alternative Fiscal Scenario 2013-2022 deficit from $10 trillion to $8.8 trillion (4.9 percent of GDP to 4.4 percent). We should note that this may underestimate the deficit reduction since it does not seem to count reductions in interest on the debt.

Of course, these estimates would only hold if the carbon tax was enacted in isolation. That may not be the case. Given the impact of a carbon tax on energy costs and carbon-intensive industries, carbon taxes are often pared with deficit-increasing measures. These could include rebates to low-income households, allowances to affected energy producers, or the trading of a carbon tax for reductions in payroll or other taxes (the latter was suggested here and here). Obviously, any of these policies would reduce the deficit impact of the carbon tax, but also the effect on the economy and households.

Many economists on the left and right advocate taxing more of what is bad and less of what is good, such as taxing carbon or congestion. Policymakers looking to raise revenue may find such taxes palatable alongside a comprehensive reform of the tax code.