Can Social Security Be Saved by Selling America’s Oil & Gas Reserves?

In a town hall hosted by Fox News, former President Donald Trump suggested that America’s fiscal problems – and specifically Social Security’s looming insolvency – can be solved by tapping into the “incredible wealth under our feet” in the form of domestic oil and gas. However, dedicating current oil and gas leasing revenues to Social Security would cover less than 4 percent of its shortfall, and it would be impossible to fix Social Security even if all federal land were opened to drilling operations.

| US Budget Watch 2024 is a project of the nonpartisan Committee for a Responsible Federal Budget designed to educate the public on the fiscal impact of presidential candidates’ proposals and platforms. Through the election, we will issue policy explainers, fact checks, budget scores, and other analyses. We do not support or oppose any candidate for public office. |

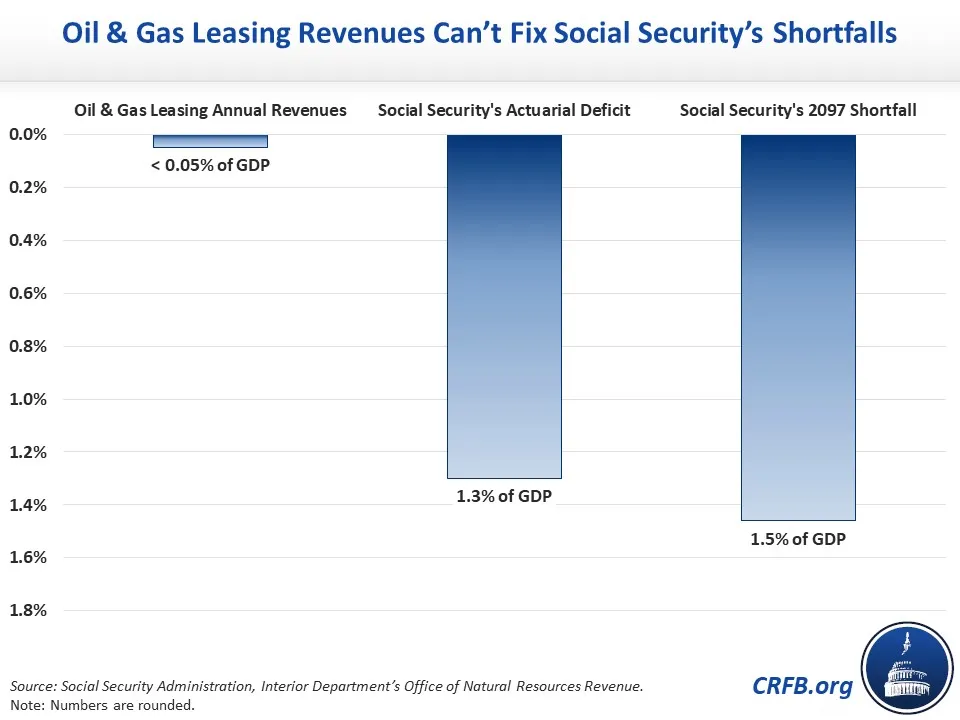

According to data from the Interior Department’s Office of Natural Resources Revenue, “oil & gas” and “oil shale” resource revenues for U.S. federal lands, federal waters, and Native American lands amounted to about $20 billion in Fiscal Year (FY) 2022. Over the past decade (2013-2022), oil and gas leasing revenues have averaged below 0.05 percent of Gross Domestic Product (GDP).

According to the 2023 Social Security Trustees' Report, the Old-Age, Survivors, and Disability Insurance (OASDI) program’s actuarial deficit is 1.3 percent of GDP. In 2097, the last year of the 75-year projection window, the shortfall will be roughly 1.5 percent of GDP. With federal revenues from oil and gas leasing averaging 0.05 percent of GDP, revenues would need to be about 27 times larger in order to cover Social Security’s actuarial deficit or 30 times larger to cover the shortfall in 2097.

Even the entirety of estimates for U.S. oil and natural gas proved reserves – including from both federal lands and privately-owned lands – total less than $5 trillion in value (at today’s oil and natural gas prices), which is just a fraction of Social Security’s 75-year present value shortfall of over $22 trillion.

While the analysis doesn’t incorporate the additional income tax that would be generated from increased extraction activity, the latest data from the Internal Revenue Service indicates that the oil and gas extraction industry paid $160 million in federal corporate income tax in 2018 – a very small fraction of the revenue needed to solve our fiscal challenges.

Although creative solutions could help improve the U.S. fiscal situation and Social Security’s solvency challenges, relying on revenue from oil and natural gas assets alone will not fix the problem.

*****

Throughout the 2024 presidential election cycle, US Budget Watch 2024 will bring information and accountability to the campaign by analyzing candidates’ proposals, fact-checking their claims, and scoring the fiscal cost of their agendas.

By injecting an impartial, fact-based approach into the national conversation, US Budget Watch 2024 will help voters better understand the nuances of the candidates’ policy proposals and what they would mean for the country’s economic and fiscal future.

You can find more US Budget Watch 2024 content here.