Bipartisan Policy Center Highlights Need for Medicare Trust Fund Solutions

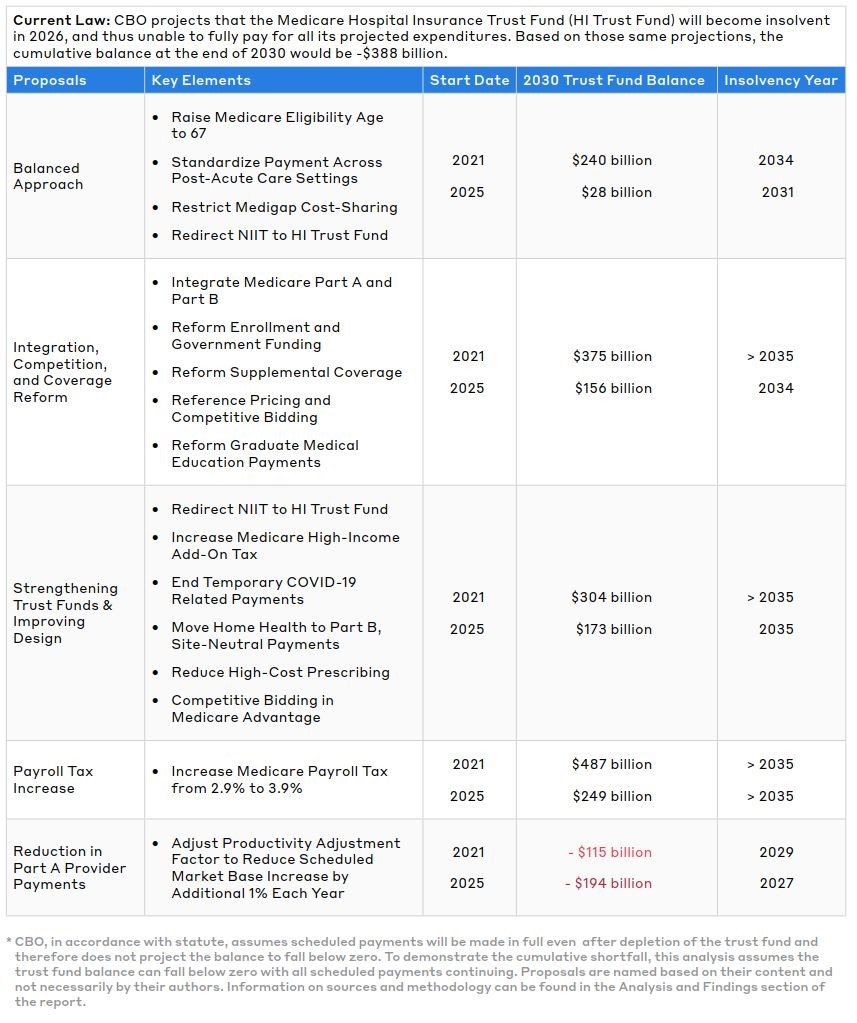

With just five years until the Medicare Hospital Insurance (HI) trust fund faces insolvency, lawmakers must address the trust fund's $515 billion net funding gap soon to avoid steep cuts or payment delays. A new report from the Bipartisan Policy Center (BPC) highlights the financial trouble facing the program and examines a few possible ways lawmakers could bring spending and revenue in line.

The report, titled “The Cost of Waiting to Act on Medicare’s Hospital Insurance Trust Fund,” shows that delaying reforms by just a few years will significantly reduce their effect on solvency and ensure that more aggressive and difficult changes will be needed in the future. With its analysis, BPC highlights the need for quick action that would also prevent any potential loss of access to care for those who benefit from the program.

Specifically, BPC looks at five different approaches to improving solvency, including a scenario involving oft-proposed bipartisan health savings reforms and others with simpler tax or spending changes. BPC then examines the potential budgetary and solvency impacts of the proposals and compares those effects when changes are implemented immediately or delayed by just four years.

The approaches analyzed by BPC are:

- “Balanced Approach” by Bill Hoagland

- “Integration, Competition, and Coverage Reform” by James Capretta

- “Strengthening Trust Funds & Improving Designs” by David Cutler, Richard Frank, Jonathan Gruber, and Joseph Newhouse

- A One-Percentage Point Payroll Tax Increase

- An Across-the-Board Reduction in Medicare Part A Provider Payments

In the “balanced approach” example, if Congress were to implement the package of reforms in 2021, trust fund solvency would be extended by eight years from 2026 to 2034. But waiting until 2025 to implement these reforms would gain only five years of solvency (extending it to 2031). The trust fund balance in the year 2030 would be $240 billion if the reforms were enacted immediately but just $28 billion if delayed for four years.

Delay is even more costly in the payroll tax increase example. Immediate implementation would result in a $487 billion trust fund balance in 2030, while delay would result in just a $249 billion trust fund balance in 2030. Under either case, though, solvency is extended beyond 2035.

Implementing any of these proposals immediately would ensure that trust fund insolvency would be pushed from 2026 to at least 2029. However, delaying changes significantly reduces the gains from policy action and therefore increases future insolvency risk.

There are many other options to secure the HI trust fund and improve the program for future generations. Through our Trust Funds Solutions Initiative, we will continue to put forward existing and new ideas to reduce Medicare costs and bring in new funding. Other experts and organizations have good ideas as well (see, for example, the recent Commonwealth Fund series).

Policymakers will need to act sooner rather than later to secure these trust funds by increasing revenues, reducing costs, or some combination. The BPC report makes clear that the longer we wait to address trust fund solvency, the fewer choices will be available and the harsher the needed adjustments will be.