Can the Budget Realistically Be Balanced Without Touching Social Security or Medicare?

During this election cycle, candidates may try to claim that it’s possible to bring the federal budget to balance without touching Medicare or Social Security – the two largest and fastest growing programs in the budget. Some may even claim this is possible on top of a large tax cut. For example, Mike Huckabee recently promised that unlike "some in Washington who want to cut benefits for seniors, I will protect Social Security and Medicare. Period" Donald Trump has also pledged that he "will not cut Social Security like every other Republican," while also proposing a $12 trillion tax cut and promising to balance the budget.

But in reality, doing so would require enormous cuts to remaining federal programs, far larger than anything that’s been seriously considered. To balance the budget by 2025, the next President and Congress would have to cut spending and/or raise revenue by over $1 trillion (including interest) in 2025 alone, and would likely need about $6 trillion of savings cumulatively over the decade. Achieving balance while excluding two of the largest government programs would be incredibly difficult – particularly if combined with the enactment of tax cuts. Excluding all mandatory programs would make the task harder still.

Outside of Social Security and Medicare, most federal spending goes toward other mandatory programs (including Medicaid, federal and military employee retirement benefits, veterans’ benefits, and a host of programs primarily benefiting people with low incomes), national defense, and annually-appropriated non-defense discretionary programs (including medical research, the Department of Education, the judicial system, and the Department of State).

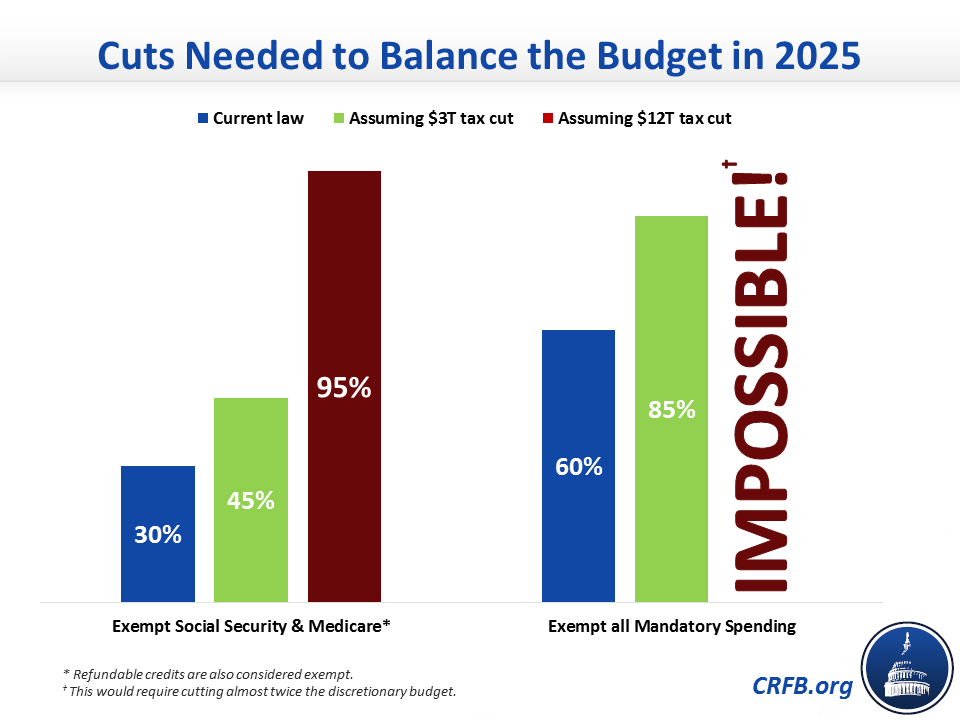

To balance the budget from these programs alone would require cutting them by 30 percent on average – which as a practical matter would mean eliminating or drastically curtailing many of them.

If one went further and also exempted other mandatory spending including Medicaid, the cut required to balance the budget by 2025 would grow to 60 percent. Thought of another way, we’d have to cut the size and cost of our military by more than half and make equivalent cuts in areas such as education, energy, homeland security, and research.

These cuts are tremendously unlikely to occur, especially given that recent Congressional action – on a bipartisan basis – has increased discretionary portion of the budget. Yet a number of candidates have proposed tax plans that would make the task harder still.

As we recently showed in our tax plan infographic, the GOP tax plans that have been scored so far would cost anywhere from $1.8 to $12 trillion under conventional scoring (and almost as much under dynamic scoring).

Assuming a middle-of-the-pack tax plan – costing $3 trillion – policymakers would need to cut all non-Social Security and non-Medicare spending by 45 percent or all discretionary spending by 85 percent to achieve balance. This would not be nearly enough to keep many parts of the government open, and would almost certainly involve massive cuts to national defense and mandatory programs, such as benefits for wounded veterans, Medicaid, food stamps, and promised federal retirement benefits.

Assuming the $12 trillion tax cut proposed by Donald Trump (the most expensive of the proposed plans), spending outside of Social Security and Medicare would need to be cut by 95 percent. If all mandatory spending were exempt, achieving a balanced budget would be literally impossible even by eliminating the rest of government.

Spending cuts will certainly be necessary to bring the federal budget into balance, but it’s not realistic to severely cut discretionary and other mandatory spending to Social Security and Medicare, which are far and away the fastest growing parts of the budget. In short, it is nearly impossible to put the government on a path to a balanced budget without addressing the growth in Social Security and Medicare.