Bipartisan Plan Paves Way for Transportation Reform

At the end of May, lawmakers will have to reauthorize surface transportation spending, and by the summer, they will need to have a solution to address the Highway Trust Fund's impending insolvency. Hopefully, they will use an enduring and, more importantly, fiscally responsible solution in contrast to the irresponsible physician payment legislation.

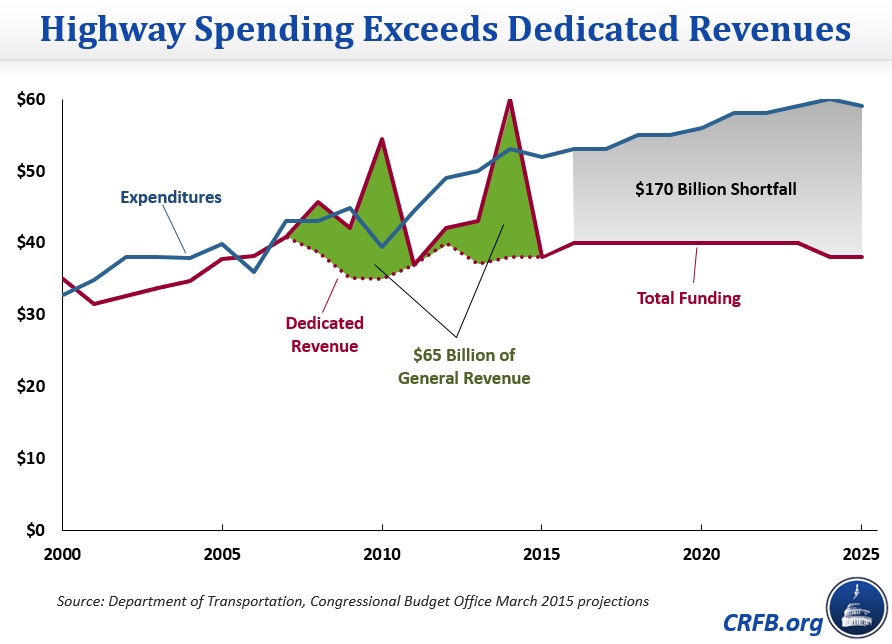

Fortunately, last week a bipartisan group of House members led by Reps. Jim Renacci (R-OH), Bill Pascrell (D-NJ), Reid Ribble (R-WI), and Dan Lipinski (D-IL) introduced the Bridge to Sustainable Infrastructure Act, which would use fuel tax increases as an enforcement mechanism to force Congress to find a permanent solution to the HTF's financing issue. The HTF faces a $168 billion shortfall through 2025, and there are many possible ways to close that shortfall, as we detailed last year.

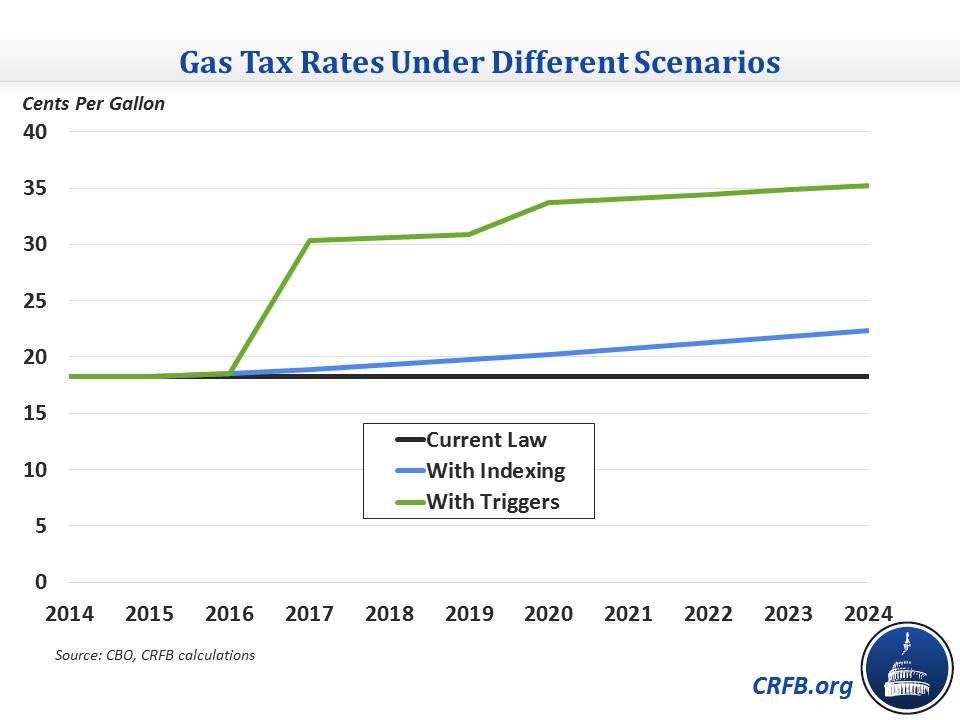

The bill would start by indexing fuel taxes dedicated to the HTF to inflation, a policy the sponsors estimate would generate $27.5 billion of revenue over ten years. On its own, this policy would not buy much time, since it would only raise a few billion dollars per year while the FY 2016 shortfall alone is $11 billion. Instead, the bill would use the revenue as an offset for what is essentially a loan from the general fund of $16 billion, closing the FY 2016 shortfall and leaving the $5 billion cushion the Department of Transportation says is necessary to avoid disruptions in HTF operations. To avoid a double-counting issue -- the fuel taxes couldn't offset a general revenue transfer on their own since both would go into the HTF -- the HTF would repay the general fund the $16 billion over a period of time.

The bill would then create an 18-member Task Force to come up with a permanent financing solution by September 1, 2016. Any proposal would need 12 votes to be approved, but if one were approved, it would get fast-track consideration in Congress.

If Congress did not act on any proposal by the beginning of 2017, automatic fuel tax increases would take effect in April to close the 2017-2019 shortfall. The same process would repeat itself at the end of this three-year period: if Congress did not act by 2020 to close the 2020-2024 shortfall, automatic tax increases would take effect again. By our estimate, the first gas tax increase would be 12 cents per gallon (increasing the rate to more than 30 cents in 2017), and the second increase would be another 3 cents per gallon (for a rate of 34 cents in 2020).

This proposal is one of many ways to responsibly address the HTF shortfall. Importantly, it creates a clear cost to policymaker inaction, thereby encouraging them to come up with a solution. In recent years, lawmakers have simply papered over the shortfall with gimmicks, but they seem to be increasingly recognizing the importance of a real solution. This bill showcases this recognition and the need to bring lawmakers to the table.

For more on the HTF, click here to read "Trust or Bust: Fixing the Highway Trust Fund."