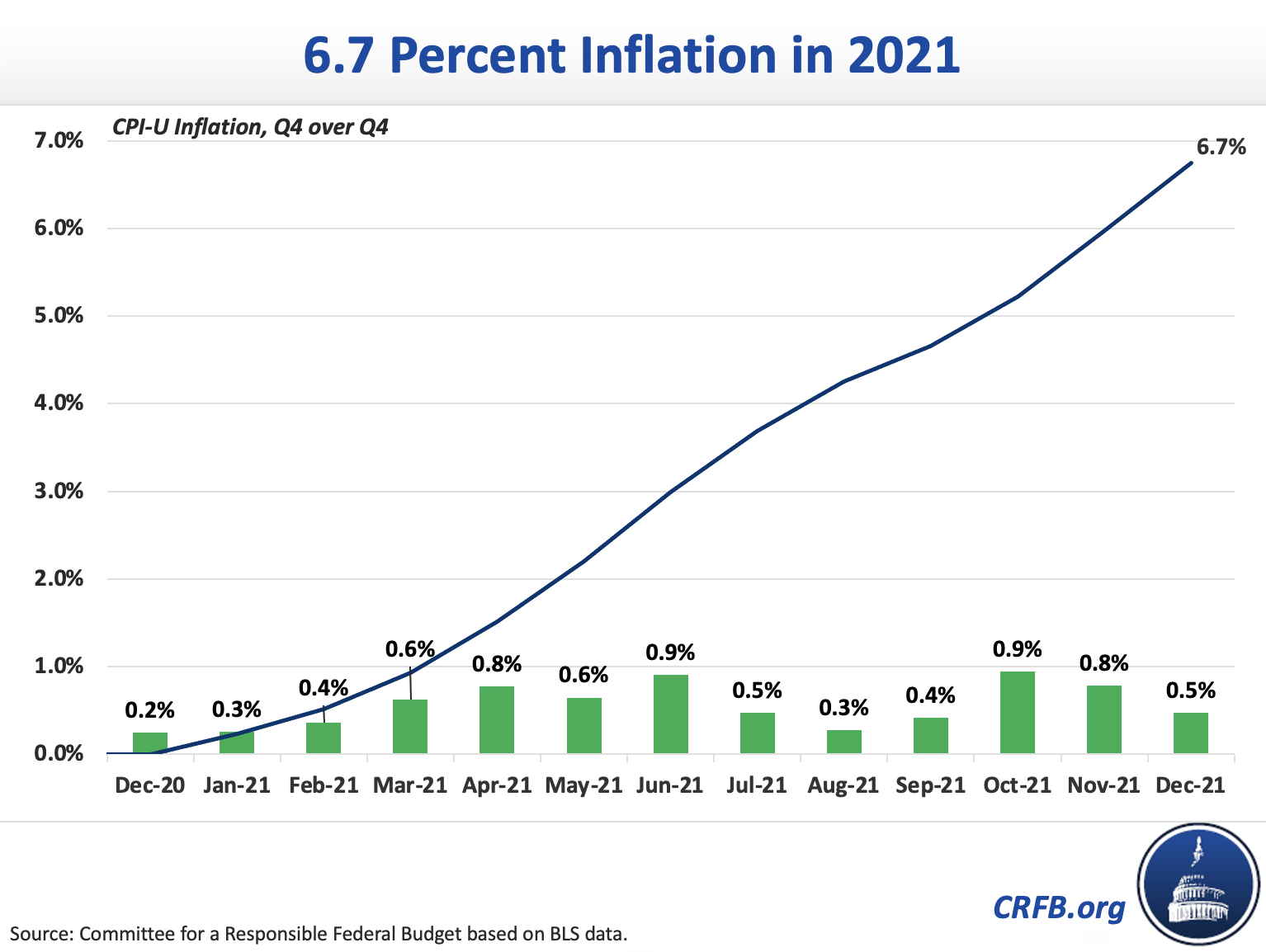

2021 Inflation Totaled 6.7 Percent

The Bureau of Labor Statistics (BLS) today released Consumer Price Index (CPI) inflation data for December 2021. Based on BLS’s data, we estimate CPI inflation totaled 6.7 percent in 2021 – the highest in four decades. Our estimate is based on the growth in the Consumer Price Index for All Urban Consumers (CPI-U) from the fourth quarter of 2020 to the fourth quarter of 2021. Other measures will show different results.

Media outlets are reporting 7 percent inflation, measuring the total increase in prices between December 2020 and December 2021 – as opposed to measuring inflation on a fourth quarter to fourth quarter basis. Looking at average prices by calendar year, inflation totaled 4.7 percent between 2020 and 2021. Meanwhile, chained CPI growth, which accounts for so-called "substitution" effects, grew by 6.6 percent in 2021 on a fourth quarter to fourth quarter basis or by 6.9 percent on a December-to-December basis. These measures all tell a similar story of a historically high inflation rate in 2021.

| CPI Growth Measure | 2021 Percent Increase |

|---|---|

| Q4 2020 over Q4 2021 | 6.7% |

| December 2020 over December 2021 | 7.0% |

| Year over Year | 4.7% |

Source: Committee for a Responsible Federal Budget calculations based on Bureau of Labor Statistics data.

