The Challenge of Corporate Tax Reform

Tax reform has many moving pieces to it and many questions that need to be answered. One question is whether the two pieces should be handled together, separately, or whether lawmakers should only do one or the other.

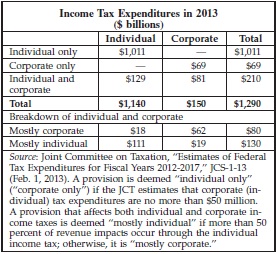

Tax Policy Center's Donald Marron points out that it is much easier to consider stand-alone individual tax reform than corporate tax reform. While the individual tax code in 2013 has more than $1.1 trillion worth of tax expenditures, the corporate code has only $150 billion. A bigger issue is the fact that a sizeable portion of that $150 billion -- $81 billion -- is from tax expenditures that benefit both corporations and pass-through businesses that are taxed through the individual code. Furthermore, the main corporate-exclusive tax expenditure is the deferral of foreign income for multinational companies, which is in some sense a design feature of the international tax code that could be dealt with in a number of ways that don't involve elimination. If that tax expenditure is left alone or only partially reduced, the prospect of dipping into tax preferences that affect both types of businesses increases.

In our corporate tax paper, we noted that reducing or eliminating "cross-over" tax preferences raises questions of fairness with stand-alone corporate reform, since pass-throughs are adversely affected by the base-broadening without the benefit of any potential rate reduction. Essentially, the pass-throughs would be financing a portion of corporate tax reform, thus transferring tax liability from corporations to the pass-throughs.

Still, Marron implies that the solution may not be excluding pass-throughs entirely from tax reform. He calculates that of the $81 billion of cross-over tax expenditures in the corporate code, $62 billion of them benefit corporations more than pass-throughs. Similarly, of the $129 billion of cross-over preferences in the individual code, $111 billion benefit pass-throughs more than corporations. It means that much of the cross-over preferences in the corporate code could be reduced without a large adverse effect on pass-throughs.

Source: Tax Policy Center

Our corporate tax calculator brings these issues to the forefront. For two of the largest tax expenditures -- accelerated depreciation and the domestic production activities deduction -- users are given the option of eliminating them only for corporations taxed through the corporate code, which reduces the revenue gained by 20 to 30 percent compared to full elimination. It also allows users to select taxation of carried interest, an individual income tax expenditure, as part of their corporate reform.

Of course, a way to get around the problem is to do both individual and corporate tax reform at the same time. Not only are both reforms merited, but also doing so would help to coordinate taxation across all businesses, whether they be taxed through the corporate code, the individual code, or not at all. Undertaking both reforms simultaneously would reduce the number of unintended consequences or economic distortions, resulting in a better tax code than if reforms were done separately.