Are Medicare and Social Security Earned Benefits that Should Not Be Touched?

Although Social Security and Medicare are two of the fastest growing programs in the budget, many argue against making adjustments to these programs under the premise that they are “earned benefits” which workers have “paid for” through the payroll tax. This logic is fundamentally flawed in several ways.

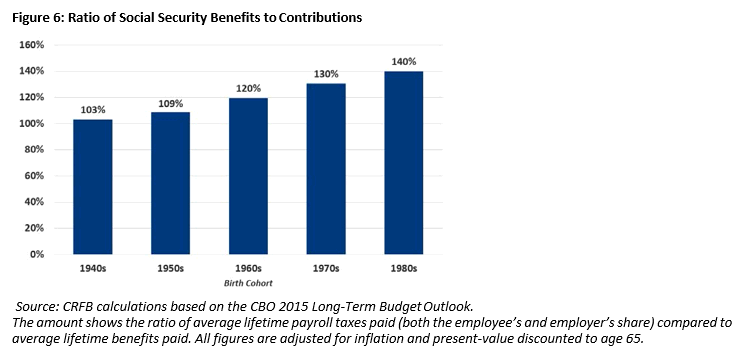

First of all, most Social Security and Medicare beneficiaries get far more out of those programs than they pay into them. When accounting for inflation and interest rates, the Congressional Budget Office (CBO) finds the average beneficiary retiring today will receive about 10 percent more in Social Security benefits than he or she paid in taxes. The average beneficiary retiring in the 2040s will receive about 30 percent more in benefits (assuming scheduled benefits are fully paid). Because Medicare is funded largely out of general revenue and health costs continue to grow, Medicare benefits are far more generous relative to contributory taxes paid. According to CBO, the average senior retiring this decade will receive 250 percent more in benefits than he or she pays in Medicare taxes.

In addition, it is important to note that both the Social Security and Medicare Hospital Insurance programs raise too little in tax revenue to pay current benefits and face insolvency within two decades or less. This means that failure to make adjustments to these programs or their sources of revenue will result in huge across-the-board benefit cuts.

Finally, failure to control the growth of Social Security and Medicare will have profound impacts on the national debt and the remainder of the budget. Since the year 2000, those programs have grown by one-third as a share of Gross Domestic Product (GDP), and by 2040 they will grow another 45 percent. This spending growth not only increases the debt, but it crowds out other spending including national defense, public investment, and other low-income programs.

Ruling: Largely False