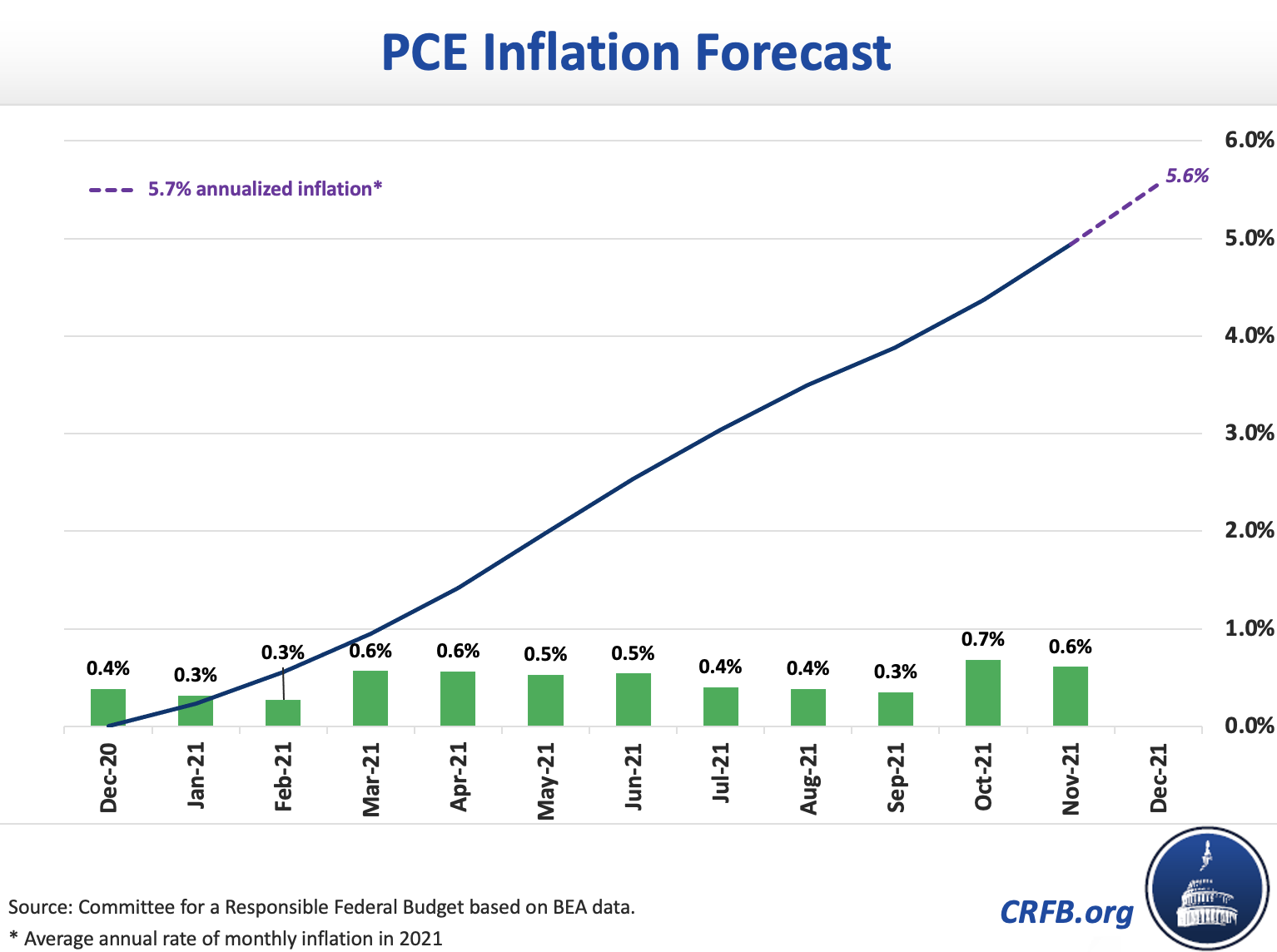

The Personal Consumption Expenditures (PCE) Price Index, which the Federal Reserve uses for its 2 percent inflation target, is somewhat lower but also historically high.

We won't have December 2021 data on PCE inflation until the next release by the Bureau of Economic Analysis on January 28, but if PCE inflation rises at the average 2021 monthly rate in December, we’ll reach 5.6 percent inflation in 2021 on a fourth quarter to fourth quarter basis, which would be 0.3 percentage points higher than the Federal Open Market Committee’s most recent median projection of 5.3 percent and 3.3 percentage points higher than the Federal Reserve's average inflation target of 2 percent.

Inflationary pressures have lasted longer than many forecasters predicted at the beginning of 2021, and there is continued uncertainty over the path of inflation in 2022. The current risks around inflation offer yet another reason to avoid further near-term deficit increases and ensure any new spending or tax cuts are fully paid for.