American Public Supports Fiscally Responsible Corporate Tax Reform

Among developed countries the US is unique in taxes in a number of different ways. One claim to fame is the fact that the U.S. now has the highest marginal corporate tax rate. The current marginal rate in the U.S. remains at 35 percent while the average marginal rate of the OECD countries, excluding the U.S., is a full 12 percentage points lower at 23 percent. At the same time, the revenue collected by the corporate tax is low by international standards due to the number of corporate tax provisions which make the effective rate not nearly as high. Reforming the corporate code by eliminating some of these provisions, like can be done in our Corporate Tax Calculator, has been suggested as a way to lower the rate without forgoing that revenue.

The RATE Coalition has been circulating the results of a recent poll meant to gauge the public's support for corporate tax reform as well as for a more broad reform of the tax code. While corporate tax reform has strong support among the business community, it may come as a surprise that it also has support among the general public.

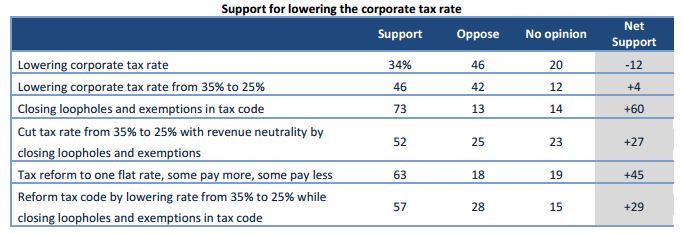

However, the initial findings of the poll indicate that there is minimal public support (34 percent) for solely reducing marginal corporate tax rates, while leaving tax provisions unaffected. This was found to be mainly because 77 percent of respondents originally, and inaccurately, perceived the corporate tax rate to be much lower than 35 percent. But when people were given more information, the picture changed dramatically. The major driver behind this large swing in support was the simultaneous elimination of corporate tax loopholes, which was supported by 73 percent of respondents. Furthermore, this provision was one of the rare areas which attracted strong support from both liberals (77 percent) and conservatives (74 percent).

The main results from the poll can be seen below:

Source: David Binder Research

The report on the poll noted that reforming the tax code is needed to restore a sense of fairness in taxation, a point that applies to both the individual and corporate tax system. Thus, the base-broadening aspect of reform is important not just for the revenue implications but also for increasing the perception of fairness in the tax code.

At its core, reform is about taking control of a broken system and getting America working again. The issue and how people react to it is much bigger than just corporations paying taxes. They see the tax code as utterly broken and in need of reform. The values that they hold up as “ideals” for a modernized code (fairness, simplicity, efficiency) and the need to create a “level playing field for all” are inextricably linked to how they see government and society at large. If we can “fix” this system, it can have a direct impact on jobs, economic growth, and global competitiveness.

Both Democrats and Republicans agree the corporate and individual tax codes need to be reformed. Particularly with the individual code, there is an opportunity to eliminate loopholes thereby both reducing marginal rates and raising additional revenue. But these gains are only possible if lawmakers refuse to protect these tax provisions. This is what is so encouraging about the re-emergence of the "Zero Plan," that was proposed this past week by Senators Max Baucus (D-MT) and Orin Hatch (R-UT). By forcing lawmakers to justify which provisions should be added back, we can reduce corporate and individual rates while raising the revenue we need. And finally, if you want to try your hand at reforming the corporate tax code, give our Corporate Tax Reform Calculator a shot.