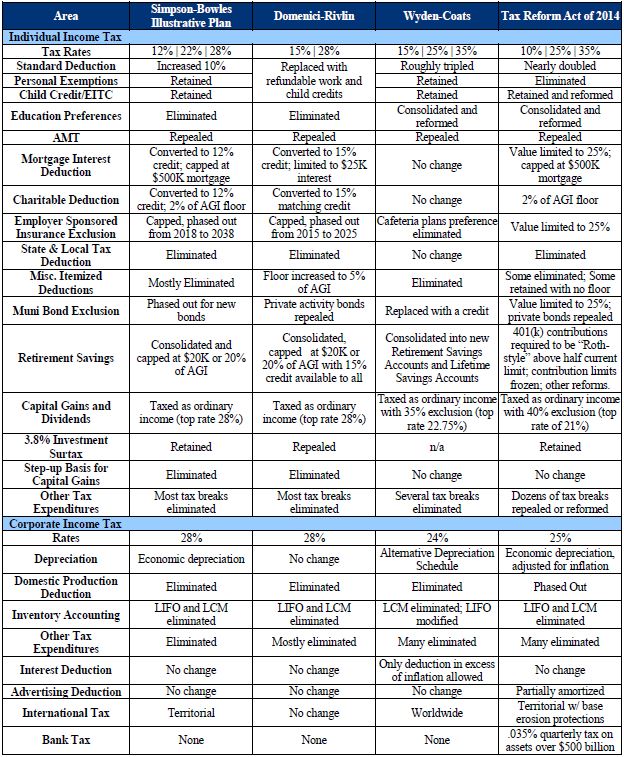

Comparison Chart: How Camp's Tax Reform Plan Stacks Up

On Wednesday, House Ways & Means Chairman Dave Camp released a detailed tax reform discussion draft, which we summarize and analyze here. On its own, the draft is an impressive piece of legislation: it is nearly 1000 pages of legislative text and addresses tax rates and preferences in both the individual and corporate tax code. But how does it stand up to other major tax reform proposals?

The comparison chart below - also found in our longer analysis paper - stacks up Chairman Camp's proposal against the Simpson-Bowles proposal, the Dominici-Rivlin proposal, and the Wyden-Coats proposal. In terms of revenue impact, both Simpson-Bowles and Domenici-Rivlin intended to raise revenue while Wyden-Coats intended to be revenue-neutral.

This tax reform draft is a good jumping off point as we enter into budget season. In releasing their budgets, we hope that President Obama and the Senate and House budgets will address tax reform - in addition to entitlement reform - as a way of addressing the long-term drivers of our debt.